The role of cryptocurrencies in financial markets is growing rapidly, which attracts both retail investors and institutions alike. New financial instruments like crypto futures are emerging as digital assets’ popularity continues to grow. The crypto futures market in Canada offers traders leveraged positions to take advantage of market fluctuations. So, In this article, we’ll explore the essentials of crypto futures Canada, including the benefits, risks, and how you can get started in this dynamic market. Let’s dive in.

What are Crypto Futures?

Crypto futures are financial contracts in which two parties agree to buy or sell cryptocurrencies at a set price in the future. The contracts allow traders to speculate on cryptocurrency prices and make money from rising and falling markets.

In contrast to spot trading, which involves the immediate exchange of assets, futures trading focuses on future value, providing leverage and risk management.

Types of Crypto Futures Contracts

Crypto futures contracts are primarily divided into two types: Perpetual Contracts and Fixed-Term Contracts.

- Perpetual Contracts: Perpetual contracts do not expire, allowing traders to keep positions indefinitely. They are similar to spot trading but utilize a funding rate mechanism to maintain a close price relationship with the underlying asset.

- Fixed-term Contracts: These have an expiration date, at which point the contract ends. To avoid automatic settlement, traders must close their positions or roll them over before the expiration date.

How do Crypto Futures Differs from Traditional Futures?

Traditional futures contracts usually involve commodities like oil, gold, or agricultural products, but crypto futures involve digital assets like Bitcoin and Ethereum. There are a few key differences, like the higher volatility, 24/7 trading, and the use of cryptocurrency.

These differences make crypto futures an attractive but risky investment, requiring a solid understanding of market dynamics.

The Crypto Futures Market in Canada

The crypto futures market in Canada provides traders with opportunities to speculate on the future prices of various cryptocurrencies. In this market, traders can leverage their positions, which could mean higher returns than traditional spot trading.

Nowadays, Canadian investors are exploring futures trading as a way to diversify their portfolios and profit from market volatility.

Regulatory Environment

Canada has a well-defined regulatory framework for cryptocurrency trading, so investors can trade in a secure and transparent environment. The Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) oversee the crypto futures market.

They ensure that trading platforms follow strict standards, such as security measures and fair trading practices. The regulatory oversight gives traders a feeling of security and protects their investments.

What are the Best Crypto Futures Trading Platforms in Canada?

Crypto futures contracts are available on several exchanges specifically for the Canadian market. Here are some of the best crypto futures exchange platforms in Canada you should be aware of:

1. Bitbuy

Bitbuy is a popular cryptocurrency exchange in Canada, known for its easy-to-use interface and robust security measures. Although Bitbuy’s focus is on spot trading, it has partnerships with international platforms that give it access to futures markets.

The Bitbuy platform supports CAD deposits and withdrawals, so Canadian traders can easily fund accounts and trade crypto futures.

2. Coinsquare

Another top choice for Canadian crypto traders is Coinsquare. The platform offers a wide range of cryptocurrencies and futures contracts and provides educational resources and tools to assist traders in navigating the complexities of futures trading.

3. Prime XBT

Prime XBT is a reliable platform for Canadian traders seeking to trade crypto futures easily. The platform offers several futures contracts and advanced trading tools like leverage options. Its user-friendly interface and comprehensive customer support make Prime XBT a great option for traders of all levels.

4. Kraken

Kraken is a well-established and highly reputable cryptocurrency exchange that offers Canadian traders access to a wide range of futures contracts. The Kraken trading platform combines high liquidity and competitive fees with solid security measures and regulatory compliance.

The platform offers advanced trading tools, including leverage options, and supports a wide range of cryptocurrencies. Whether you’re a novice or a pro, Kraken’s educational resources and responsive support make it one of the top options for Canadian futures traders.

5. Coinbase

Coinbase is one of the most respected cryptocurrency exchanges known for its security and regulatory compliance. Although Coinbase is primarily a spot trading platform, it recently added crypto futures to its offerings.

Its easy-to-use interface, robust security measures, and extensive educational resources make Coinbase an excellent choice for Canadian traders. Customers who want to start trading futures can rely on the platform’s strong reputation and customer support.

6. Crypto.com

In Canada, Crypto.com is a popular cryptocurrency platform that offers a range of services, including futures trading. It offers advanced trading tools, a wide selection of futures contracts, and competitive fees.

Crypto.com offers an easy-to-use mobile app, robust security protocols, and a variety of promotional offers for Canadian traders. It also offers educational resources and market insights to help traders make informed decisions.

Benefits of Trading Crypto Futures in Canada

The cryptocurrency futures market offers numerous advantages for investors looking to earn a profit from this market. Such as:

Leverage Opportunities

Leverage is one of the primary benefits of trading crypto futures. The use of leverage allows traders to control a larger position with a relatively small amount of capital. For instance, with a 10x leverage, a trader can open a position worth $10,000 with only $1,000.

It’s an attractive option for those looking to maximize their returns because it magnifies potential profits. However, leverage also increases the risk of significant losses, so it’s essential to use it carefully.

Hedging Against Market Volatility

Crypto futures provide an effective way to protect against market volatility. Traders can use futures contracts to protect their portfolios from adverse price movements.

