Futures contracts play a crucial role in financial markets, offering both opportunities and risks for investors and traders. Understanding the pros and cons of investing in futures contracts allows you to make informed investments with reduced risk. We have compiled a detailed guide explaining the advantages and disadvantages of futures contracts.

What are Futures Contracts?

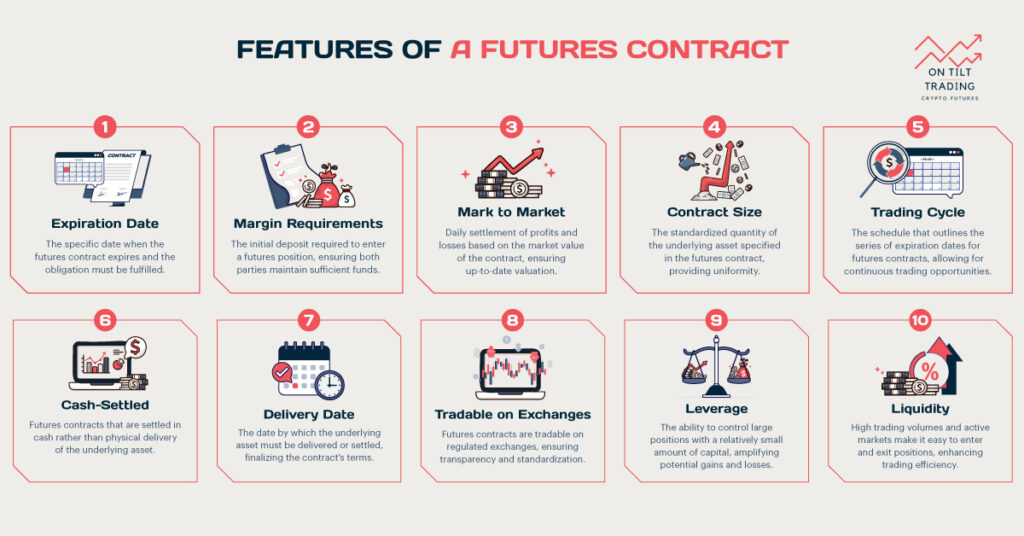

Futures contracts are agreements between two parties to buy or sell assets at a set price on a specified date in the future. Key elements of a futures contract include:

- Underlying Asset: The asset being bought or sold, which could be commodities like oil, gold, or agricultural products, financial instruments like stocks or indices, or even cryptocurrencies.

- Contract Specifications: Includes quantity, quality, delivery date, price quotation units, minimum price change, and settlement location.

For example, a trader might enter a futures contract agreeing to buy 1 ETH at $2,000 per token in three months. If the price of Ethereum rises to $2,500 by the contract’s expiration, the trader could sell their futures contract at a higher price, making a profit of $500 per ETH. Conversely, if ETH’s price falls, the trader could incur losses.

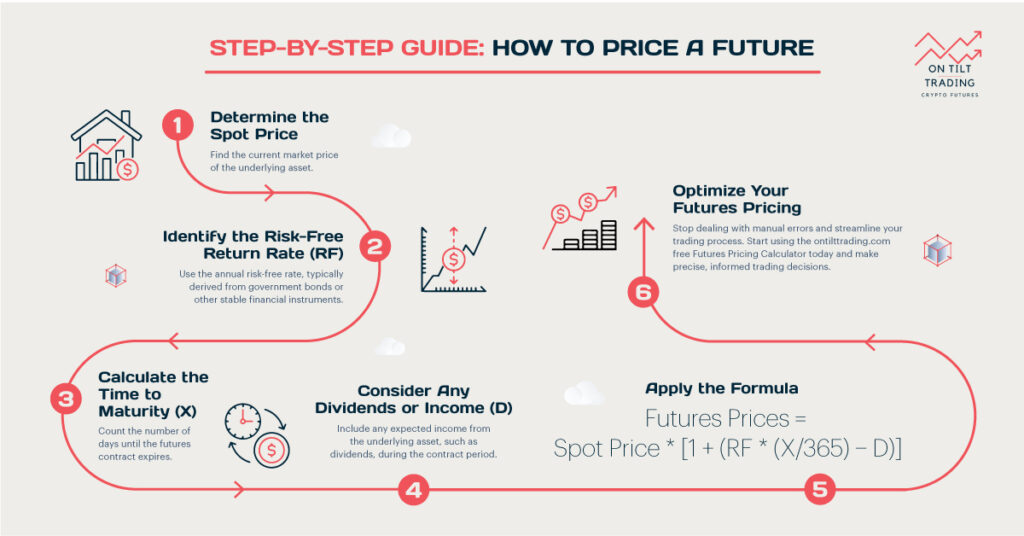

Futures contracts involve an initial margin deposit and can be settled financially rather than requiring physical delivery. This flexibility attracts traders seeking to hedge against price movements or profit from market speculation.

Advantages of Futures Contracts

1. Stable Margin Requirements

Futures contracts typically require lower initial margins compared to other forms of trading like stocks. This makes them accessible to a broader range of investors. For instance, an investor might need to put up only a fraction of the contract’s total value as margin. An investor wants to buy 10 futures contracts of gold, each contract representing 100 ounces. With a margin requirement of 5%, they need to deposit only 5% of the total contract value as initial margin.

