If you are about to start crypto trading, you have two main trading options: spot trading and futures trading. But what are the differences between them, and which is more profitable spot or futures trading? Sometimes traders choose the futures market over the spot market. To make informed decisions, you need to understand the trade properly.

What is Futures Crypto Trading?

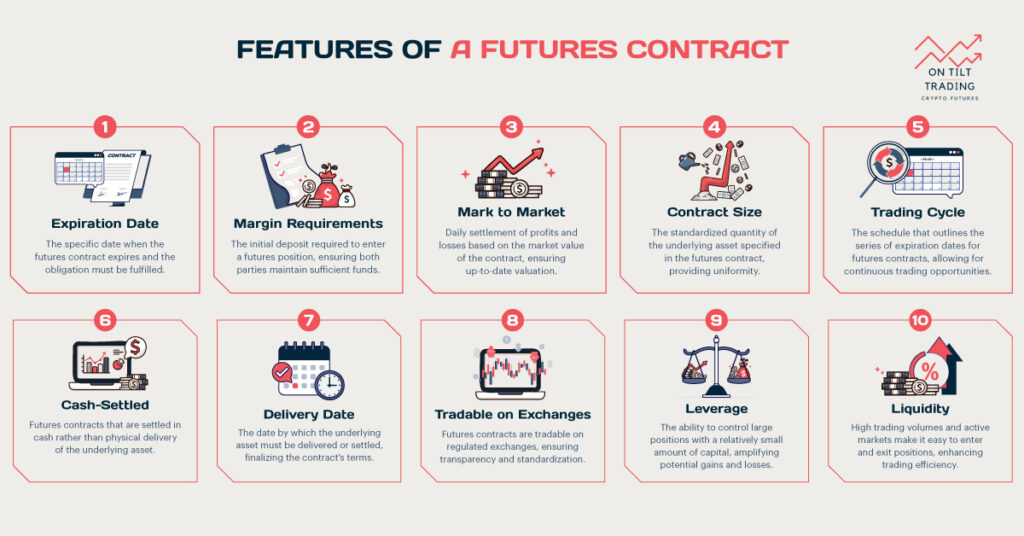

Futures crypto trading involves the buying or selling of contracts that commit you to buy or sell a specific cryptocurrency at a predetermined price on a future date. These contracts are standardized and traded on futures exchanges on cryptocurrency-specific platforms. Futures trading does not involve immediate ownership of the underlying asset, but rather speculates on its future price.

In futures trading, traders can leverage their positions, meaning they can control larger positions with a smaller amount of capital (margin). This amplifies both potential profits and losses, making futures trading a more complex and higher-risk strategy compared to spot trading.

Advantages of Futures Crypto Trading

- Futures trading allows traders to use leverage, such as 10x, 20x, or even higher, to control larger positions with a smaller amount of capital.

- It allows traders to hedge against price fluctuations or speculate on the future direction of cryptocurrency prices.

- Futures markets provide access to a wide range of cryptocurrencies and trading strategies that may not be available in the spot market.

- Unlike spot trading, where you can only profit from rising prices, futures trading allows you to profit from both upward (going long) and downward (going short) price movements. This versatility can be advantageous in volatile markets.

- Futures contracts have fixed expiry dates, which can provide clarity and structure to trading strategies.

- Traders can plan their positions around specific market events or price expectations.

When to Choose Crypto Futures Trading?

Advanced Trading Strategies

Futures trading is suitable for experienced traders who are familiar with technical analysis, market trends, and risk management strategies. It requires a deeper understanding of market dynamics and the ability to interpret complex trading instruments.

Short-Term Trading Opportunities

If you are looking to capitalize on short-term price movements or market fluctuations, futures trading offers the flexibility to enter and exit positions quickly. This can be advantageous for traders who actively monitor market trends.

Risk Management and Hedging

Futures contracts allow traders to hedge against potential losses in their spot positions. By taking opposite positions in futures contracts, traders can offset risks associated with price volatility in the underlying cryptocurrency. Do you need to evaluate the profitability of your trades? Our On Tilt Trading ROI Calculator helps you assess and optimize your portfolio, identifying high-performing investments. Boost your trading success now!

Speculative Trading

For traders seeking higher-risk, higher-reward opportunities, futures trading provides a platform to speculate on the future direction of cryptocurrency prices. Leverage can amplify potential profits but also increase the risk of significant losses.

Market Arbitrage and Price Discovery

Futures markets contribute to price discovery and market efficiency by reflecting investor sentiment and supply-demand dynamics. Traders can capitalize on arbitrage opportunities between futures and spot prices to profit from market inefficiencies.

