In recent years, cryptocurrency futures trading has become a popular financial instrument that offers traders and investors unique risk hedges. The Netherlands stands out for its progressive approach to financial innovation and cryptocurrency adoption as this market evolves globally. In this guide, we explore the essentials of crypto futures Netherlands, including the regulatory landscape, popular trading platforms, and critical strategies. Understanding the intricacies of this market is crucial for anyone wanting to capitalize on these opportunities.

What are Crypto Futures?

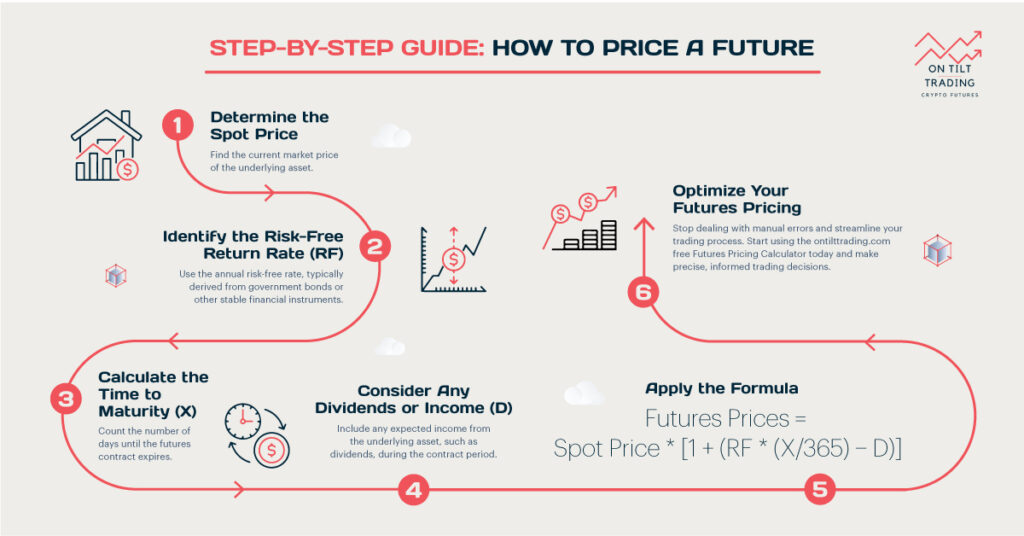

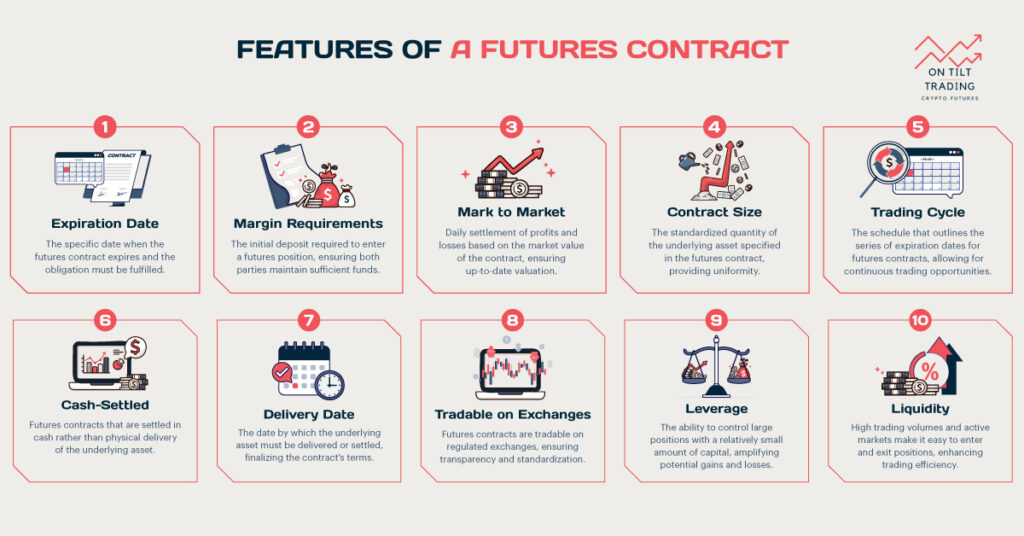

Cryptocurrency futures are financial contracts requiring the buyer or seller to buy or sell a specific amount of cryptocurrency at a predetermined price and date. The contracts allow traders to speculate on future cryptocurrency price movements without actually owning the asset. It’s great for those looking to leverage their positions and increase profits.

