Trading crypto futures has rapidly gained popularity among traders looking to profit from cryptocurrency volatility. Traders can speculate on cryptocurrencies’ future price movements without owning the underlying assets, so crypto futures offer both high rewards and significant risks. But how risky are crypto futures? In this article, we will discuss the risks associated with crypto futures trading and how to mitigate them. Let’s dive in.

What Are Crypto Futures?

Crypto futures allow traders to buy or sell a cryptocurrency at a predetermined price at a future date. Spot trading involves buying and selling the actual cryptocurrency; futures trading involves speculating on the cryptocurrency’s price movement without owning it. It’s highly lucrative because big price swings are possible, but it’s also risky.

In crypto futures, traders can take long or short positions depending on whether they think the price is going up or down. With this flexibility, you can make money no matter what direction the market goes. Even so, futures trading can be a double-edged sword because of its inherent complexity and leverage.

Types of Crypto Futures

Crypto futures contracts fall into two main categories: perpetual contracts and fixed-term contracts.

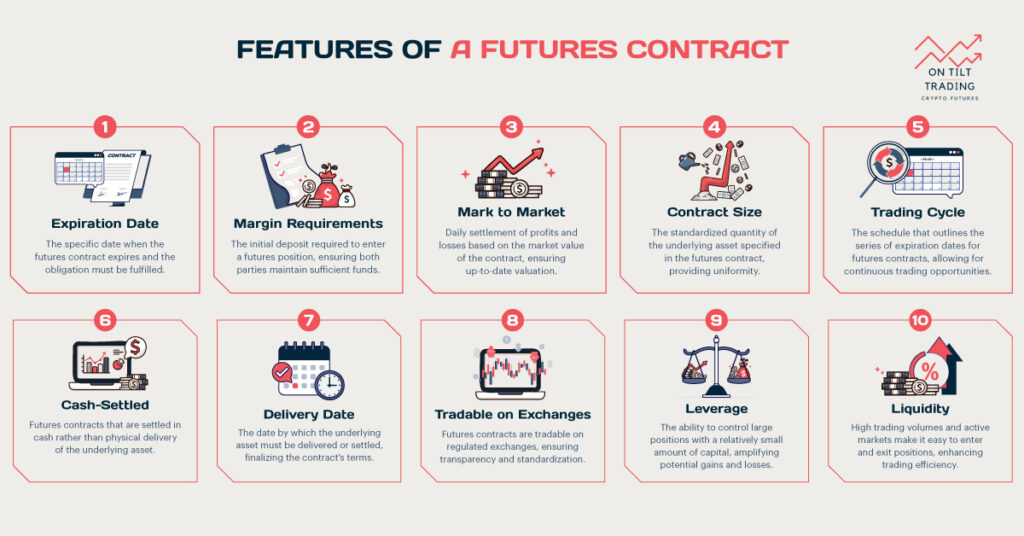

- Perpetual Contracts: Trading perpetual contracts is becoming increasingly popular because they have no expiration date. Traders can hold positions for as long as they like, provided that they meet the margin requirements. Hedging and speculative trading are common uses for these contracts.

- Fixed-Term Contracts: A fixed-term contract has an expiration date at which it must be settled. Traders who want to hedge against price fluctuations over a specific period or have a clear view of market movements can use these contracts.

Knowing the differences between different types of contracts can help traders choose the right one for their trading strategy.

How Risky are Crypto Futures

Crypto futures trading involves many risks and can have a huge impact on traders’ finances. Because of the cryptocurrency market’s high volatility, leverage can amplify both profits and losses.

High Volatility

The inherent volatility of the cryptocurrency market is one of the most significant risks associated with crypto futures. Depending on market sentiment, regulatory news, technological advancements, and macroeconomic factors, prices can swing dramatically.

When a regulatory announcement happens, prices can drop quickly, causing substantial losses for traders with long positions. Volatility can be both a blessing and a curse, as it creates opportunities for profit but also puts traders at risk.

Leverage Risks

The use of leverage in crypto futures trading has two opposing aspects. Despite its ability to control larger positions with a smaller initial investment, it can also magnify losses.

Consequently, even a small adverse price movement can result in significant losses, potentially wiping out an entire trading account within minutes.

When traders must deposit additional funds to maintain their positions, margin calls can exacerbate this risk, forcing them to sell off assets at unfavorable prices.

Liquidity Risks

In the market, liquidity refers to the ease with which an asset can be bought or sold without affecting its price. Liquidity varies significantly between contracts and trading pairs in the crypto futures market.

Slippage occurs when orders are executed at prices different from those expected during low liquidity periods. This can result in unexpected losses, especially for aggressive traders. Market depth and selecting highly liquid contracts can mitigate this risk.