Examples of When to Use Futures Trading

- Market Volatility: Futures trading can be used to profit from volatility by taking advantage of price swings in both directions.

- Portfolio Diversification: Including futures contracts in a diversified investment portfolio can help manage risk and enhance overall returns.

- Event-Driven Trading: Traders may use futures contracts to position themselves ahead of market-moving events, such as regulatory announcements or macroeconomic indicators.

What is Spot Crypto Trading?

Spot crypto trading involves the immediate buying and selling of cryptocurrencies at their current market prices, known as spot prices. In this type of trading, transactions are settled instantly, meaning the buyer immediately owns the cryptocurrency purchased, and the seller receives the payment right away. The spot market is where these transactions occur, typically on cryptocurrency exchanges such as Binance, Coinbase, or Kraken.

In spot trading, you directly own the cryptocurrency, which can be stored in a digital wallet for future transactions or held as an investment. This type of trading is straightforward and does not involve the use of leverage, making it less complex and generally safer than other forms of trading, like futures trading.

Advantages of Spot Crypto Trading

- You buy a cryptocurrency at the current market price and can hold it for as long as you want.

- When you engage in spot trading, you actually own the cryptocurrency.

- Spot trading is considered less risky compared to futures trading because it does not involve leverage.

- Unlike futures contracts, which have expiration dates, spot trades do not expire. You can hold your cryptocurrency for as long as you like without worrying about contract deadlines.

When to Choose Spot Trading?

New to Crypto Trading

If you are new to cryptocurrency trading, spot trading is a great place to start. Its simplicity and lower risk profile make it easier to learn the basics of trading and understand how the market works.

Investing in the Long Term Appeals

Spot trading is ideal for long-term investors who believe in the future potential of a cryptocurrency. By buying and holding, investors can benefit from the long-term appreciation of their chosen assets.

Desire for Asset Ownership

If you prefer to own the actual cryptocurrency rather than a contract representing its future price, spot trading is the right choice. Ownership allows for greater flexibility in how you use and store your assets.

Risk Aversion

If you have a low tolerance for risk, spot trading is safer because it does not involve leverage. You can only lose what you have invested, which provides a sense of security not available in more speculative forms of trading.

Immediate Transactions

Spot trading is suitable for those who want immediate transactions. Since trades are settled on the spot, you can quickly buy or sell cryptocurrencies as market conditions change.

Avoiding Liquidation Risk

In futures trading, there is a risk of liquidation if the market moves against your position. Spot trading eliminates this risk since there are no margin requirements or leveraged positions to worry about.

Examples of When to Use Spot Trading

- Market Entry and Exit: If you want to enter or exit the market quickly, spot trading allows you to buy or sell at the current market price without delay. Our On Tilt Trading ROI Calculator helps you assess and optimize your portfolio, identifying high-performing investments. Boost your trading success now!

- Stablecoin Conversions: Spot trading is useful for converting one cryptocurrency to another, such as trading Bitcoin for Ethereum or converting crypto to stablecoins like USDT for stability in a volatile market.

- Using Cryptocurrency for Transactions: If you need to use cryptocurrency for payments, transfers, or other transactions, spot trading ensures you have the actual assets in your wallet ready for use.

Now let’s take a look at which is more profitable spot or futures trading?

Which is More Profitable Spot or Futures Trading?

Investing in futures or options depends on your investment goals and risk tolerance. Comparing the profitability of spot and futures trading in cryptocurrency markets is not straightforward, as each has its own advantages and risks. Spot trading involves buying or selling crypto at the current market price, with profits coming from price appreciation.

It’s generally considered less risky and more suitable for beginners, as you’re only using your own funds and actually own the cryptocurrency. However, potential gains are limited to the amount invested.

Futures trading, on the other hand, allows traders to speculate on future prices and potentially profit from both rising and falling markets. It often involves leverage, which can amplify gains but also magnify losses. This makes futures trading potentially more profitable but also riskier and more complex.

The profitability of each method largely depends on market conditions, individual trading strategies, and risk management skills. Experienced traders might find futures more lucrative due to the ability to use leverage and short the market. However, beginners often fare better with spot trading due to its simplicity and lower risk.

Final Words

That’s all from today’s round-up about which is more profitable spot or futures trading. The most profitable approach depends on market volatility, trading fees, and the trader’s ability to predict market movements. It’s crucial to choose a method that aligns with your experience level, risk tolerance, and investment goals. Higher profit potential often comes with increased risk. However, choosing the right tools can increase your profit.