Among the main advantages of trading cryptocurrency futures is the ability to hedge against price volatility. For example, if you own a lot of Bitcoin and are worried about a potential price drop, you can sell Bitcoin at a set price in the future and avoid losses. Furthermore, traders can use futures contracts for speculative purposes so they can make money up and down the market.

Cryptocurrency Market in the Netherlands

Cryptocurrency trading has grown in popularity in the Netherlands, with more investors and traders getting involved. The country’s progressive approach to financial innovation and technology adoption has made cryptocurrencies thrive. Numerous blockchain startups and exchanges have set up shop in major cities like Amsterdam and Rotterdam.

Despite global trends, Bitcoin and Ethereum remain the most popular cryptocurrencies traded in the Netherlands. However, other digital assets such as Ripple (XRP), Litecoin (LTC), and Binance Coin (BNB) are also gaining traction among Dutch investors. Diverse cryptocurrencies offer numerous opportunities for portfolio diversification and speculative trading.

Recently, the Netherlands has embraced cryptocurrencies due to technological enthusiasm and a quest for financial returns. The volatile nature of the cryptocurrency market attracts Dutch investors looking for high returns. The increasing integration of cryptocurrencies into mainstream financial systems has also solidified their position in the Netherlands.

Regulatory Environment of Crypto Futures in the Netherlands

The regulatory environment in the Netherlands greatly shapes cryptocurrency futures trading. The Dutch Central Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) have implemented a robust regulatory framework that ensures financial integrity and security while encouraging cryptocurrency innovation.

Cryptocurrencies are not legal tender in the Netherlands, but they are treated as assets. DNB requires cryptocurrency exchanges and wallet providers to register and follow anti-money laundering and counter-terrorism financing regulations. It ensures these entities adhere to strict compliance standards, including customer due diligence and reporting suspicious transactions.

Regulatory frameworks in the European Union also significantly impact the Dutch market. The Markets in Financial Instruments Directive II (MiFID II) and the General Data Protection Regulation (GDPR) are two significant pieces of legislation that impact cryptocurrency trading. The MiFID II legislation intends to increase transparency in financial markets and enhance investor protection, while the GDPR ensures privacy and data protection.

The Dutch government is supportive of cryptocurrencies and blockchain technology despite the strict regulations. The financial sector, regulatory bodies, and tech startups are all working together to promote innovation and collaboration. This balanced approach keeps the Netherlands appealing to cryptocurrency investors while protecting their interests.

Popular Cryptocurrency Futures Platforms in the Netherlands

There are a lot of reliable platforms in the Netherlands that cater to cryptocurrency futures trading. Beginners and experts can both use these platforms, which offer a variety of features, competitive fees, and strong security measures. The following are some of the best platforms for trading crypto futures in the Netherlands:

Prime XBT

Prime XBT is a leading platform for future cryptocurrency trading in the Netherlands. With its easy-to-use interface and advanced trading tools, Prime XBT allows traders to leverage their positions up to 100x. It supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and more.

Furthermore, Prime XBT offers competitive trading fees and educational resources to help you make intelligent choices. Security measures like two-factor authentication (2FA) and cold storage for assets make your trading safe.

BitMEX

The BitMEX platform specializes in trading derivatives, such as perpetual contracts and futures on cryptocurrency. Because of its high-leverage options, it’s popular among traders looking to maximize their returns.

The charting tools and market data analysis features on the platform help traders execute precise strategies. The BitMEX platform employs rigorous withdrawal procedures and multi-signature wallets to ensure user security.

Kraken

Kraken is an established exchange that offers futures trading alongside spot trading. The platform is known for its strong regulatory compliance and transparent fee structure. The Kraken exchange offers up to 50x leverage on cryptocurrencies for futures trading.

The platform’s comprehensive educational resources and responsive customer support make it accessible to everyone. Security measures at Kraken include encrypted cold storage and regular security audits.

Bybit

Bybit is gaining popularity in the Netherlands due to its seamless trading experience and high-leverage options. Platforms like this offer perpetual contracts on major cryptocurrencies and insurance funds to protect traders.

The user-friendly interface and advanced trading tools make Bybit a strong contender in the crypto futures market. The platform is more reliable with SSL encryption and offline cold storage.

Coinbase

Cryptocurrency platform Coinbase offers a variety of services, including futures trading in some regions. Cryptocurrency beginners love Coinbase because of its easy-to-use interface and robust security measures. In addition to spot trading, Coinbase now offers derivatives and futures for Dutch traders interested in cryptocurrencies.

Crypto.com

The Crypto.com platform offers a comprehensive range of cryptocurrency trading options, including futures contracts. The Crypto.com futures trading platform focuses on user experience and security.

