Fear and greed are powerful emotions that can significantly impact trading decisions. Traders often experience a rollercoaster of feelings, affecting their judgment and strategy. Managing these emotions is crucial for success in the dynamic world of trading. In this article, we will explore how to control fear and greed in trading. Understanding these emotions and implementing practical techniques is the best way to improve your trading performance and long-term success.

Many traders use platforms like Prime XBT to navigate this emotional landscape. There are many useful tools and resources available on this reliable crypto trading platform. The use of such platforms can help traders improve their skills and become more disciplined. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is Fear and Greed in Trading?

Fear is a common emotion among traders. It often arises from the uncertainty of financial markets. Many traders fear losing money or missing profitable opportunities. This fear can lead to impulsive decisions, resulting in significant losses.

On the other hand, greed can be equally detrimental. Greed drives traders to chase profits, sometimes at the expense of their strategy. This emotion can lead to overtrading or holding onto losing positions too long. Ultimately, both fear and greed can cloud judgment.

Traders need to understand these emotions. Recognizing how fear and greed affect decisions helps traders regain control. This self-awareness is the first step toward improving trading discipline.

The Importance of Emotional Control in Trading

Emotional control is vital for successful trading. Uncontrolled emotions can lead to significant financial losses. When fear takes over, traders may panic and exit positions prematurely. This reaction can result in missed opportunities for profit.

Conversely, when greed drives decisions, traders may take excessive risks. They might hold onto losing positions, hoping for a turnaround. This behavior often exacerbates losses and increases emotional stress. The consequences of these emotional swings can be detrimental to a trader’s overall performance.

Maintaining emotional stability provides numerous benefits. Traders who manage their emotions make more rational decisions. They can stick to their trading plans and strategies, leading to consistent results. By prioritizing emotional control, traders can enhance their long-term profitability and success in the market.

How to Control Fear and Greed in Trading

Controlling fear and greed in trading is essential for achieving consistent success. Implementing practical strategies can help traders maintain emotional balance and make informed decisions. Below are several effective methods to manage these powerful emotions.

Establish a Trading Plan

A well-defined trading plan is the foundation for successful trading. It outlines your trading goals, strategies, and rules. This plan should include specific entry and exit points for each trade and criteria for trade selection.

When traders have a clear plan, they are less likely to make impulsive decisions driven by fear or greed. A solid trading plan also provides a sense of direction and confidence, making it easier to stick to your strategy, even during market volatility.

Risk Management Techniques

Effective risk management is crucial in controlling emotions. Traders should determine their position sizes based on their overall risk tolerance. This means deciding how much of your capital you are willing to risk on each trade.

Diversifying your portfolio can help mitigate potential losses and reduce the emotional impact of bad trades. Putting stop-loss and take-profit levels on each trade can protect your capital and minimize emotional reactions.

Stop-loss calculators are useful tools for implementing risk management. Our On Tilt Trading Store provides valuable trading tools like a stop-loss calculator for managing risk effectively.

Using a stop-loss calculator helps traders determine the appropriate exit point for a trade, ensuring that they stick to their risk management plan. With these tools, traders can focus more on the process and less on the fear of losing.

Keeping a Trading Journal

Maintaining a trading journal is a powerful tool for emotional control. Documenting each trade allows traders to analyze their performance and identify patterns. In your journal, include details such as entry and exit points, reasons for entering a trade, and your emotional state during the trade.

Regularly reviewing your journal can reveal emotional triggers that lead to fear or greed. This self-reflection helps traders learn from their experiences and develop strategies to handle emotions better in the future. Over time, a trading journal fosters greater self-awareness and discipline.

Practicing Mindfulness and Emotional Awareness

Incorporating mindfulness techniques into your trading routine can significantly enhance emotional control. Mindfulness involves being present and fully engaged in the moment, which can help reduce anxiety. Techniques such as meditation, deep breathing exercises, and visualization can promote relaxation and clarity.

Practicing mindfulness allows traders to observe their thoughts and emotions without reacting impulsively. By recognizing emotional triggers, traders can respond more thoughtfully to market movements. This emotional awareness can help reduce the influence of fear and greed on trading decisions.

Continuous Education and Self-Improvement

Education plays a vital role in controlling fear and greed. The more knowledge a trader has about the markets, strategies, and risk management, the more confident they will feel. This confidence can help mitigate fear and greed during trading.

