Trading cryptocurrencies has become increasingly popular, with several methods available to investors. One method is trading crypto futures, which allows you to speculate on the future price of cryptos. But are crypto futures worth it?

In this article, we’ll explore the market of crypto futures. In this article, we’ll discuss how they work, their potential benefits, and their risks. It’ll help you figure out whether trading crypto futures is worth your investment. Let’s dive in.

What are Crypto Futures?

Crypto futures are financial contracts. They obligate parties to buy or sell a cryptocurrency. This transaction occurs at a predetermined future date. The price is agreed upon when the contract is created.

Crypto futures allow traders to speculate on future prices. They don’t require actual ownership of the underlying asset, which is what makes them different from spot trading. Futures trading can offer high leverage, but it also comes with significant risks.

The Benefits of Crypto Futures

Crypto futures offer several benefits. They attract both new and experienced traders. Let’s explore why they are appealing.

Leverage

Leverage allows traders to control larger positions with smaller capital, which can significantly amplify potential profits. However, it also magnifies potential losses. Thus, high leverage is a double-edged sword.

While it can lead to substantial gains, it can also cause severe losses. Therefore, traders must use leverage carefully. Risk management is crucial. Proper leverage use can enhance trading strategies. It is one of the main attractions of crypto futures.

Speculation Opportunities

Crypto futures enable traders to speculate on price movements. They can profit from both rising and falling markets. This flexibility is desirable, as it allows traders to adapt to changing market conditions.

Speculating on future prices can be very lucrative. However, it requires significant market knowledge and strategic planning. Successful speculation depends on accurate market predictions. It makes it both exciting and risky.

Hedging

Hedging with crypto futures helps protect against market volatility. Investors can offset potential losses with futures contracts. This strategy provides a valuable safety net. It is beneficial for long-term investors.

Hedging can stabilize portfolios during market swings. By reducing overall risk, it ensures more predictable returns, making futures a valuable tool for risk management.

Liquidity

Crypto futures markets are highly liquid. High liquidity ensures quick trade execution. This results in tighter bid-ask spreads. Liquidity reduces slippage, which is beneficial for traders.

Liquid markets are more efficient and provide better trading conditions. This is especially important for high-frequency traders. Liquidity ensures that large trades can be executed without significant price impact.

Accessibility

Many exchanges offer crypto futures trading. They provide user-friendly platforms, making trading accessible to a broader audience. Both beginners and experienced traders can participate.

Accessibility attracts many new traders to crypto futures, broadening the market and increasing trading volume. User-friendly interfaces and educational resources help beginners get started, lowering the barrier to entry.

Diverse Strategies

Crypto futures support various trading strategies, including simple or complex ones. This diversity caters to different skill levels and financial goals. Options are plentiful, from day trading to long-term investing.

This versatility makes futures trading appealing. Traders can adapt their strategies based on market conditions. This flexibility enhances the overall trading experience.

Risks of Crypto Futures

While crypto futures offer numerous benefits, they also come with significant risks. Traders must understand these risks. Here are some critical risks associated with crypto futures trading.

Market Volatility

The cryptocurrency market is known for its high volatility. Prices can fluctuate dramatically in a short time, leading to substantial gains or losses. Traders may find it challenging to predict price movements. Market sentiment can change quickly, affecting futures contracts. This unpredictability adds to the risk.

Leverage Risks

Using leverage can amplify both profits and losses. High leverage can lead to rapid liquidation of positions. Traders must be cautious when using leverage. A small price movement can wipe out an entire investment. Acknowledging margin calls is essential for managing leverage risks. Traders should have a clear risk management strategy.

Liquidation Risks

Positions can be liquidated if the market moves against a trader. Liquidation occurs when a trader’s equity falls below the maintenance margin. In volatile markets, this can happen quickly, and traders may lose their entire investment unexpectedly. Liquidation thresholds are crucial for managing this risk.

Lack of Regulation

The crypto futures market is less regulated than traditional financial markets, which can expose traders to fraud and manipulation. Not all exchanges are trustworthy, so traders should choose reputable platforms with good security measures. Researching the exchange’s background is essential for safety.

Emotional Trading

Emotions can heavily influence trading decisions. Fear and greed can lead to impulsive actions, and emotional trading often results in poor decision-making. Maintaining discipline is crucial for long-term success. Traders should stick to their strategies and avoid emotional responses. Having a solid trading plan helps manage emotions.

