Trading psychology is a crucial aspect of successful trading. It involves understanding how your mindset affects your trading decisions and overall performance. Developing a strong mental approach can make the difference between success and failure in the markets. In this blog post, we’ll explore trading psychology levels, from beginner to advanced. Understanding and mastering these psychological aspects will enable you to trade with greater confidence and discipline.

You can enhance your trading experience with reliable trading platforms like Prime XBT. The Prime XBT platform offers a number of resources and tools that can help you on your trading journey. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is Trading Psychology?

Trading psychology refers to the mental and emotional aspects of trading. It affects how traders make decisions. Emotions like fear and greed play a significant role. These emotions can lead to impulsive actions or missed opportunities. Psychology impacts decision-making, risk management, and performance.

Traders need a balanced mindset to make rational choices. Emotional control helps in managing risk effectively. Psychological resilience is vital for long-term trading success. Getting to know your psychological patterns can help you improve your trading results. Developing a strong mental game is essential for overcoming market challenges.

What are Trading Psychology Levels?

In trading, “psychology levels” often refer to key price levels in the market that are influenced by the psychological behavior of traders. Traders make buying and selling decisions at these levels based on their collective emotions like fear and greed. Here are some typical psychological levels in trading:

Round Numbers

Round numbers (e.g., 100, 1,000, 10,000) are significant psychological levels because traders tend to view them as important milestones. For example, a stock reaching $100 or an index hitting 10,000 can trigger emotional responses that influence buying or selling behavior.

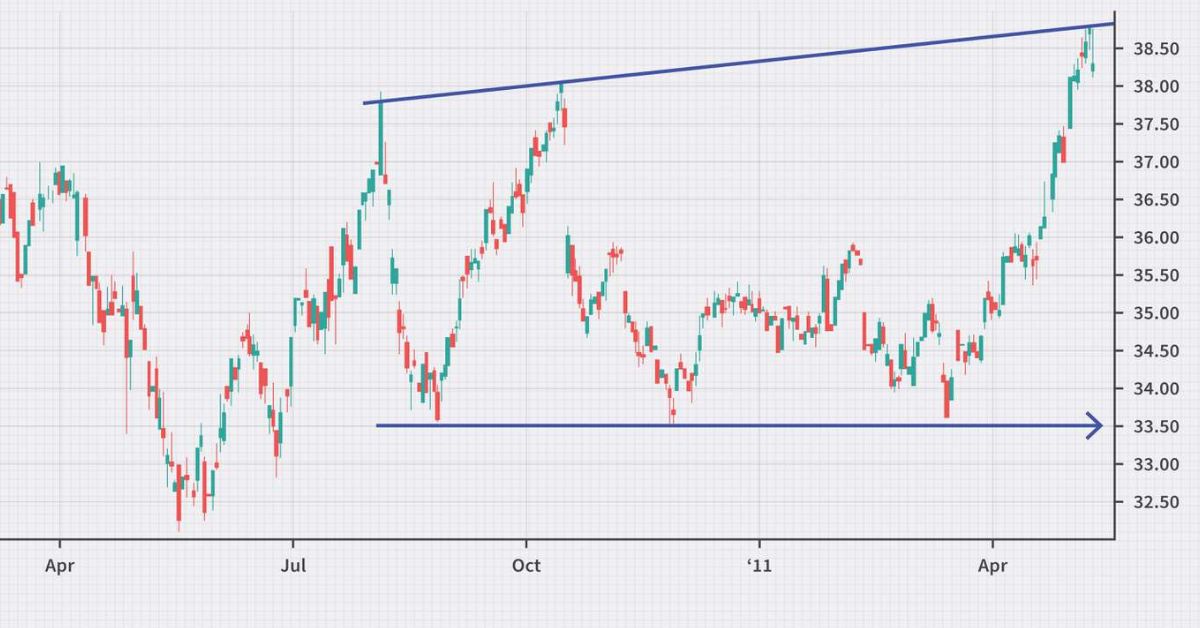

Support and Resistance Levels

Support Levels are price levels where security tends to stop falling because buyers start to enter the market, creating a psychological barrier that prevents further decline. Traders often see these levels as buying opportunities.

Resistance Levels are price levels where security tends to stop rising because sellers start to exit the market, creating a psychological barrier that prevents further gains. Traders often see these levels as selling opportunities.

52-Week Highs and Lows

A stock reaching a 52-week high may attract buyers due to momentum and optimism, while reaching a 52-week low may attract sellers due to pessimism and fear of further declines. These levels are often seen as significant psychological barriers that can lead to increased trading activity.

Previous Highs and Lows

Historical highs and lows act as psychological levels because they represent points where the price has reversed in the past. Traders may use these levels to make decisions based on patterns or trends they expect to repeat.

Fibonacci Retracement Levels

These are levels derived from the Fibonacci sequence (such as 38.2%, 50%, 61.8%) that traders use to identify potential support or resistance levels. The belief in these levels is partly based on psychology, as many traders use them, creating self-fulfilling prophecies.

Moving Averages

Moving averages, such as the 50-day or 200-day moving averages, are commonly used by traders to identify psychological levels. When prices approach these moving averages, they often act as support or resistance due to the collective actions of traders who monitor these indicators.

