The price of futures contracts can behave in interesting ways. Sometimes, the price of a commodity for future delivery is actually lower than its current price. It is a well-known financial market phenomenon that is known as backwardation. So what happens if the future price is less than the spot price? Let’s try to understand.

What are Future Contracts?

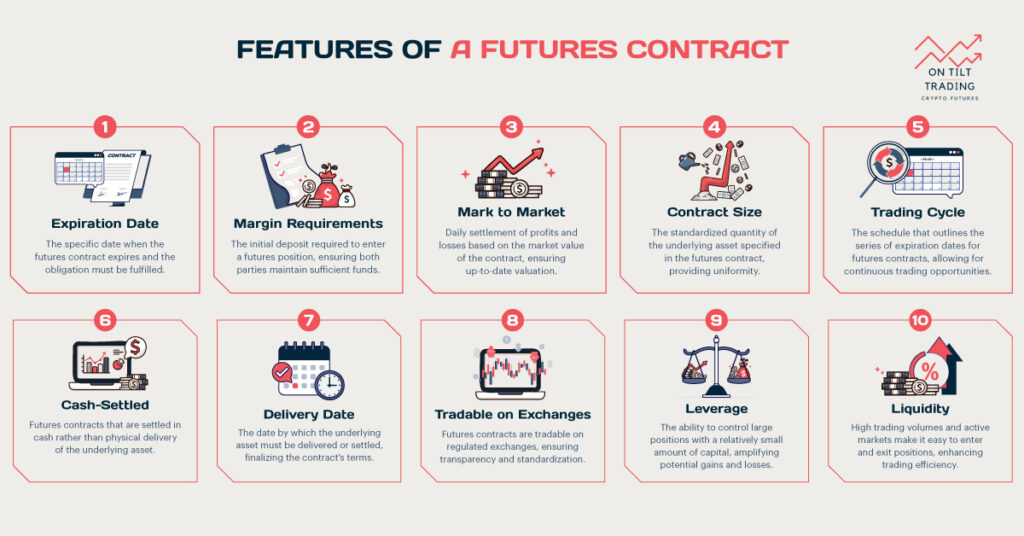

Futures contracts are agreements to buy or sell an asset at a predetermined price in the future date. They are widely used in trading for hedging risks or speculating on price movements of various assets, such as commodities, financial instruments, or cryptocurrencies. Each contract specifies the quantity of the asset, the price, and the expiration date. At expiration, the contract is settled, meaning the buyer purchases and the seller delivers the asset at the agreed-upon price.

What is Spot Price?

The spot price in trading is the current market price at which an asset can be bought or sold for immediate delivery. It reflects the most up-to-date valuation based on supply and demand dynamics. Transactions at the spot price are settled promptly, typically within a couple of business days. The spot price serves as a benchmark for futures and options contracts, influencing their pricing and market behavior. It is crucial for traders and investors to provide a clear picture of the asset’s real-time value in the open market.

What Happens If Future Price is Less Than Spot Price?

The situation is known as Backwardation. It is a market condition where the future price of a commodity is lower than its current spot price. In simpler terms, it means that people are willing to pay more for a commodity right now than they are for the same commodity delivered in the future. This might sound strange. After all, shouldn’t future prices be higher to account for storage costs and the time value of money?

While that’s often the case, there are situations where backwardation makes sense. Backwardation usually occurs when there’s a shortage of a commodity in the present, but people expect this shortage to ease in the future. It can happen with all sorts of commodities, from oil and natural gas to agricultural products and metals.

Let’s look at a concrete example to make this clearer. Imagine the current spot price for Bitcoin is $30,000. In a normal market, we might expect the price for Bitcoin delivered in three months to be higher, maybe $31,000, to account for holding costs and other factors.

But in a backwardation scenario, the price for Bitcoin delivered in three months might be only $29,000. This means traders are willing to pay a $1,000 premium to get Bitcoin now rather than wait for future delivery. Why would this happen? There could be several reasons.

Reasons of Backwardation

- There might be a current surge in demand for Bitcoin, driving up the spot price.

- Traders might expect the supply of Bitcoin to increase or demand to decrease in the future, lowering future prices.

- Holding Bitcoin right now could come with high costs, such as increased transaction fees or regulatory risks.