Additionally, the platform’s mobile app allows traders to manage their portfolios on the go. Crypto.com’s commitment to regulatory compliance and customer service appeals to Dutch traders.

Bitvavo

Bitvavo is a Dutch cryptocurrency exchange that offers futures trading for various digital assets. It is popular among Dutch traders of all experience levels because of its low fees and easy interface.

The platform offers features such as automated trading and a secure wallet for storing assets. The Dutch banking system and local regulations make Bitvavo a trusted choice for cryptocurrency enthusiasts.

Advantages of Trading Crypto Futures in the Netherlands

Cryptocurrency futures trading in the Netherlands offers several advantages, making it an appealing option for both new and experienced traders:

Diverse Range of Trading Platforms

Many trusted platforms are available to Dutch traders, such as Prime XBT, BitMEX, Kraken, Bybit, Coinbase, Crypto.com, and Bitvavo. These platforms include high leverage, low fees, advanced trading tools, and robust security measures. The diversity of platforms allows traders to choose platforms that best suit their preferences and risk tolerance.

Regulatory Clarity and Security

The Netherlands has a clear regulatory framework through the Dutch Central Bank (DNB) and the Netherlands Authority for the Financial Markets (AFM), ensuring a safe environment for cryptocurrency futures trading. In order to boost investor confidence, the country has strict regulations, including anti-money laundering (AML) and customer protection measures.

Access to Global Cryptocurrency Markets

Global cryptocurrency markets allow Dutch traders to trade a variety of digital assets beyond the constraints of traditional financial markets. Having global access to cryptocurrency offers portfolio diversification and exposure to emerging trends.

Leveraging Volatility for Profit

With cryptocurrency futures, traders can profit from rising and falling markets, leveraging volatility. Futures contracts allow traders to go long (buy) or short (sell) regardless of price direction, potentially increasing their returns.

Technological Innovation and Support

The Netherlands is known for its progressive approach to technology and innovation. In the country, trading platforms leverage advanced tech, like artificial intelligence and blockchain, to make trading more efficient.

Educational Resources and Community Support

Many trading platforms offer extensive educational resources, tutorials, and community forums. Trading resources like these help traders enhance their knowledge, develop trading strategies, and stay on top of market trends.

Risks and Challenges of Trading Crypto Futures in the Netherlands

Traders should carefully consider the following risks when trading cryptocurrency futures in the Netherlands:

Volatility and Market Fluctuations

The cryptocurrency market is highly volatile and prone to rapid price swings that can result in substantial gains or losses. A trader has to be prepared for sudden market movements and employ adequate risk management strategies.

Leverage and Margin Risks

Leverage allows traders to increase their exposure to the market, potentially increasing profits but also magnifying losses. When the market moves against a trader’s position, margin trading may result in liquidation, resulting in a loss of invested capital.

Regulatory Uncertainty

Trading in cryptocurrencies and futures is subject to evolving regulations. Changes in regulations by authorities like the Dutch Central Bank (DNB) can affect trading conditions. It’s essential for traders to stay on top of regulatory developments and to follow local laws.

Security Risks and Cyber Threats

Cryptocurrency exchanges are frequent targets for cyberattacks because they’re so lucrative. To protect against theft, traders should pick platforms that have robust security features, like two-factor authentication (2FA) and cold storage of funds.

Liquidity Concerns

Liquidity may be low on some cryptocurrency futures markets, particularly for less popular trading pairs or in times of market stress. The lack of liquidity can lead to wide bid-ask spreads and difficulty executing trades at desired prices, affecting trading strategies.

Operational Reliability

Technical issues or downtime may occur on trading platforms during periods of high market volatility. Traders can’t access their accounts or execute trades due to these disruptions, so it’s essential to choose a reliable platform with backup plans.

Emotional and Behavioral Biases

Traders who make irrational trading decisions based on fear or greed can spend significant amounts of money. Traders should cultivate discipline and stick to their plans to avoid making impulsive decisions.

Systemic and Taxation Risks

Cryptocurrency markets are susceptible to systemic risks like market crashes or regulatory interventions. Also, traders have to report cryptocurrency futures trade profits accurately and comply with tax laws.

Read our comprehensive guide on Crypto Futures India to learn more about crypto futures trading.

Conclusion

Trading crypto futures in the Netherlands requires a mix of strategy, risk management, and market knowledge. Traders must stay vigilant about volatility, regulatory changes, and security risks. Trading discipline and staying informed allow Dutch traders to capitalize on market opportunities.