2. High Liquidity

Futures markets are highly liquid, meaning it’s easy to enter and exit positions without significantly affecting prices. This liquidity ensures efficient price discovery and allows traders to execute large trades without much slippage. A trader can buy or sell crude oil futures contracts worth millions of dollars without experiencing substantial price changes due to the market’s depth.

3. Lower Associated Costs

Compared to other forms of trading, futures contracts often involve lower transaction costs. This is because futures are traded on organized exchanges where brokerage fees and clearing costs are standardized and competitive. Trading futures on commodities like wheat or corn typically incurs lower transaction costs compared to physically buying and storing these commodities.

4. Allows Hedging

One of the primary advantages of futures contracts is their ability to hedge against price fluctuations. Hedging allows businesses and investors to protect themselves from adverse price movements in the underlying asset. A wheat farmer can hedge against falling wheat prices by selling wheat futures contracts. If wheat prices drop, the losses on the physical crop are offset by gains in the futures position.

5. Speculation Opportunities

Besides hedging, futures contracts offer significant opportunities for speculation. Traders can profit from price movements in various assets without owning the underlying asset, leveraging their positions to amplify potential returns. A trader speculates on the rise of technology stocks by buying NASDAQ-100 futures contracts, anticipating an increase in the index’s value.

Futures contracts enable investors to diversify their portfolios across different asset classes, reducing overall investment risk. Futures markets operate globally, allowing investors to access international markets and diversify geographically.

Disadvantages of Futures Contracts

1. No Control Over Future Events

Investors trading futures have no control over external factors that can influence prices, such as geopolitical events, economic indicators, or natural disasters. Sudden changes can lead to unexpected losses. A trader holding crude oil futures may suffer losses if geopolitical tensions disrupt oil supplies, causing prices to spike unexpectedly.

2. Leverage Issues

While leverage can amplify profits, it also magnifies losses. Futures contracts involve substantial leverage, requiring traders to maintain adequate margin levels to avoid margin calls and potential liquidation of positions. A trader buys S&P 500 futures contracts with borrowed funds. If the market moves against them, the losses could exceed their initial investment.

3. Fixed Expiry Dates

Futures contracts have fixed expiry dates, limiting flexibility for traders who may need more time to realize their investment strategies. Rolling over positions can incur additional costs and complexity. A trader holding a futures contract for gas expiring in July may have to roll over their position to August, potentially incurring transaction costs.

Traders exploit price differences between futures and spot markets to profit from market inefficiencies. Futures markets provide valuable price information, aiding businesses and investors in setting future prices and making informed decisions.

Options vs Futures: Which One is Better?

When deciding between options and futures, it all depends on what you want from your investment, and how much risk you’re comfortable with.

Options give you the choice, but not the requirement, to buy or sell something at a set price before a certain date. You pay a fee (called a premium) for this flexibility. It’s good if you want to limit your risk because you can decide not to buy or sell if the market goes against you.

Futures, on the other hand, mean you have to buy or sell at a set time in the future. They offer lots of leverage (ability to control a large amount of assets with a small amount of money), are easy to buy and sell, and are good for making bets on price changes or protecting against price changes.

Let’s say someone believes gold will increase in value over time. They might buy gold futures to directly benefit from this rise. But if someone is worried about gold’s price changing a lot in the short term, they might choose gold options instead. So they can limit how much they could lose if the price goes down suddenly. Want to enhance trading decisions? Our On Tilt Trading Risk Reward Calculator assesses risk-reward ratios, helping you make informed choices and find best opportunities. Trade smarter now

How many times can you trade futures?

You can trade futures contracts multiple times throughout their trading hours, which typically span the trading day.

Futures markets are active and allow traders to buy and sell contracts as many times as they wish during these hours. This flexibility enables traders to react swiftly to market movements and adjust their positions according to their trading strategies and market conditions.

Why do futures contracts fail?

Futures contracts can fail due to various reasons, primarily because the anticipated price movements do not materialize as expected. Factors such as unexpected market news, economic changes, or geopolitical events can lead to price swings that undermine the profitability of a futures position. Additionally, inadequate risk management, insufficient market knowledge, or poor timing of trades can contribute to the failure of futures contracts.

What is the daily limit in futures?

The daily limit in futures refers to the maximum amount that a futures contract’s price can increase or decrease in a single trading session. This limit is set by the exchange and serves to stabilize trading and prevent extreme price volatility. Once a futures contract hits its daily limit, trading is halted temporarily, allowing traders to reassess market conditions before trading resumes.

The risk in futures trading is primarily related to the potential for significant price movements in the underlying asset. While traders can use risk management tools like stop-loss orders to limit losses, unexpected market events or large price swings can lead to losses that exceed initial investments.

What is the life cycle of a futures contract?

The life cycle of a futures contract includes several stages: initial listing, trading, expiration, and settlement. Contracts are initially listed by the exchange, after which they are actively traded until their expiration date. During trading, prices fluctuate based on market demand and supply. Upon expiration, contracts are settled either through physical delivery or cash settlement, depending on the contract specifications.

Read More: What Is The Downside Of Futures Contracts?

Conclusion

Futures contracts are powerful financial instruments offering advantages such as stable margins, high liquidity, lower costs, and hedging capabilities. However, they come with risks like leverage, lack of control over external events, and fixed expiry dates.

Understanding these factors and comparing them to options can help investors make informed decisions and manage their portfolios effectively. Besides, choosing the right tools can significantly boost your trading profits.