Trading bots are common in Forex and crypto trading. Traders use bots as a quick path to effortless profits. But the reality is different because many traders face unexpected disappointments. Their trusted trading bot fails, and they lose all their money within seconds. So, why do trading bots fail?

Your trading bot can fail due to factors like market volatility, programming errors, and more. But don’t worry, we’ll give you tips to avoid failure. But before overcoming it, you have to know about the reasons.

So, today, we would like to discuss why trading bots fail and how you can avoid these challenges for better outcomes. Let’s get started!

What Are Trading Bots?

You can call bots a computer program. This program operates specific tasks automatically or with minimal supervision. We use bots to automate repetitive tasks usually done by humans.

Trading bots are also used to automate trading. In cryptocurrency, a trading bot is a software program that automates the buying and selling of digital assets, executing strategies on behalf of a trader.

If you’re a busy trader, a trading bot will help monitor the market 24/7. Time is significant in crypto trading, and a slight delay can cause significant losses for you. In that case, trading bots allow you to buy and sell assets based on pre-set strategies. And for this, you don’t need to monitor the markets regularly. However, to achieve significant gains using a trading bot, it’s essential to use a reliable trading platform. PrimeXBT is an excellent choice, as it supports a variety of crypto bot strategies.

Besides, PrimeXBT offers exclusive bonuses to its users. You have to use the promo code PRIMEOTT to receive a 7% bonus on your deposit. This bonus can give your trading a valuable boost, making it easier to reach your financial goals. Join PrimeXBT today and maximize your trading potential.

How Do Trading Bots Work?

A trading bot uses algorithms to automate our trading tasks. It collects market data and analyzes trading signals. Also, it can check risks and deal with trades based on your strategy.

These bots can check whether an asset is overvalued or undervalued and determine the optimal times to enter or exit a market. You can customize your bots to follow specific strategies and allow them to handle the trading.

Trading bots use market data to calculate the risks and decide when to trade. If you use a bot for trading, it won’t execute trades influenced by human emotions like fear or greed. But you should not always depend on the bots. Because sometimes it can be wrong.

Why Do Trading Bots Fail?

Nowadays, trading bots are very popular with us because they automate trading decisions. And it could develop our profitability in financial markets like Forex. But, if you’re not careful, trading bots can be risky and cause big failures. So, you have to understand the reasons behind these failures. Let’s talk about the reasons why trading bots fail:

Poor Research and Selection

The first reason is inadequate research and selection. Your trading will only succeed if you have the idea of automated trading, but you research it properly. Before picking a trading bot, research who made it, how it works, how well it’s been done, and more. You must verify the bot’s credibility from its reviews and understand its expected market conditions.

Fully Dependable on Automation

Another reason is the overreliance on automation. While trading bots can execute trades consistently, they lack human traders’ adaptability and intuition. Sometimes, market conditions require careful decisions that bots might not make properly. As a trader, you should keep an eye on automated strategies and step in when needed to adjust trading settings based on what’s happening in the market.

Programming Errors

If the trading bot has programming errors, its effectiveness can be reduced. Minor problems in the bot’s code can cause unexpected trades or fail to make trades correctly. You must thoroughly test your trading bot and ensure it works well before using it in real markets. If you check it regularly and update its code, you can prevent technical problems from affecting trades.

Lack of Understanding

You may have risks if you use a trading bot without understanding how it works. If you don’t adjust its settings, it won’t perform well or cause unexpected losses.

Market Impacts

Trading bots can affect fast-moving markets like Forex. Bots programmed to follow patterns or use specific indicators can develop market movements and increase unpredictability. You should think about how the bots might affect the market and make sure they follow the rules to keep trading fair.

Poor Capital Management

One of the important decisions in trading is managing risks and the capital you use. However, some trading bots need more protection to take big risks. You can use such strategies, double your bets after losing, and quickly use up your money when the market goes bad. It would help if you used strong plans to manage risk and avoid strategies that risk too much of your money.

Technical Failures

It can’t work properly if the bot has technical problems like software bugs, bad connections, or platform crashes. If your bot can’t make trades because of these issues, you might miss chances to make money. You can also lose money, so you need to ensure your trading setup works well.

Unsustainable Core Strategy

Every trading bot has its core strategy. It maintains an algorithm that dictates its trading decisions. Many bots have strategies that perform well under specific market conditions but struggle when market dynamics change. In that case, you should select a bot that can change its strategy according to market updates.

Scammers

Some developers sell low-quality bots promising big profits without delivering. To avoid scams, you must be careful and check thoroughly before buying or using bots.

How To Avoid Unexpected Issues With Trading Bots

Trading bots help us make automated trading decisions and reduce emotional mistakes. But before using them, we must know why they might fail. Here are some tips on how to avoid any sudden issues.