Whole Numbers in Currency Pairs

In forex trading, whole numbers like 1.2000 in the EUR/USD currency pair are significant psychological levels. These levels often attract a high volume of buy and sell orders.

Major Economic Events or Announcements

Upcoming economic reports, earnings announcements, or geopolitical events can also influence psychological levels. Traders may anticipate market reactions and adjust their strategies accordingly.

Psychological Traits and Their Impact on Trading

Understanding psychological traits is vital to successful trading. Key traits like self-awareness, emotional control, patience, and risk tolerance significantly impact trading decisions. These traits influence how traders respond to market conditions and manage their strategies.

Self-Awareness

Self-awareness involves recognizing your psychological triggers and biases. Traders must understand their emotional responses to market conditions. This awareness helps in avoiding impulsive decisions. Reflecting on past trades can reveal patterns in your behavior. Being aware of your strengths and weaknesses fosters personal growth in trading.

Emotional Control

Controlling your emotions is crucial to a successful trading career. Techniques like deep breathing and meditation can help manage stress. Staying calm during volatile market conditions prevents rash decisions. Regular emotional check-ins can help maintain balance. Controlled emotions lead to more rational and effective trading decisions.

Patience and Discipline

Patience is needed to wait for the right trading opportunities. Discipline ensures adherence to your trading plan without deviation. Avoiding impulsive trades improves overall trading performance. Consistent application of trading strategies requires both patience and discipline. Developing these traits helps in achieving long-term trading success.

Risk Tolerance

Risk tolerance defines how much risk you’re willing to take. Assessing personal risk levels helps in making informed decisions. Traders must adjust their risk tolerance based on market conditions. Understanding and adapting to your risk tolerance can prevent significant losses. Proper risk management is vital to sustainable trading success.

How to Trade with Psychological Levels

Trading psychological levels involves recognizing key price points that act as significant barriers or triggers for market action due to collective behavior. With these levels, traders can optimize entry and exit points, manage risk, and improve overall performance. Here’s a detailed guide on how to trade with psychological levels:

Identifying Psychological Levels

To trade with psychological levels, first identify key price points. Look for significant round numbers, like 100 or 1,000. These are common psychological levels to which traders tend to react. Support and resistance levels are also significant. These are points where prices have repeatedly reversed.

Recognizing these levels helps in predicting future price movements. Other key levels include 52-week highs and lows, which often act as barriers. Use technical tools like Fibonacci retracement levels to find potential reversals. Moving averages, such as the 50-day or 200-day, are also valuable indicators of psychological levels.

Developing a Trading Strategy

Once you’ve identified psychological levels, develop a trading strategy. Trend trading involves entering trades when prices break through a psychological level. This often signals the start of a new trend. You can set stop-loss orders near these levels to manage risk. For range trading, buy near support and sell near resistance.

It works well if prices bounce between two psychological levels. Breakout trading focuses on price moves beyond these levels with solid volume. Enter trades in the direction of the breakout, anticipating momentum. Pullback trading involves trading after a price pulls back to a psychological level, expecting it to hold.

Risk Management

Risk management is crucial when trading psychological levels. Always use stop-loss orders to limit potential losses. Place these just beyond the psychological levels to avoid getting stopped by noise. Position sizing is also essential; adjust based on your risk tolerance.

It ensures a single trade does not significantly impact your portfolio. Avoid overtrading, as not every move around these levels is an opportunity. Stick to your strategy and avoid making decisions based on emotions. Proper risk management helps preserve your capital and ensures long-term success.

Monitoring Market Sentiment and News

Stay aware of market sentiment and news, as these can impact psychological levels. Major news events, like economic reports or geopolitical developments, can cause significant price movements. Be mindful of upcoming events and how they might influence your trading levels.

Use sentiment analysis tools to gauge overall market mood. Indicators like the VIX can help assess market volatility. Understanding sentiment helps anticipate reactions around psychological levels. This information allows you to make more informed trading decisions and adapt to changing conditions.

Continuous Learning and Adaptation

Markets are dynamic, so continue learning and adapting. Review your trades regularly to assess how well they respect psychological levels. Adjust your strategy based on your findings to improve performance.

Stay informed about new trading techniques, market trends, and psychological patterns. This ongoing education helps refine your approach. Learning from experience and adapting to new information is vital to long-term trading success. Always be open to adjusting your strategy as the market evolves.

Practice Discipline and Patience

Trading with psychological levels requires discipline and patience. Wait for confirmation before entering trades around these levels. Avoid rushing in as prices approach vital points. Confirmation can come from price action, volume, or technical indicators. Staying calm is essential, as psychological levels can lead to increased volatility.

Stick to your trading plan and avoid impulsive decisions. Patience and discipline help you make better trading choices. This approach increases your chances of success and reduces emotional trading errors.

Read More: Trading Psychology Help: What You Need to Know

Conclusion

Using psychological levels can help you understand key price points and market behavior so you can make better decisions. If you can identify these levels, develop a solid strategy, manage risk effectively, and stay on top of market sentiment, you’ll be able to make better trading decisions. Remember, discipline and patience are crucial to success.

Do you want to stop losing money to panic selling, FOMO, overtrading, and bag trading psychology leveling? We recommend the Vestinda trading app. It helps eliminate emotional decision-making with automated crypto trading strategies. Start trading smarter and more efficiently with Vestinda today!