- Geopolitical events might be creating uncertainty about the future value or availability of Bitcoin.

In this example, a trader who buys Bitcoin futures at $29,000 and waits for delivery would save money compared to buying at the current spot price of $30,000. However, they would also be taking on the risk that the spot price might fall even further by the time of delivery.

Backwardation vs Contango

To fully understand backwardation, it’s helpful to compare it with its opposite: contango. Contango is the more common market condition where future prices are higher than current spot prices.

In a contango market:

- Future prices are higher than spot prices

- This is considered the “normal” state for many commodities

- It reflects storage costs and the time value of money

- Buyers are willing to pay a premium for future delivery

In a backwardation market:

- Future prices are lower than spot prices

- This is less common and often temporary

- It usually reflects a current shortage or strong immediate demand

- Buyers are willing to pay a premium for immediate delivery

Both backwardation and contango can provide opportunities and risks for traders and investors. Understanding which condition the market is in can help inform trading strategies and investment decisions.

How does Spot Price Affect Futures Prices?

The relationship between spot prices and futures prices is complex and dynamic. While futures prices are influenced by expectations of future supply and demand, they’re also closely tied to current spot prices.

When spot prices rise:

- It can pull futures prices up with them

- If the rise is seen as temporary, it might lead to backwardation

- It can change market expectations about future supply and demand

When spot prices fall:

- It can push futures prices down

- If the fall is seen as temporary, it might lead to contango

- It can signal changes in current supply and demand conditions

The spot price serves as a reference point for futures prices. Traders constantly compare spot and futures prices, looking for arbitrage opportunities. This continuous comparison helps keep spot and futures prices in a logical relationship with each other.

However, it’s important to note that futures prices don’t always move in lockstep with spot prices. Futures prices also factor in expectations about future events that might affect supply and demand. These could include:

- Weather forecasts for agricultural commodities

- Geopolitical events for energy commodities

- Economic indicators for industrial metals

So while spot prices certainly influence futures prices, the relationship isn’t always straightforward. The market’s expectations about the future play a crucial role in determining whether prices will be in backwardation or contango.

Is backwardation Bullish or Bearish?

Determining whether backwardation is bullish or bearish isn’t always straightforward. It can depend on the specific commodity, the reasons for the backwardation, and the time frame you’re considering.

In general, backwardation is often seen as bullish for near-term prices. Here’s why:

- Current demand is strong: Backwardation usually indicates that there’s strong demand for the commodity right now. This high demand is pushing up current prices.

- Supply constraints: The higher spot price might reflect current supply constraints. If these constraints are temporary, it could lead to higher prices in the short term.

- Market expectations: Backwardation suggests that the market expects prices to fall in the future. This expectation itself can sometimes lead to higher near-term prices as buyers rush to secure supplies.

However, backwardation can also have bearish implications, especially for longer-term outlooks:

- Future oversupply: The lower future prices in backwardation might indicate that the market expects an oversupply in the future. This could lead to lower prices down the road.

- Temporary spike: If the current high prices are due to a temporary shortage or spike in demand, prices might fall once this situation resolves.

- Economic signals: In some cases, backwardation might signal economic problems. For example, if oil futures are in backwardation, it might indicate concerns about future economic growth and energy demand. Do you need to evaluate trade profitability? Our On Tilt Trading ROI Calculator helps you assess and optimize your portfolio, identifying high-performing investments. Boost your trading success now.

Effects of Backwardation

It’s also worth noting that the effects of backwardation can vary depending on whether you’re a producer, consumer, or investor in the commodity:

- For producers: Backwardation can be challenging. It means they’ll get less money for future production than current production. This might discourage investment in new production capacity.

- For consumers: Backwardation can be a mixed bag. While current prices are high, the futures market is signaling lower prices ahead. This might influence purchasing and inventory decisions.

- For investors: Backwardation can create opportunities. Investors who can store the physical commodity might profit from the price difference. However, investors in futures might face losses as futures contracts converge to the spot price over time.

Read More: Which is More Profitable Spot or Futures Trading?

Final Words

That’s all from our today’s round-up on what happens if future price is less than spot price. Anyone interested in commodity markets or economic trends needs to understand backwardation. You can make more informed decisions whether you’re an investor, a business owner, or simply someone trying to understand economic news. Besides, you have to use the right tools to make a profit.