Trading psychology is one of the most crucial but often overlooked parts of trading. Many traders focus only on technical analysis or market trends, but without a solid psychological foundation, even the best strategies fail. A trading psychology chart helps traders visualize the emotional stages they go through, highlighting the importance of managing emotions.

In this blog, we’ll explore the concept of a trading psychology chart. Understanding the emotional phases traders experience will help you manage your reactions and make better trading decisions.

Prime XBT, a platform known for its reliability and advanced trading tools, can provide traders with the tools to navigate the emotional highs and lows of trading. Its user-friendly interface and robust risk management features make it easier for traders to stick to their trading plans. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is the Trading Psychology Chart?

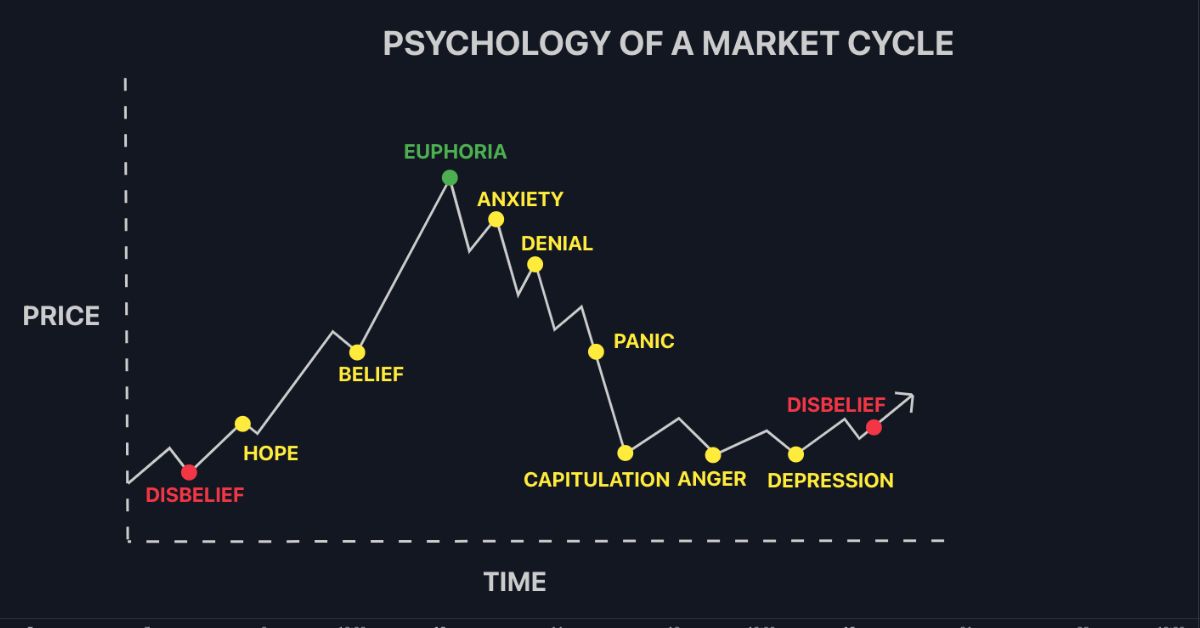

The trading psychology chart maps out the emotional journey traders experience during market cycles. It begins with optimism, where traders feel confident in their decisions. As the market rises, emotions shift to excitement and euphoria, often leading to overconfidence.

When the market turns, anxiety sets in. Traders start doubting their choices, leading to the denial phase, where they hope for a reversal. Panic follows as losses mount, and traders may capitulate, selling at the lowest point.

Despondency hits after capitulation, where traders feel regret and frustration. However, the market begins to recover, sparking hope and relief as prices rise. The cycle completes when optimism returns, often leading traders to repeat the emotional journey.

This knowledge will help you anticipate emotional reactions, allowing you to make better decisions. Knowing where you are in the cycle will help you avoid emotional trading pitfalls.

Key Phases of the Trading Psychology Chart

According to the trading psychology chart, traders typically experience distinct emotional phases. This chart helps traders anticipate emotional responses and make informed decisions. Each phase represents a different stage of the emotional journey, from optimism to eventual recovery.

Optimism and Euphoria

In the optimism phase, traders are confident and hopeful about market trends. They believe their decisions will yield positive results. As the market continues to rise, euphoria sets in, leading to overconfidence.

It often results in increased risk-taking and overtrading. Recognizing this phase can help you avoid impulsive decisions and maintain discipline.

Anxiety and Denial

As market conditions change, anxiety begins to set in. Traders worry about potential losses and question their strategies. Denial follows as traders hope for a turnaround, refusing to accept reality.

This phase can cause traders to hold onto losing positions longer than they should. Awareness of these emotions helps in making more rational decisions.

Panic and Capitulation

Panic is a strong emotional response to worsening market conditions. Traders fear further losses and may act impulsively. Capitulation occurs when traders sell off their positions at a loss, often at the market’s lowest point.

This phase is marked by high emotional distress and regret. Understanding this phase helps avoid hasty decisions and recognize when to stay the course.

Despondency and Depression

Despondency follows capitulation, characterized by feelings of hopelessness and frustration. Traders may feel disconnected from the market and doubt their abilities.

Depression sets in as they struggle with the losses they’ve incurred. It’s crucial to acknowledge these feelings and focus on recovery strategies. Using the trading psychology chart can guide you through this challenging period.

