Traders often utilize future contracts to predict the profit of their investments. What are future contracts? Futures contracts are agreements to buy or sell assets at set prices on future dates. These contracts have standard terms to reduce risks. It helps businesses manage risk and allows investors to bet on market trends. They play an important role in financial markets. Initially, determining the price of a future contract may seem complicated to you. But in this detailed guide, we will describe everything you need to know about pricing a future contract. How to price a future? Let’s find out.

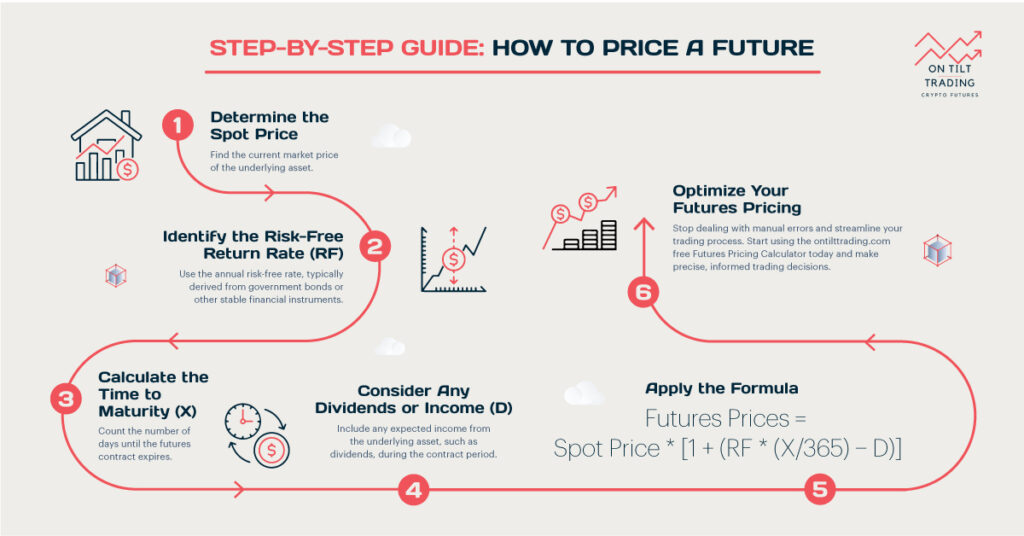

How to Price Future Contracts: Step-by-Step Guide

1. Determine the Spot Price

The spot price refers to the underlying asset’s current market price. This price serves as a foundation for calculating future prices. Where to get the spot price? To determine the spot price, you can check reliable financial sources. For example, websites like Bloomberg, Reuters, and financial news platforms provide up-to-date spot prices for various assets. For assets like stocks, bonds, or commodities, market exchanges provide real-time spot prices.

2. Identify the Risk-Free Return

The risk-free return is the theoretical return on an investment with zero risk. Government bonds typically represent a risk-free return. To identify this rate:

Check the rate on short-term government bonds. You can choose a bond whose maturity matches the duration of your future contract. This ensures your calculation remains accurate. For example, if you are pricing a three-month future, use the yield on a three-month Treasury bill.

3. Calculate the Time to Maturity

Future contracts have a time to maturity before they expire. Calculate this by finding the expiration date. The exact expiration date can be found in the contract details. Calculate the number of days from today until the expiration date. You can use a calendar or an online date calculator for accuracy. Let’s look at an example to better understand this. For example, if today is January 1 and the contract expires on April 1, the time to maturity is 90 days.

4. Consider Dividends or Income

If the underlying asset generates income, such as dividends from stocks, you need to factor this into the future price. Now, you have to determine the projected dividends or income. For stocks, check the dividend yield and expected payment dates.

Make sure your calculation matches the contract’s time to maturity. For instance, if a stock pays a quarterly dividend, consider whether the payment falls within the contract period.

Incorporating this income prevents overestimating the future price.

5. Apply the Formula

Now, you can apply the formula to calculate the future price. The formula is:

Future Price=Spot Price×[1+(365 Risk-Free Rate×Time to Maturity )−Dividends or Income]

Let’s break it down:

- Multiply the spot price by 1 plus the risk-free rate adjusted for time to maturity: This step accounts for the growth of the spot price over time due to the risk-free return.

- Subtract the dividends or income: This step ensures the future price reflects the income generated by the underlying asset.

