There are more than 295 million cryptocurrency users worldwide. So, you have the opportunity to make money through crypto trading. Most of us live busy lives and don’t have time to sit all day at a computer doing crypto research and watching those charts like a hawk. In that case, you should start using crypto trading bots. But can you make money with crypto trading bots? More than 38% of investors utilize crypto bots to make money. All you need to do is choose a reliable trading bot and the right strategy. Crypto bots allow you to invest and win big. Let’s try to find out how

How do Trading Bots Work?

Trading bots are software programs that use algorithms to automate the process of trading assets. Trading bots start by analyzing market data. This can include price movements, trading volume, and historical data. The bots use technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to make sense of market trends and identify potential trading opportunities.

Based on the market analysis, the bot generates trading signals. These signals are alerts or triggers indicating when to buy or sell an asset. For instance, a bot might generate a buy signal when the price of an asset crosses above a certain moving average and a sell signal when it falls below that average.

The bot executes the trade once a trading signal is generated and the risk management conditions are met. You must choose a reliable trade platform to make money using trading bots. The bot connects to the trading platform via APIs (Application Programming Interfaces) to place real-time orders. This ensures that trades are executed quickly and at the best possible prices. You have to trade on a reliable platform like PrimeXBT. The platform has more than 1 million active users worldwide. The platform offers a range of features, including Copy Trading, CFDs and Forex, Crypto buying, and Crypto Futures trading. Trading using this platform is less risky for new users. Use the promo code “PRIMEOTT,” and receive a +7% bonus on your deposit. Join Prime XBT and get started with profitable automated trading.

How Successful Are Crypto Trading Bots?

The success rate of crypto trading bots can vary. Low-risk bots are capable of achieving 99% success rates. While these bots might help some people manage their trades, they’re not a guaranteed way to make money. The effectiveness of a bot depends on many factors:

- The bots quality

- Market Conditions

- Investor’s knowledge

- Expectations

Trading Strategies to Make Money With Crypto Bots

Trend Following

Trend following is a strategy where trading bots analyze historical price movements and attempt to capitalize on sustained price trends. The idea is simple: if a cryptocurrency’s price has been increasing steadily, the bot will buy in anticipation of further gains. Conversely, if the price is declining, the bot may sell to avoid losses.

This strategy works well when the market is trending strongly in one direction. It aims to ride the momentum of the trend until signs of reversal appear. Trend-following bots are useful in bull markets when cryptocurrencies experience prolonged upward movements.

For example, Bitcoin’s price has steadily increased over several weeks. A trend-following bot would detect this trend and automatically buy Bitcoin, expecting the price to continue rising. It might sell when the trend shows signs of weakening or reversing.

Mean Reversion

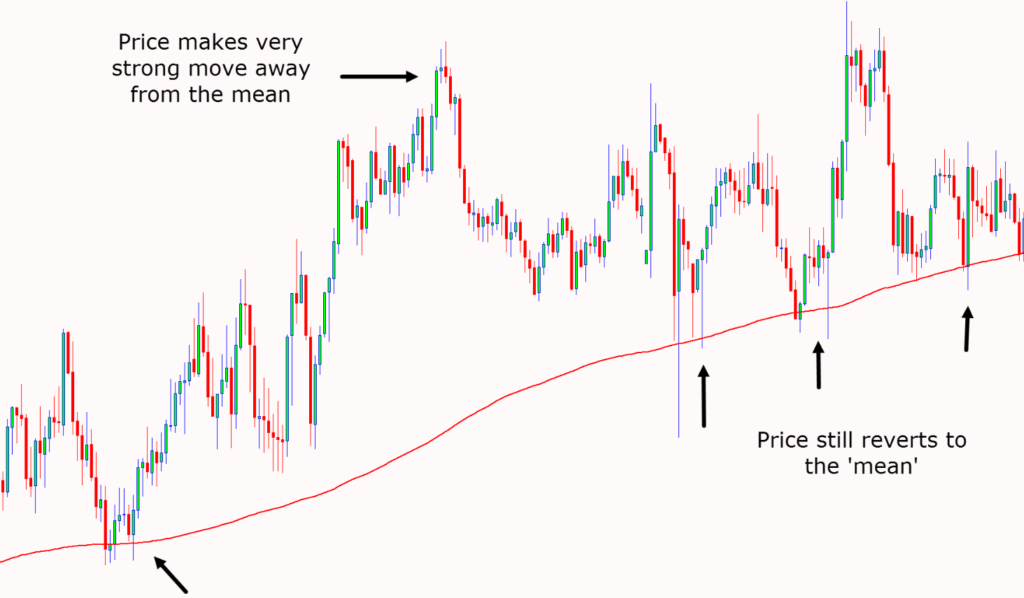

Mean reversion is based on the idea that prices tend to return to their average or mean over time after deviating from it. Trading bots using this strategy identify when a cryptocurrency’s price has moved significantly away from its historical average and anticipate a reversal.

