Trading psychology is equally essential to mastering technical analysis and market knowledge. Traders often face mental challenges that significantly impact their decisions and overall success. But what is the trading psychology cycle? In this blog, we’ll explore the trading psychology cycle, breaking down the various stages traders experience.

You can improve your trading performance and get more consistent results if you understand and master these phases. Whether you’re a beginner or an experienced trader, honing your psychological approach is vital. A reliable trading platform like Prime XBT can provide the tools you need to navigate the markets with confidence.

The platform offers an environment that can help manage trading psychology effectively. Prime XBT empowers traders to stay disciplined and make informed decisions, reducing the impact of emotions like greed and fear. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is the Trading Psychology Cycle?

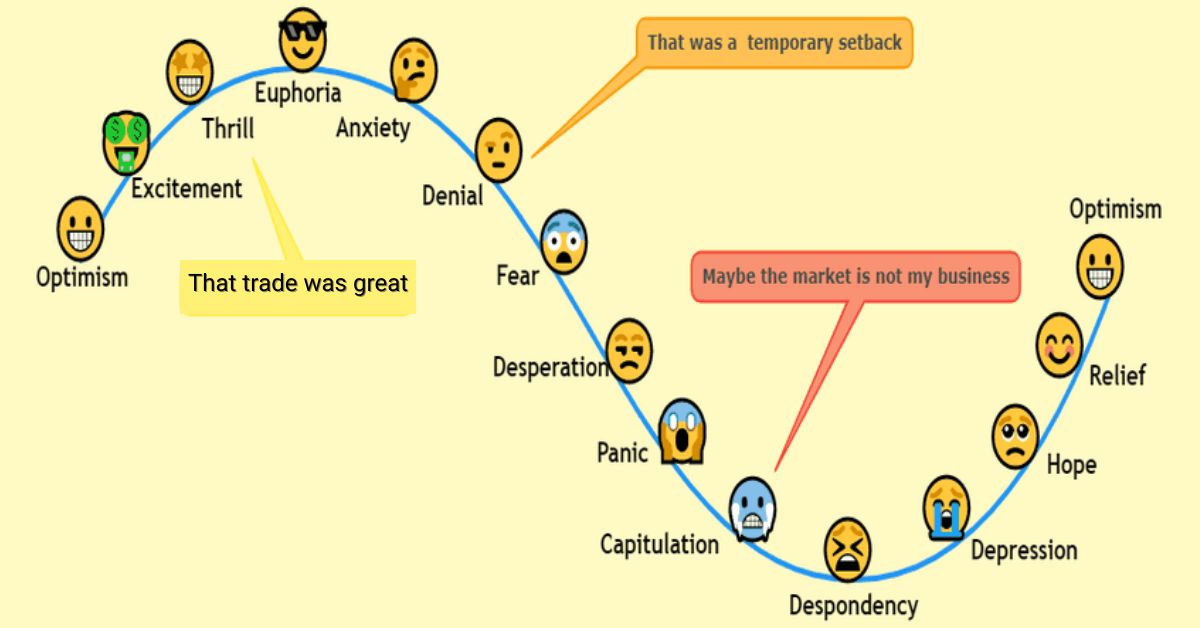

The trading psychology cycle describes the emotional stages traders go through. It starts with optimism and can lead to overconfidence. Traders initially feel positive after a successful trade. Success breeds confidence, but this can quickly turn into euphoria.

However, when markets turn, optimism fades. Losses create anxiety, leading to denial. Traders may refuse to accept the reality of a loss. This denial can worsen the situation, leading to panic. Eventually, fear takes over, often resulting in poor decisions.

The cycle then moves from panic to despair, where traders may feel hopeless. Over time, hope slowly returns, and the cycle repeats. Understanding this cycle is crucial for managing emotions.

The Role of Emotions in Trading

Emotions are central to every trading decision. Fear often drives traders to exit trades too early, and greed can push traders to take excessive risks. Both feelings can negatively impact trading outcomes. Recognizing these emotions is essential for success.

A trader must maintain emotional balance. Effectively managing emotions leads to more rational decisions. Awareness of the cycle can help traders stay grounded. Developing a stable mindset is critical to long-term profitability.

Tools like trading journals can track emotional patterns. This tracking helps traders understand and control their psychological responses.

Stages of the Trading Psychology Cycle

The trading psychology cycle consists of several emotional stages. Understanding each stage helps traders manage their responses effectively.

Euphoria and Overconfidence

Euphoria is the first stage after a successful trade. Traders feel invincible and may take on more risk. Overconfidence sets in, leading to larger trades. This mindset can be dangerous. Overconfident traders often ignore potential risks. They believe their success will continue indefinitely. However, markets are unpredictable, and overconfidence can lead to significant losses.

Anxiety and Denial

Anxiety follows when trades start to fail. Traders begin to doubt their decisions. Denial kicks in as they refuse to accept losses. They may hold onto losing positions, hoping for a reversal. This stage can cause emotional turmoil. Denial prevents traders from making rational decisions, prolonging the cycle of losses.

Panic and Capitulation

Panic occurs when losses become overwhelming. Traders may make impulsive decisions. Capitulation is when they finally give up. They exit the market to stop further losses. This stage often results in regret. Many traders wish they had acted sooner. Panic and capitulation mark the lowest point in the cycle.

Despondency and Depression

Despondency sets in after heavy losses. Traders feel defeated and may lose confidence. Depression can follow, affecting both trading and personal life. During this stage, traders may consider quitting and question their ability to trade successfully. Recovery from this stage requires time and reflection.

