Cryptocurrency trading has become increasingly popular because of its profit potential. Among the most exciting and potentially profitable areas within this market is the trading of crypto futures. Traders can make significant gains if they understand the mechanics and strategies involved. So, how can you make money trading crypto futures?

In this comprehensive guide, we’ll explore everything you need to know about making money with crypto futures. You will learn the basics of crypto futures trading as well as develop effective trading strategies. Keep reading to learn more.

What are Crypto Futures Contracts?

Crypto futures contracts are agreements to buy or sell cryptocurrencies at a predetermined price in the future. In contrast with spot trading, futures trading involves speculation about cryptocurrency price movements. Here are some key terms:

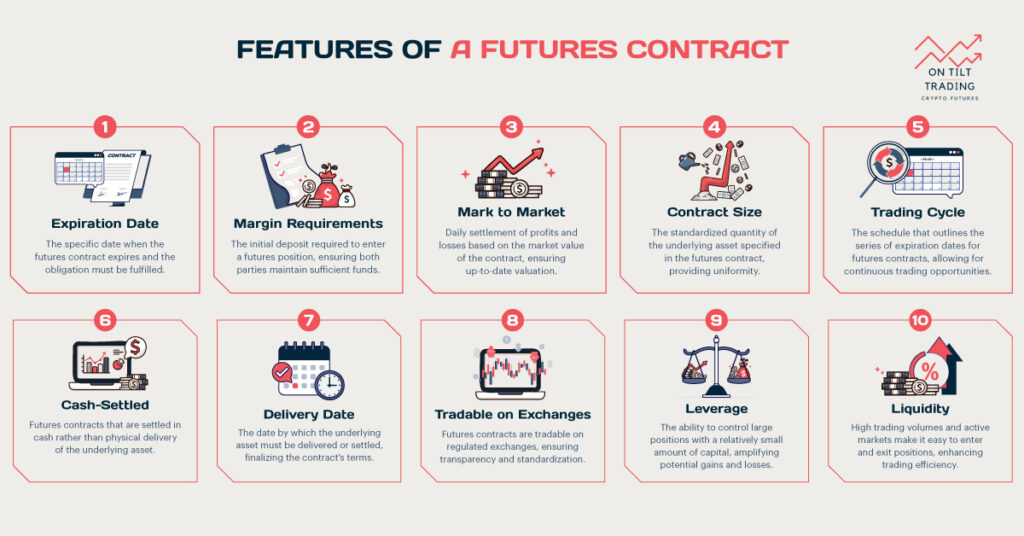

- Contract size: The amount of cryptocurrency per contract. For example, a Bitcoin futures contract might represent one Bitcoin.

- Expiration date: The date on which the contract ends and must be fulfilled. It can be a fixed date in the future, like the last Friday of the month.

- Leverage: Allows traders to hold large positions with a relatively small initial investment. For example, 10x leverage means you can control a $10,000 position with just $1,000.

Types of Crypto Futures

There are different types of cryptocurrency futures contracts, each with its characteristics:

- Perpetual contracts: These contracts have no expiration date and closely mimic spot trading with the added benefit of leverage. They are popular because traders can hold their positions indefinitely.

- Fixed-date contracts: They expire at a specific date and settle at that time. It is up to traders to decide whether to roll over their positions or let them expire.

- Inverse contracts: These are priced in a cryptocurrency (e.g., BTC) but settled in USD. Therefore, the contract’s value is inversely related to the cryptocurrency’s price.

- Linear contracts: These are priced and settled in the same currency, such as USD or stablecoins, making them easier to understand.

Understanding the different types of futures contracts is crucial in selecting the right one for your trading strategy and risk tolerance.

Benefits of Trading Crypto Futures

There are several advantages to trading crypto futures over traditional spot trading. Such as:

Leverage

Investing a smaller amount of money in a larger position allows you to increase your returns. For instance, with 10x leverage, a 5% move in the underlying asset can result in a 50% profit or loss on your position.

Profit from Both Market Directions

You can profit from both rising and falling markets when you trade crypto futures. In other words, you can take long positions when you expect prices to rise and short positions when you expect prices to fall.

Diversification

Provides a tool for diversifying trading strategies and maximizing returns. You can hedge other investments and improve risk management by including futures in your portfolio.