Complexity of Products

Crypto futures can be complex financial instruments. Traders must have a thorough understanding of different contracts and be familiar with terms like “funding rates” and “margin.” A lack of knowledge can lead to costly mistakes. It’s essential to educate oneself before trading futures. Seeking resources and guidance can help clarify complex concepts.

Comparing Crypto Futures with Other Investment Options

When exploring investment strategies, it’s essential to compare crypto futures with various alternatives. The features, risks, and rewards of each option vary depending on the investor’s needs. These differences can help traders make informed financial decisions.

Crypto Futures vs Spot Trading

Crypto futures involve contracts for the future delivery of assets. In contrast, spot trading means buying or selling assets immediately. One significant advantage of futures is leverage, which allows traders to control larger positions.

However, spot trading offers ownership of the actual asset. Futures can lead to higher potential profits but also more significant losses, while spot trading typically has lower risk. Understanding these differences is crucial for choosing the right strategy.

Crypto Futures vs Traditional Futures

Crypto futures and traditional futures both involve contracts for future delivery. However, traditional futures cover assets like commodities and financial instruments. Crypto futures are more volatile and subject to market sentiment.

Traditional futures are often more regulated, offering more stability. Both types can utilize leverage, increasing potential returns. However, risk levels vary significantly due to market behaviors.

Crypto Futures vs Options

Both crypto futures and options are derivatives, but they work differently. Futures obligate traders to buy or sell assets at a predetermined price, while options provide the right, but not the obligation, to trade. This fundamental difference influences risk levels.

Futures have more straightforward profit and loss potential, while options allow for more complex strategies with limited risk. Each has unique benefits and drawbacks, requiring careful consideration based on individual trading goals.

Is Crypto Futures Worth It for You?

Yes, crypto futures can be worth it for some traders, but it depends on your circumstances. If you have a solid understanding of the crypto market and are comfortable with high volatility, crypto futures may be an excellent opportunity for profit.

The ability to leverage positions can amplify gains significantly. However, this also means increased risk, which is not suitable for everyone.

On the other hand, if you are a beginner or uncomfortable with risk, you might want to avoid crypto futures. The complexity of futures trading requires knowledge and experience. Additionally, the potential for rapid losses can be daunting.

Ultimately, it’s crucial to evaluate your risk tolerance, trading goals, and market understanding before diving into crypto futures. Consider starting with more straightforward trading options to build confidence before exploring futures.

Strategies for Trading Crypto Futures

Successful trading in crypto futures requires effective strategies. Implementing the right approach can enhance potential profits. Here are some popular strategies traders use.