Hope and Relief

Hope emerges as the market begins to recover. Traders start to see the potential for improvement and regain some confidence. Relief follows as losses are minimized and positions start to turn profitable.

This phase is marked by renewed optimism and a cautious approach to re-entering the market. Recognizing this phase helps manage expectations and set realistic goals.

The Cycle Repeats

The emotional cycle of trading often repeats with new market conditions. Traders experience similar phases of optimism, anxiety, panic, and recovery.

Understanding that these phases are cyclical helps manage expectations and prepare for future market movements. Recognizing the cycle allows traders to make informed decisions and avoid repeating past mistakes.

Practical Strategies to Manage Trading Psychology

Effective management of trading psychology involves several vital strategies. Self-awareness, disciplined planning, and continuous reflection can help you control emotions. Maintaining a balanced approach enhances your trading performance.

Self-Awareness and Emotional Control

Self-awareness is crucial for effective trading. Recognize when emotions, such as fear or greed, influence your decisions. Practice mindfulness techniques to stay focused and avoid impulsive actions.

Evaluate your emotional state regularly before making trades to ensure rational decision-making. Tracking your emotional patterns helps you understand their impact on your trading.

Developing a Trading Plan and Sticking to It

A well-defined trading plan outlines your strategies, goals, and risk management rules. Adhering to your plan helps maintain discipline, even during emotional highs and lows.

Ensure your plan includes entry and exit criteria to guide your decisions. Sticking to this plan reduces the chances of making impulsive trades driven by emotions.

Journaling and Reflecting on Trades

Maintaining a trading journal is essential for tracking your trades and associated emotions. Record each trade, including the reasons behind your decisions and emotional state.

Review and reflect on these entries regularly to identify patterns and triggers. Analyzing both successful and unsuccessful trades provides insights for improving your future strategies and emotional responses.

The Role of Continuous Education and Mentorship

Ongoing education helps you stay updated with market trends and trading strategies. Engaging with a mentor offers personalized guidance and support. Continuous learning enhances your trading skills and psychological resilience.

Mentors can provide feedback and help you overcome emotional challenges, improving your trading results. Our On Tilt Trading Store trading psychology coaching will also help you overcome your specific psychological challenges.

Benefits of Using a Trading Psychology Chart

Traders who want to improve their performance can benefit from a trading psychology chart. It assists in recognizing and managing emotional phases that affect trading decisions. Knowing these phases will help you make more rational decisions and improve your trading.

Better Decision-Making

A trading psychology chart helps you recognize different emotional phases in your trading journey. Understanding these phases will enable you to make more rational decisions.

It enables you to identify when emotions, like euphoria or fear, might be influencing your trades. This awareness reduces the likelihood of impulsive actions and helps you adhere to your trading strategy.

Improved Risk Management

The trading psychology chart improves risk management by highlighting emotional stages. Knowing when you are overconfident or overly fearful helps you adjust your risk levels.

For example, during periods of euphoria, you might take on excessive risk. Identifying these tendencies will help you manage your risk exposure more effectively, leading to more balanced trading decisions.

Increased Emotional Resilience

Utilizing a trading psychology chart boosts your emotional resilience. It prepares you for the emotional highs and lows of trading.

Anticipating these reactions makes maintaining consistency and managing stress easier. This increased resilience helps you stay focused and make thoughtful decisions, even during volatile market conditions.

How to Use a Trading Psychology Chart in Your Routine

Adding a trading psychology chart to your routine can boost your decision-making. Create a chart that shows your emotional responses throughout your trading. Review and update this chart regularly to better understand and manage your psychology.

Create Your Chart

Begin by designing a trading psychology chart that reflects your emotional journey. Identify key emotional phases such as optimism, fear, and panic.

Customize the chart to align with your personal trading experiences and psychological responses. It will help you visualize how different emotions influence your trading decisions.

Regularly Update Your Chart

Keep your chart updated with new insights from recent trades and market conditions. Document your emotions during each trade to maintain accuracy.

Regular updates ensure the chart accurately reflects your current emotional state and trading patterns. This ongoing adjustment helps you stay aligned with your emotional responses.

Use Insights to Adjust Strategies

Examine the data from your chart to pinpoint emotional triggers and recurring patterns. Use these insights to refine your trading strategies and risk management.

Adjust your approach based on emotional trends to maintain a more balanced and rational trading mindset. It will help you make better-informed trading decisions.

Review and Reflect Periodically

Set aside time periodically to review your trading psychology chart and assess how emotional changes have impacted your trading performance.

Reflecting on this data helps you understand your psychological growth and areas for improvement. This continuous review process allows you to refine your trading strategies on an ongoing basis.

Conclusion

Mastering trading psychology is crucial for achieving long-term success in the markets. It helps you identify and manage emotional phases, resulting in more rational and disciplined trading decisions. You’ll avoid common pitfalls if you understand and address emotional triggers like fear, greed, and overconfidence.

It’s best to follow a structured approach, like regularly updating and analyzing your trading psychology chart. This ongoing self-awareness can improve consistency and refine your strategies.

Are you tired of losing money as a result of panic selling, FOMO, or overtrading? The Vestinda trading app allows you to make better crypto trading decisions without emotion influencing your decisions. Enhance your trading experience with Vestinda and take control of your trading success.