Example Calculation

Suppose you want to price a future on a stock with the following details:

- Spot price: $100

- Risk-free rate: 2% (0.02 as a decimal)

- Time to maturity: 90 days

- Expected dividends: $1

Here’s the calculation:

Adjust the risk-free rate for time to maturity: (0.02×90)/365=0.00493

Calculate the future price:

Future Price=100×[1+0.00493−1/100]

= 100 × (1 + 0.00493 − 0.01) = 100 × 0.99493

= 99.49

The future price is $99.49.

The formula for pricing future contracts is applicable across many sectors. It fits commodities such as crude oil, natural gas, gold, silver, wheat, and coffee.

In equities, it applies to individual stocks like Apple or Microsoft and stock indices like the S&P 500. For currencies, it works with major pairs like EUR/USD and USD/JPY. Additionally, it can be used for cryptocurrencies like Bitcoin and Ethereum, as well as other financial instruments such as ETFs and REITs.

Things You Need to Know Before Determining Future Contract Price

Buying and Selling Futures Contracts

Futures contracts are legal agreements between a buyer and a seller. The buyer takes a long position, anticipating that the asset’s price will rise.

The seller takes a short position, expecting the price to fall. For example, a farmer might sell futures to lock in a price for their crop, while a food manufacturer might buy futures to secure a stable cost for raw materials.

Margin

Margin is the amount of money deposited by both parties with stockbrokers at the beginning of a trade. This deposit acts as a security to ensure both parties honor their commitments upon contract expiry.

If the initial margin falls below a certain level, known as the maintenance margin, the parties may receive a margin call. This requires them to deposit additional funds to maintain the margin level. Margin ensures the financial integrity of the futures market.

Mark to Market

Mark to market is a daily process used to settle futures prices. Because futures prices fluctuate due to active trading, the contracts are re-evaluated at the end of each trading day.

The clearinghouse calculates the daily gains and losses by comparing the contract price to the market price at the close of trading. This daily settlement process ensures that any changes in value are accounted for immediately, maintaining market stability. The profit and loss (P&L) account of the parties involved is credited or debited with the differential amount.

Common Mistakes in Determining Future Contract Prices

- Volatility can affect the spot price and, consequently, the future price.

- A change in the risk-free rate impacts the future price. Keep track of central bank announcements and economic indicators.

- Unexpected payouts can change the future price. Stay updated on corporate announcements.

- Shifts in demand and supply for the underlying asset can influence prices.

- Political instability or significant geopolitical events can impact market prices.

- New regulations or changes in existing ones can affect future pricing

Tips for Pricing Futures

Online calculators and financial software can streamline the calculation process of future contracts. For example, our On Tilt Trading Risk Reward Calculator assesses risk-reward ratios, helping you make informed choices and find the best opportunities while making a future contract.

As we all know, market conditions change rapidly. Ensure your data, especially spot prices and risk-free rates, is up-to-date. Besides, small errors can lead to significant discrepancies. Besides, review your calculations carefully to get help from a professional.

FAQs

Do all futures contracts have price limits?

Price limits are specific rules set by exchanges to prevent extreme volatility in certain futures markets. These limits restrict how much the price of a futures contract can move up or down in a single trading day.

When the price hits the limit, trading may be paused or restricted to prevent further drastic movements. However, not every futures market imposes these limits. The existence and specifics of price limits depend on the exchange and the type of futures contract.

Do futures contracts have strike prices?

The answer is No. Futures contracts do not have a strike price. Strike prices are specific to options contracts. As we mentioned before, a futures contract involves the purchase or sale of an asset at a predetermined price at a future date. Over time, this price fluctuates based on market conditions.

On the other hand, options contracts give the holder the right, but not the obligation, to buy or sell an asset at a specified strike price before expiration. Futures contracts require both parties to complete the trade at the current market price on the contract’s expiration date.

Can I lose more than my initial investment when trading futures?

Yes, you can lose more than your initial investment while trading futures. Futures trading involves leverage, allowing you to control a large position with a small margin deposit. If the market moves against your position, losses can exceed your initial margin. For example, futures are traded on margins that can be 15-20% of the underlying price, depending on the lot size. Hence, your initial investment will erode if the underlying falls more than 15%-20%.

Hope you got a complete idea about how to price future contracts. Following these steps, you can accurately price future contracts and make informed investment decisions. Stay informed about market conditions and use available tools to aid your calculations. If there are still issues, seek the help of an expert to help you understand the process.