Mean reversion strategies are suitable when a cryptocurrency’s price appears to have overreacted to news or market events, causing it to move sharply away from its usual price range. Bots employing this strategy aim to profit from the price returning to its normal levels. Suppose Ethereum’s price suddenly drops significantly due to market panic over regulatory news. A mean reversion bot would identify this as a potential buying opportunity, expecting Ethereum’s price to rebound as the panic subsides and the market stabilizes.

Arbitrage

Arbitrage involves exploiting price differences of the same cryptocurrency on different exchanges. Bots executing arbitrage buy the cryptocurrency on the exchange where it’s priced lower and simultaneously sell it on another exchange where it commands a higher price, profiting from the price differential. Arbitrage opportunities arise when there are discrepancies in cryptocurrency prices across different exchanges. It requires fast execution and access to multiple exchanges to capitalize on these price differentials before they normalize.

If Bitcoin is trading at $35,000 on Exchange A and $35,200 on Exchange B simultaneously, an arbitrage bot would buy Bitcoin on Exchange A and sell it on Exchange B, pocketing the $200 price difference per Bitcoin.

Market Making

Market making involves placing both buy and sell orders around the current market price. The bot profits from the spread between the buy and sell prices, providing liquidity to the market. Market-making bots aim to profit from the bid-ask spread and can adjust their orders dynamically based on market conditions.

The strategy is suitable for traders looking to earn profits from the spread between buy and sell prices. It’s beneficial in stable markets or when trading highly liquid cryptocurrencies where there’s frequent trading activity and narrow bid-ask spreads.

A market-making bot places buy orders slightly below the market price and sell orders slightly above it. If a trader buys from the bot at a lower price and sells back at a higher price, the bot profits from the spread between these prices.

Scalping

Scalping involves making numerous small trades to profit from small price movements. Scalping bots execute trades quickly, aiming to capture tiny price differentials within seconds or minutes. This strategy requires low latency and high-frequency trading capabilities.

Scalping suits traders comfortable with rapid trading and seeking to capitalize on short-term price fluctuations. It’s effective in volatile markets where price movements are frequent and predictable over very short time frames. A scalping bot might buy Bitcoin when its price drops by $50 and sell it when it increases by $60, making a $10 profit per trade. The bot accumulates profits from these small price movements by executing many such trades rapidly.

Choose The Right Crypto Trading Bot to Make Money

Security

The bot will have access to your trading account and potentially your funds. Look for bots with strong encryption, two-factor authentication, and a solid reputation for security. Avoid bots that ask for direct access to withdraw funds.

Research the bot’s history and user feedback. Look for reviews on trusted platforms and crypto forums. Be wary of overly positive reviews that might be fake. A good bot will have a mix of positive feedback and constructive criticism.

Supported exchanges

The bot should work with the exchanges you prefer. Some bots support multiple exchanges, which can be useful for arbitrage strategies. Check if the bot can handle the trading pairs you’re interested in.

A user-friendly interface is important, especially if you’re new to trading bots. Look for bots with clear instructions, intuitive controls, and helpful tutorials. Some bots offer both simple and advanced modes to cater to different skill levels.

Customization

The ability to adjust settings allows you to fine-tune strategies. Good bots let you set parameters like trading volume, price thresholds, and timing. More advanced bots might allow you to create custom strategies using programming languages. Besides, some bots can help you to implement new strategies without coding.

Backtesting

This feature lets you test your strategy against historical data. It helps you see how your bot might have performed in past market conditions. Keep in mind that past performance doesn’t guarantee future results, but it’s a useful tool for refining strategies.

Performance History

The crypto market changes rapidly. A good bot should receive regular updates to adapt to new market conditions and security requirements. Check the bot’s update history and the developer’s commitment to ongoing improvements.

Trial period

A free trial or money-back guarantee allows you to test the bot without financial risk. Use this time to thoroughly test the bot’s features and performance. Be aware of any limitations during the trial period.

Final Words

To succeed in crypto trading, choose a reliable bot and a strategy aligned with your risk profile and market conditions. Prior knowledge in crypto trading helps assess risks and optimise bot settings effectively for profitable trades. If you are concerned about losing money in crypto trading, we recommend Vestinda.

Using automated strategies it eliminates emotional decision-making in crypto trading. It’s easy to implement your own strategies without coding. With over $50M in trading volumes, Vestinda integrates with five major exchanges and serves more than 50 countries. Check the official site of Vestinda for more information or connect with us.