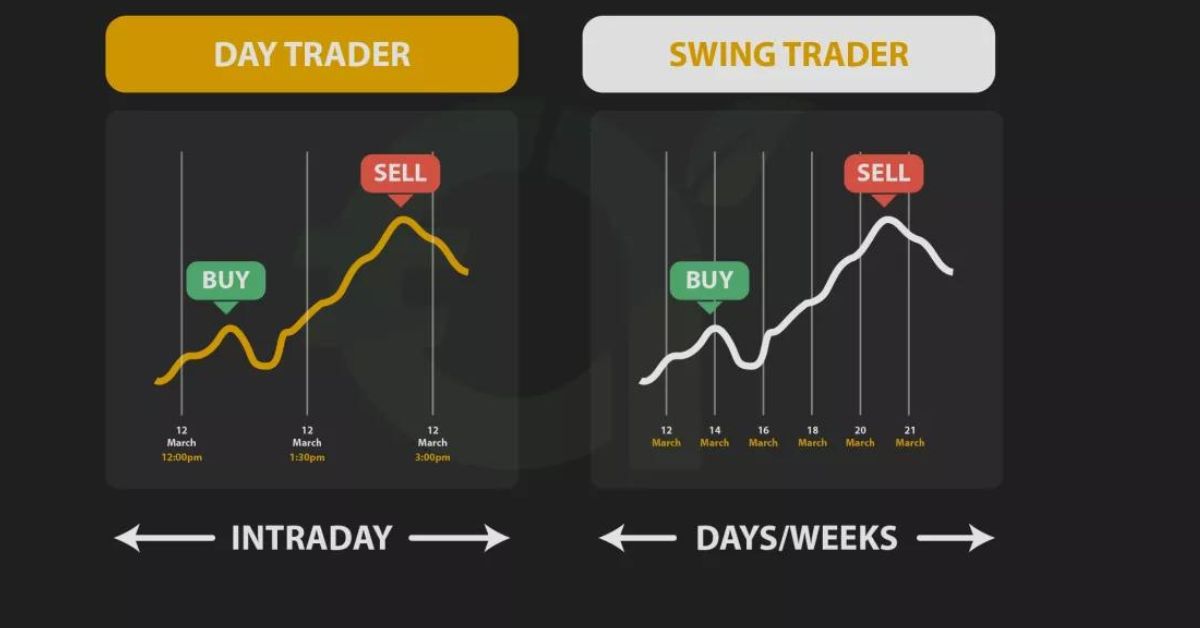

Day Trading

Day trading involves making multiple trades within a single day. Traders capitalize on short-term price movements. This strategy requires quick decision-making and analysis. Monitoring the market closely is crucial. Day traders typically avoid holding positions overnight. It reduces exposure to overnight volatility.

Swing Trading

Swing trading focuses on capturing short to medium-term price swings. Traders hold positions for several days to weeks. This strategy allows for more analysis and less stress. It suits traders who cannot monitor the market constantly. Swing trading aims to profit from market trends.

Arbitrage

Arbitrage involves exploiting price differences between exchanges. Traders buy a cryptocurrency on one exchange and sell it on another. This strategy requires quick execution and minimal transaction fees. Arbitrage opportunities can be short-lived, so traders must act quickly to capitalize on them.

Hedging

Hedging protects against potential losses in existing positions. Traders use futures contracts to offset risks. This strategy is helpful for long-term investors. It can stabilize a portfolio during market fluctuations. Hedging provides a safety net against adverse price movements.

Trend Following

Trend following involves analyzing market trends and making trades based on them. Traders identify upward or downward trends. They aim to profit from continued movement in the same direction. This strategy requires careful technical analysis. Following trends can increase the likelihood of successful trades.

Risk Management

Risk management is essential in crypto futures trading. Traders should set stop-loss orders to limit losses. Position sizing is also crucial to protect capital. Being aware of risk-reward ratios helps in decision-making. A solid risk management plan can enhance long-term success.

FAQs

Do crypto futures expire?

Yes, crypto futures contracts do expire. Each contract has a specific expiration date set by the exchange. On this date, the contract must be settled. Traders can either close their positions or roll over to a new contract.

Expiration dates vary, so it’s essential to track them. Failing to manage expiring contracts can lead to unexpected losses. Always be aware of expiration details when trading crypto futures.

Can you lose more than you invest in crypto futures?

Yes, it is possible to lose more than you invest in crypto futures. It occurs when using leverage, which amplifies both gains and losses. If the market moves against your position, losses can exceed your initial investment.

Liquidation can occur if your equity falls below a certain threshold. Therefore, it’s crucial to implement strong risk management strategies. Before investing, always be aware of the potential risks associated with trading crypto futures.

How long can you hold crypto futures?

The holding period for crypto futures depends on the contract type and expiration date. Futures contracts have specific expiration dates set by the exchange. You can hold a contract until it expires or close it at any time before then.

Some traders opt for day trading, while others hold for longer periods to capitalize on price movements. Always be aware of the expiration date and market conditions affecting your position. It’s essential to manage your trades actively.

Is crypto futures gambling?

While crypto futures share similarities with gambling, they are not purely gambling. Trading crypto futures involves analysis, strategy, and market understanding. Successful traders utilize technical and fundamental analysis to inform decisions. However, the high volatility and leverage in crypto futures can lead to significant risks.

This unpredictability may feel like gambling to some. Ultimately, it requires skill and knowledge, unlike pure chance-based games. Proper risk management and research are essential to mitigate potential losses.

Read More: What are the Disadvantages of Crypto Futures

Conclusion

Crypto futures present traders with both opportunities and risks. Investing successfully depends on understanding the market, strategies, and various options. The proper knowledge and approach will help you navigate this dynamic landscape. It’s essential to keep learning and adapting your strategy.