For example, a trader who has a lot of Bitcoin and expects it to drop in price can enter a short futures contract to offset it. The strategy helps in managing risk and maintaining portfolio stability in an unpredictable market such as cryptocurrency.

Diversification

A crypto futures trading strategy can help investors diversify their investment strategies. Trading futures contracts can expose traders to various cryptocurrencies and hedge against other market moves. It can help spread risk and potentially improve portfolio performance.

Potential for Higher Returns

Futures trading has the potential for higher returns than spot trading due to its leverage. Traders can capitalize on small price movements to generate substantial profits. The potential for significant gains makes futures trading an appealing option for investors looking for a high return.

24/7 Market Access

Unlike traditional financial markets, the cryptocurrency market operates 24/7. Traders can respond to price movements and news events in real time, ensuring they don’t miss out. Prime XBT, which offers round-the-clock trading, enables Canadian traders to participate in the global crypto futures market 24/7.

Tax Efficiency

Futures contracts can offer certain tax advantages over spot trading in Canada. The tax treatment of futures profits depends on the trader’s specific circumstances and the duration of the trade. Traders should consult a tax professional to understand the implications and benefits thoroughly.

Increased Market Participation

Crypto futures trading has increased market participation, attracting both retail and institutional investors. It increases liquidity and price discovery in the crypto futures market, making it more efficient and dynamic. It gives Canadian traders more trading opportunities and potentially better prices, so they benefit from it.

Risks of Trading Crypto Futures in Canada

Trading crypto futures in Canada carries several risks that traders need to be aware of. Some of them are:

High Volatility

Cryptocurrencies are known for their extreme price volatility, which can lead to significant gains and losses. The leverage involved in futures trading amplifies this volatility, potentially magnifying both profits and losses.

Market Uncertainty

Changing regulations and market sentiment can rapidly affect cryptocurrency prices and trading conditions. Therefore, it’s crucial for traders in Canada to stay informed about regulatory developments and market news.

Leverage Risks

Leverage can increase profits, but it can also increase losses. When the market moves against traders, they can lose more than their initial investment. The best way to mitigate these risks is to use proper risk management strategies.

Counterparty Risk

A futures contract involves an agreement between two parties, and the counterparty may default on their obligations. To reduce this risk, it’s important to choose reputable and regulated platforms for futures trading.

Liquidity Risks

In times of extreme market volatility, liquidity in specific futures contracts may dry up, making it difficult to enter or exit positions. It’s a good idea to assess liquidity conditions before trading less popular agreements.

Regulatory Risks

The regulation surrounding cryptocurrencies and futures can vary by jurisdiction and change over time. In Canada, traders need to follow local rules and be aware of potential legal ramifications.

Complexities of Trading

Futures trading requires an understanding of market dynamics, technical analysis, and trading strategies. To gain experience, beginners should educate themselves thoroughly or start with smaller positions.

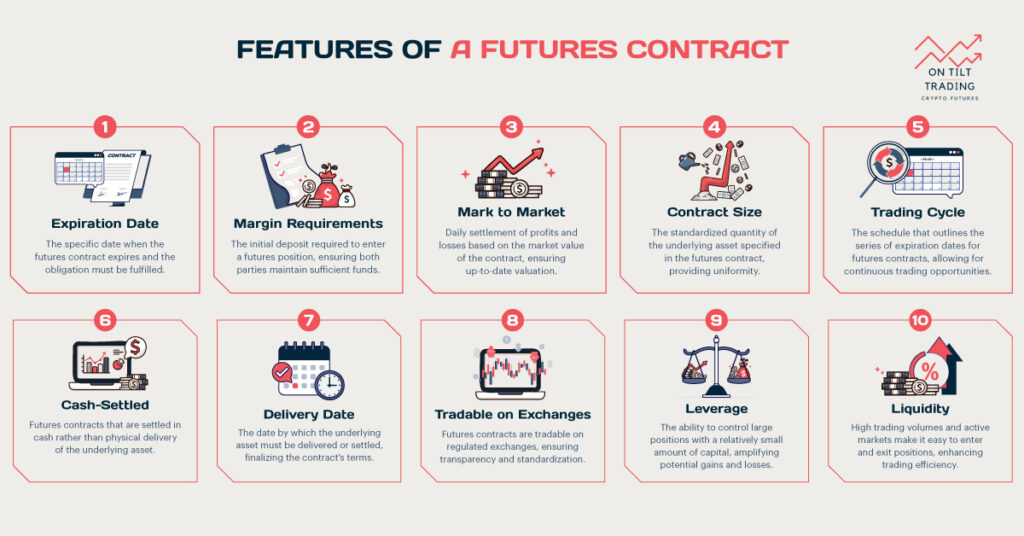

Check out our comprehensive guide on Features of Futures Contract to learn more about how future contracts work.

Trading crypto futures in Canada carries significant risks as well as potential rewards. The best way to navigate these risks is to conduct thorough research, employ risk management strategies, and stay cautious.

Conclusion

Crypto futures trading in Canada offers plenty of opportunities, but it’s imperative to understand the risks and choose the right platform. To navigate this dynamic market effectively, Canadian traders should stay informed and use reliable exchanges like PrimeXBT. Invest in our expert resources to enhance your trading skills and maximize your potential!