Research Enough Before Selection

All bots are not created equally. So, you have to research before choosing bots. You can keep a transparent track record and verified performance metrics. Good forums can give you helpful reviews. Also, you can have expert opinions from different financial communities.

Understanding the Bot’s Strategy

You must have a deep understanding of the bot’s strategy. Traders should understand how a bot reacts to market conditions, whether it follows trends, looks for price reversals, does arbitrage, or uses other strategies. It helps you set it up well and step in when needed. Make sure the bot works with its goals and changes its settings according to market changes.

Use Demo Versions for Testing

Before using a trading bot on a real account, you have to test it on a demo version. You will also see how the bot works in real market conditions without risking real money. When testing, you have to find problems with the bot’s strategy or setup and make sure it works well with the broker’s platform.

Setting Realistic Expectations

As traders, we all have expectations for automated trading. Though trading bots can build up efficiency, they are not unbeatable. Good bots usually cost more because they’re more reliable and work better. On the other hand, cheaper or free bots might give you less support than premium bots. Make sure your expectations match what the bot can do. If you want to make consistent profits, set realistic goals and keep watching how the bot performs.

Ensure Technical Setup

A good technical setup is important to keep your bot running smoothly without any interruptions. That means you need a steady internet connection, backup power, and maybe a Virtual Private Server to keep your bot running all the time. If you set up these technical things properly, your bot will continue to run smoothly.

Professional Software

If you want your trading bot to work well, use professional backtesting software. These tools use previous market data to simulate different market situations, helping traders improve their bot’s strategy. Testing the bot thoroughly helps you find problems. Also, it handles different market situations, so it works reliably when trading for real.

Continuous Monitoring with Adjustment

Also, the best trading bots need to be checked and adjusted regularly. Markets are changing day by day; you have to review bot performance regularly and make necessary adjustments. Make sure it remains aligned with current market dynamics and risk parameters. This approach helps the bot perform better and adjust to market changes easily.

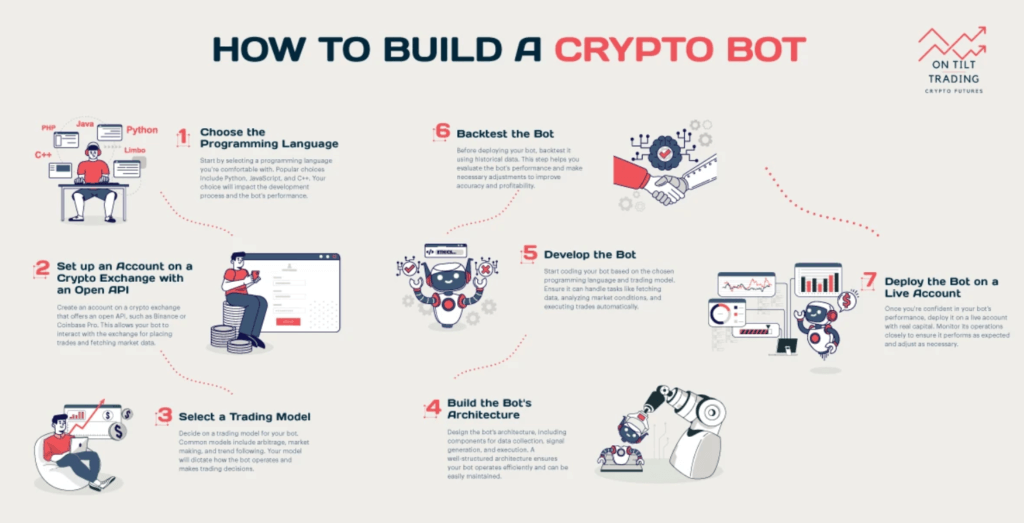

Building Own Trading Bot

If you’re a technical expert, you can build a custom trading bot that offers the advantage of complete customization. While making a bot from scratch needs tech skills and learning, it gives you much control over your trade.

Read More: What Is AI Trading For Beginners

Final Words

Though trading bots save traders valuable time, they are not always right. Why do trading bot fails? They can fail for various reasons, such as technical glitches, programming errors, sudden market changes, and more.

When you know the reasons, you can take action to overcome them. If you would like to benefit from trade business, you do not trust your trading bot blindly. If you worry about losing money in crypto, try the Vestinda crypto futures trading app. You don’t need to write any code to apply custom trading strategies. You can sign up for free and explore the features of Vestinda.

FAQs

Do professional traders use bots?

Yes, professional traders use bots to analyze markets, try different strategies, and make trades accurately. Traders use bots to do better in changing markets.

Is Forex robots profitable for you?

Yes, of course. Forex robots can be profitable if you use them with a smart plan in the right market and monitor them as markets change.

How much do Forex bots cost?

Forex bots come at different prices, ranging from free to thousands of dollars. The cost depends on how advanced they are, how well they perform, and who made them.

Is trading bots legal?

Yes, trading bots are legal in markets like cryptocurrency and forex, which can make them a target for scams.