Counterparty Risks

Counterparty risk is another critical concern when trading crypto futures. The risk comes from the exchange or trading platform defaulting on its obligations. Even though reputable exchanges put security measures in place, there have been hacks and exchange failures.

To minimize counterparty risk, traders should choose established platforms like Prime XBT, which have a strong track record of security and reliability.

Regulatory Risks

Cryptocurrency regulation is continuously evolving. Global governments are trying to figure out how to regulate the crypto market, and sudden changes can have a significant impact. New regulations could restrict traders’ trading activities or tax futures contracts, which could hurt their profits.

Anyone trading crypto futures needs to stay on top of regulatory developments and market changes.

Psychological Factors Affecting Trading Decisions

Psychological factors play a significant role in crypto futures traders’ decisions. Often, emotional responses can lead to impulsive decisions that deviate from well-planned strategies. Two dominant emotions can cloud a trader’s judgment: fear and greed.

In addition, fear of loss can cause a trader to sell too quickly, locking in losses that could have been avoided with a more measured approach. Furthermore, overconfidence can lead traders to take on too much risk, believing they can predict market movements consistently. It may result in larger positions and higher exposure, increasing the risk of significant losses.

In contrast, a lack of confidence can cause traders to miss out on lucrative opportunities since they’re hesitant to act even when things are great. Trading crypto futures more effectively requires understanding these psychological factors and implementing strategies to manage emotions.

Operational Risks

Risks associated with operational activities include failures in internal processes, systems, or external events that can disrupt trading. The dangers of crypto futures can manifest in a variety of ways, impacting traders’ ability to execute their strategies. For example, many technical factors can hinder trade execution at critical points, resulting in missed opportunities or unexpected losses.

Furthermore, traders may face risks related to account management and security. Poor password practices and neglecting two-factor authentication can expose accounts to hacking and theft. Successful hacks can cause traders to lose a lot of money. Maintaining robust security protocols, choosing reputable exchanges, and staying connected with technology and infrastructure are all important.

How to Reduce Risks in Crypto Futures Trading

A proactive approach and effective strategies are essential for mitigating the risks associated with crypto futures trading. Such as:

Risk Management Strategies

Implementing effective risk management strategies is crucial to navigating crypto futures trading’s complexities and uncertainties. One of the most fundamental techniques is setting stop-loss and take-profit levels. Stop-loss orders close positions automatically when an asset reaches a predetermined price, helping you limit losses.

In the same way, a take-profit order locks in profits once a certain price target is reached, preventing price reversals from eroding gains. These parameters can help you make disciplined trades and reduce emotional decisions.

Choosing Reputable Exchanges

A trustworthy and reliable exchange is vital in mitigating various crypto futures trading risks. You should do your research and look for platforms with a solid reputation, good security, and a transparent history.

User reviews, feedback, and an exchange’s response to past incidents can provide valuable insight. A reputable platform like Prime XBT can significantly reduce counterparty and operational risks with its established security protocols.

Staying Informed

Numerous factors influence the cryptocurrency market, including regulatory changes, technological advancements, and market sentiment. Keeping up with market trends, news, and events can help traders make better decisions.

Using forums, social media, and reputable news sources can enhance awareness and provide valuable insight. Furthermore, trading strategies, market analysis, and risk management education can empower traders to adapt to changing conditions.

Limiting Leverage

In crypto futures trading, leverage can increase potential gains, but it can also significantly increase risk. If you’re inexperienced, you should be careful how much leverage you use.

Taking a conservative approach involves starting with low leverage ratios and gradually increasing exposure as you get more confident. Traders can protect their capital from the adverse effects of market volatility by limiting leverage.

Practicing with Demo Accounts

Those new to crypto futures trading can practice with demo accounts without risking real money. Traders can get familiar with the platform test strategies and understand market dynamics before committing real money. The risk-free environment helps traders build confidence and become more disciplined.

Take Breaks

Taking regular breaks helps manage the psychological side of trading in the high-pressure environment of crypto futures. Without breaks, continuous trading can cause burnout and emotional fatigue, affecting judgment and decision-making. Exhausted traders make impulsive decisions based on emotion instead of logic, which increases losses.

Breaks in a trading routine allow for mental clarity and help maintain focus. Take a break from your screens, do some physical activity, or practice mindfulness techniques. In addition to reducing stress, this practice allows traders to reassess trading strategies and market conditions with a fresh perspective, ultimately resulting in better decisions.

Conclusion

Crypto futures trading involves many risks. You must understand market dynamics and devise effective risk management strategies. Traders should also be aware of psychological risks, operational risks, and market volatility to protect their investments. Staying informed, setting stop-loss orders, and taking breaks can significantly enhance your trading performance.