Continuous learning can involve reading books, attending webinars, or participating in trading courses. Engaging with experienced traders through forums or mentorship can also provide valuable insights. By committing to self-improvement, traders can build their skills and resilience against emotional challenges.

Utilizing Technology and Tools

Leveraging technology can help traders manage their emotions effectively. Many trading platforms offer features like alerts and notifications, which can help keep traders informed without emotional pressure. Automated trading systems can also minimize emotional involvement by executing trades based on predefined criteria.

Additionally, some platforms provide analytical tools to assess market conditions without the influence of emotions. By using technology to streamline trading decisions, traders can focus on strategy rather than being swayed by fear and greed.

Utilizing Technology and Tools

Leveraging technology can significantly aid traders in managing fear and greed. Various tools and resources are available to enhance trading performance and emotional control.

Trading Platforms and Software

Many trading platforms offer advanced features to help traders stay informed about market movements. Tools such as charting software provide visual insights into price trends, and technical indicators, like moving averages, can help identify potential entry and exit points.

By analyzing these trends, traders can make more informed decisions based on data. This data-driven approach reduces emotional involvement in trading. Confidence in analysis helps traders stick to their strategies, mitigating fear and greed.

Alerts and Notifications

Setting up alerts and notifications is a powerful way to manage emotions effectively. Many trading platforms allow users to set alerts for specific price levels. For instance, traders can receive notifications when a stock reaches a certain price.

This feature eliminates the need for constant market monitoring. By receiving timely notifications, traders can make decisions without feeling rushed, helping reduce impulsive decisions driven by fear or greed.

Automated Trading Systems

Automated trading systems can help traders minimize emotional involvement in their decisions. These systems execute trades based on predefined criteria set by the trader. By relying on algorithms, traders can remove the emotional aspect of decision-making. Automated systems can trade based on specific indicators, trends, or risk profiles.

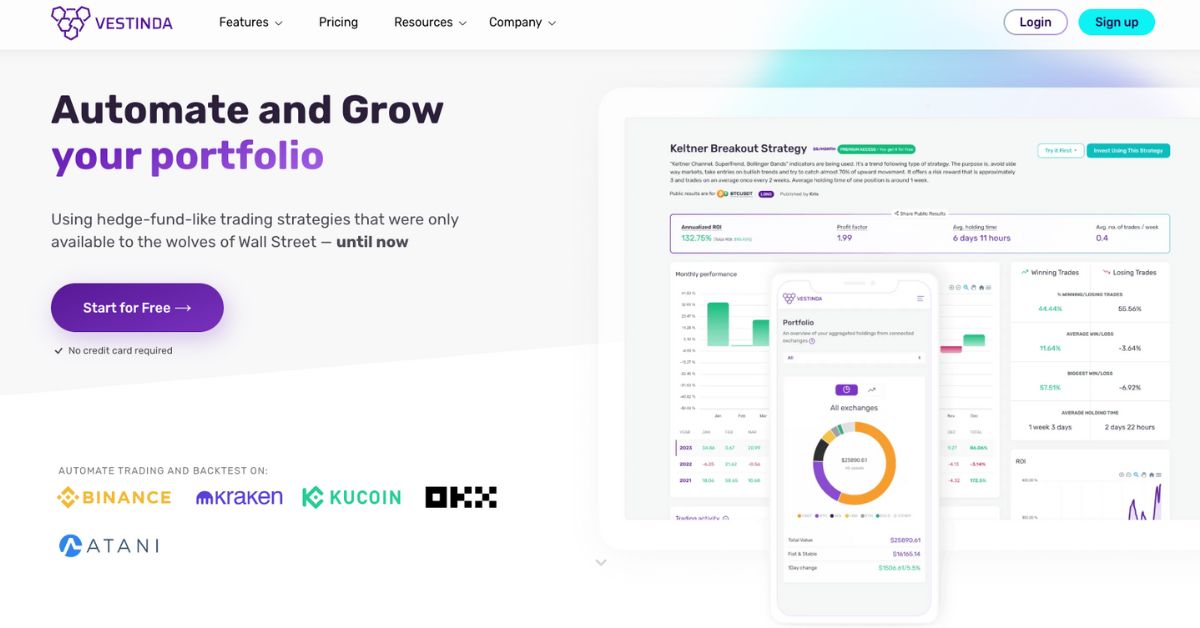

Are you tired of losing money due to panic selling, FOMO, overtrading, and bag holding? We recommend the Vestinda trading app to eliminate emotional decision-making with automated crypto trading strategies.