Hope and Caution

Hope begins to return after time has passed. Traders start to see opportunities again. However, they remain cautious, fearing more losses. Caution can lead to better decision-making. Traders become more disciplined and selective with their trades. This stage marks the beginning of recovery.

Relief and Optimism

Relief follows successful trades after a period of caution. Traders start to feel optimistic again, believing they have regained control. Optimism grows as trades succeed. However, this can lead back to the start of the cycle. It’s important to stay mindful and avoid repeating mistakes.

Common Psychological Biases in Trading

Psychological biases can distort decision-making in trading. Recognizing these biases is crucial for improving trading performance.

Confirmation Bias

Confirmation bias occurs when traders only seek information that supports their beliefs. They ignore evidence that contradicts their views. This bias can lead to poor trading decisions. Traders may overestimate the success of their trades, preventing a balanced analysis of the market.

Loss Aversion

Loss aversion is the tendency to fear losses more than value gains. Traders may avoid taking necessary risks. This bias often leads to holding onto losing trades. They hope to avoid realizing a loss. Loss aversion can hinder profitable decision-making.

The Sunk Cost Fallacy

The sunk cost fallacy involves continuing a trade because of previous losses. Traders feel they must recover their initial investment. This bias can lead to further losses. They keep investing more in losing positions. It prevents objective evaluation of current trades.

Anchoring

Anchoring occurs when traders rely too heavily on initial information. They use past prices as reference points. It can skew their perception of current market value. Traders may ignore new data that contradicts their initial anchor.

Overconfidence Bias

Overconfidence bias leads traders to overestimate their knowledge and abilities. They believe they can predict market movements accurately.

This bias can result in excessive risk-taking. Traders may underestimate potential downsides and losses. Overconfidence often leads to significant trading errors.

The Impact of External Factors on Trading Psychology

External factors play a significant role in shaping your trading psychology. A better understanding of these influences will help you manage their effects better.

Market Volatility

Market volatility refers to the rate at which prices fluctuate. High volatility can cause emotional stress and anxiety. Rapid price swings may lead to impulsive trading decisions, and traders might react emotionally rather than rationally.

Implementing robust risk management strategies can mitigate the effects of volatility. Maintaining discipline helps in navigating turbulent market conditions.

Economic News and Events

Economic news and events, such as interest rate changes or GDP reports, can significantly impact market trends. Major announcements may cause sudden and significant price movements. Traders must stay informed about upcoming economic events.

Prepare for potential market impacts by adjusting your strategy accordingly. Being proactive helps in managing the uncertainty created by economic news.

Social Media and News

Social media and news outlets often influence trader sentiment and behavior. Misinformation and sensational headlines can lead to irrational trading decisions.

It’s essential to verify news from reliable sources and avoid making trading decisions based solely on social media chatter. Critical thinking and independent analysis are crucial in filtering out noise.

Peer Influence

Peer influence can affect trading decisions, especially in trading communities or forums. Following others’ advice may lead to herd behavior, which can cause traders to make irrational choices based on group sentiment. Always base your trading decisions on your analysis. Trust your trading plan and avoid being swayed by peer pressure.

Personal Life Stress

Personal life stress can impact your focus and decision-making in trading. Issues such as relationship problems or work-related stress may affect your mental state. Stress can lead to poor trading decisions and emotional trading.

Managing personal stress through healthy coping mechanisms is vital. Maintaining a balance between personal life and trading can enhance performance.

Strategies to Manage the Trading Psychology Cycle

Effectively managing the trading psychology cycle requires specific strategies. Implementing these strategies helps traders stay disciplined and make rational decisions.

Developing Emotional Awareness

Emotional awareness involves recognizing your feelings during trading. Learn how emotions such as fear and greed can influence your decisions. Regularly assess your emotional state. Use mindfulness techniques to stay grounded. This awareness helps you manage your reactions to market fluctuations.

Setting Realistic Expectations

Realistic expectations prevent disappointment and frustration. Set achievable goals based on your trading experience and market conditions. Avoid expecting unrealistic returns. Recognize that losses are part of trading. Setting practical goals helps maintain a balanced perspective.

Creating a Trading Plan

A well-defined trading plan outlines your strategy and rules. It helps you stick to your plan and avoid emotional decisions. Include entry and exit criteria, risk management, and trading goals. A trading plan provides structure and discipline. It reduces the impact of emotional responses.

Regular Reflection and Journaling

Maintain a trading journal to record your trades and emotions. Reflect on your decisions and their outcomes. Journaling helps identify patterns in your behavior. Analyze past trades to improve future strategies. Regular reflection fosters continuous improvement and self-awareness.

Seeking Professional Guidance

A trading psychologist or coach can provide valuable insights. At On Tilt Trading Store, we offer expert trading psychology coaching to help you understand and manage psychological challenges.

We provide personalized strategies and tools to enhance your trading mindset. Professional guidance can accelerate personal growth and improve trading success. Check out our store today and use promo code OTT10 to receive 10% off your order.

Conclusion

Ultimately, successful trading depends on mastering the trading psychology cycle. Recognizing and managing emotional stages can significantly improve your trading outcomes. Implementing strategies like emotional awareness and maintaining a trading plan are crucial steps.

Are you feeling the pain of losing money due to panic selling, FOMO, overtrading, or bag holding? We recommend the Vestinda trading app. It helps eliminate emotional decision-making with automated crypto trading strategies. Start using Vestinda to enhance your trading experience.

Building resilience and understanding external influences also play a crucial role. Maintaining discipline and staying informed will help you navigate the challenges of trading.