This app allows traders to implement strategies without the influence of fear or greed. By automating trades, users can enhance discipline and stick to their strategy consistently. This method makes trading more systematic and less prone to emotional fluctuations.

Educational Resources

Accessing educational resources can significantly bolster trading confidence. Many platforms offer webinars, tutorials, and articles to enhance traders’ knowledge. Engaging with educational content helps traders better understand market dynamics.

Continuous learning improves skills and prepares traders for different market scenarios. A strong knowledge foundation reduces the fear of making uninformed decisions. Informed traders are better equipped to manage emotions and take calculated risks.

Building a Support System

Creating a support system is essential for managing emotions in trading. Connecting with others can provide encouragement, insights, and accountability.

Joining Trading Communities

Participating in trading communities can offer emotional support and valuable resources. Online forums, social media groups, and local meetups foster connections among traders, and sharing experiences with others helps normalize the emotional challenges faced in trading.

Members can share strategies, tips, and market analysis to enhance learning. This sense of belonging can reduce feelings of isolation, making the trading journey less daunting.

Seeking Mentorship

Finding a mentor can significantly impact a trader’s growth and confidence. A mentor provides guidance, advice, and encouragement based on their experiences. They can help newer traders navigate challenges and uncertainties more effectively.

Mentors can share their insights on risk management and emotional control. Their experience can help mentees avoid common pitfalls, fostering a more disciplined trading approach.

Sharing Experiences

Openly discussing trading experiences with peers creates an environment of learning and support. Sharing successes and failures encourages honesty and vulnerability among traders.

This exchange of information helps traders gain new perspectives on their strategies. Understanding that others face similar challenges can alleviate emotional stress. Sharing lessons learned can also improve decision-making in future trades.

Accountability Partners

Establishing accountability partnerships can enhance discipline and focus. Accountability partners help each other consistently adhere to trading plans and strategies. Regular check-ins can foster a commitment to personal goals and risk management practices.

This mutual support helps both partners remain accountable for their trading behaviors. Knowing someone else is invested in your success can motivate you to stay disciplined.

Professional Support

In some cases, seeking professional support may be beneficial for emotional well-being. Therapists or coaches specializing in trading psychology can provide tailored guidance. They can help traders work through emotional challenges and develop coping strategies.

Professional support fosters personal growth and resilience in trading. Understanding your emotional triggers can lead to more effective decision-making.

How to Stop Revenge Trading

Revenge trading can be detrimental to a trader’s emotional and financial well-being. Here are several strategies to help break the cycle of revenge trading.

Acknowledge Your Emotions

Recognizing and acknowledging your emotions is the first step to overcoming revenge trading. Understand that feeling frustrated or angry after a loss is normal. Accepting these emotions can prevent them from making impulsive decisions. Awareness is essential in regaining control over your trading behavior.

Take a Break

When you feel the urge to engage in revenge trading, step away from the market. Taking a break allows you to clear your mind and regain perspective. Use this time to reflect on your recent trades and emotions. A short pause can help you return to trading with a calmer mindset.

Review Your Trading Plan

Returning to your trading plan can provide clarity and guidance. Reassess your strategies, entry and exit points, and risk management techniques. Ensure your plan aligns with your trading goals and market conditions. A well-structured plan can help you avoid impulsive decisions driven by revenge.

Set Realistic Expectations

Setting realistic expectations for your trading journey can reduce the urge to seek revenge. Understand that losses are a part of trading and that not every trade will be profitable. Accepting this reality can help you maintain a balanced perspective. Focus on long-term success rather than immediate gains.

Maintain a Trading Journal

Keeping a trading journal allows you to reflect on your emotions and decisions. Document your feelings after losses and any urges to revenge trade. Reviewing these entries can help you identify patterns in your behavior. This self-awareness is essential for breaking the cycle of revenge trading.

Focus on Continuous Improvement

Shift your focus from seeking revenge to continuous improvement. Concentrate on refining your trading skills and strategies over time. Set specific goals for personal development rather than immediate financial gains. This growth mindset fosters resilience and reduces the urge to engage in revenge trading.

Read More: Trading FOMO: A Complete Guide

Conclusion

Controlling fear and greed is essential for successful trading. Keep a trading journal and build a support system to improve your emotional resilience. Focus on clear goals, risk management, and continuous education to create a balanced trading mindset. Remember, the journey in trading is as important as the outcome. Stay disciplined and embrace personal growth to improve your trading performance.