How to Make Money Trading Crypto Futures

If approached with the right strategies and knowledge, trading crypto futures can be a lucrative venture. Trading techniques can help traders capitalize on price movements and increase profitability. Let’s look at some methods and strategies for making money trading crypto futures:

Leveraging Market Volatility

Leveraging market volatility is one of the best ways to make money trading crypto futures. Prices in the cryptocurrency market fluctuate fast, which can lead to big profits. Traders can take advantage of price swings by:

- Going long: If you believe the price of a cryptocurrency will rise, you can buy a futures contract to benefit from the upward movement. Selling the contract at a higher price allows you to make money when the price goes up.

- Going short: On the other hand, you can sell a futures contract if you believe the price will drop. In the event that the price decreases as anticipated, you can buy back the contract at a lower price and lock in your profit.

However, it is essential to realize that leverage can also increase risks as well as gains. The importance of effective risk management cannot be overstated.

Implementing Effective Trading Strategies

Crypto futures trading requires a solid trading strategy to maximize profits. The following are a few popular strategies:

- Day Trading: It involves making multiple trades within a single day, taking advantage of short-term price movements. Identifying entry and exit points on charts and technical analysis is a critical part of day trading.

- Swing Trading: Swing traders hold positions for several days or weeks, hoping to profit from price swings. Using this strategy requires a thorough understanding of market trends and indicators.

- Scalping: Scalpers trade frequently throughout the day, focusing on small price movements. Often, this type of trading strategy relies on automated trading tools and requires quick decision-making.

- Position Trading: It involves holding positions for a long time based on fundamentals and trends. Traders who focus on long-term growth often withstand short-term market fluctuations.

Utilizing Technical and Fundamental Analysis

A successful crypto futures trade relies on both technical and fundamental analysis:

- Technical Analysis: This involves analyzing price charts and using indicators (like moving averages, MACD, and RSI) to predict price movements. Chart patterns and market trends can help traders identify potential entry and exit points.

- Fundamental Analysis: Assessing how market conditions, news, and blockchain developments may impact cryptocurrency prices can provide valuable insight. Staying current with regulatory changes, technological advancements, and macroeconomic factors can also be helpful.

Hedging and Arbitrage Opportunities

Arbitrage and hedging are two additional strategies to make money trading crypto futures:

- Hedging: Traders can use futures contracts to protect their cryptocurrency holdings from price drops. If you take an opposite position in the futures market, you can minimize your spot losses.

- Arbitrage: This strategy takes advantage of price discrepancies between exchanges. Traders can pocket the difference if one exchange’s exchange’s price for a cryptocurrency futures contract is lower than another exchange’s exchange’s price.

Maximizing Profits with Automated Trading Bots

Using automated trading bots can help you maximize your profits in crypto futures trading. These bots analyze market conditions and trade based on predetermined criteria. These are some of the benefits of trading bots:

- Speed: Bots can execute trades in milliseconds, allowing traders to take advantage of fleeting opportunities.

- Emotionless trading: Automated bots help trading strategies remain disciplined by eliminating emotional decision-making.

- Backtesting: Most trading bots allow you to test your strategies on historical data so you can refine your approach before risking real money.

With these tools and strategies, traders can increase their chances of making money in the volatile world of crypto futures trading.

How to Start Trading Crypto Futures

Trading crypto futures requires careful preparation and a clear understanding of the steps. You can participate in this dynamic market if you have a reliable exchange, a trading account, and suitable funds. Let’s explore these essential steps in detail.

Choosing a Reliable Exchange

Choosing a reliable exchange is the first step in trading crypto futures. Trading on a trustworthy exchange is secure and efficient, and you get access to cryptocurrencies and futures. Consider things like security, liquidity, and fees when choosing an exchange.

Look for exchanges with strong security measures, like two-factor authentication (2FA) and cold storage. In addition, make sure the exchange trades heavily, indicating good liquidity, so you can buy and sell futures contracts with little price slippage.

Finally, compare exchange fee structures to find one that suits your strategy. Among the most popular exchanges for trading crypto futures are Prime XBT, Binance, BitMEX, and Bybit.

Setting Up Your Trading Account

Once you’ve chosen an exchange, you’ll need to create an account to trade. Typically, this involves registering, verifying your KYC (Know Your Customer) information, and securing your account. Create an account on the exchange with your email address and a secure password.

In most exchanges, KYC and Anti-Money Laundering (AML) verification processes require users to submit identification documents and proof of residence. To protect your account, enable two-factor authentication (2FA) and choose a strong password. These steps will help ensure a secure futures trading environment.

Funding Your Account

Once you have set up your account, you will need to fund it before you can trade. Depending on the exchange’s offerings, this typically involves depositing cryptocurrency or fiat currency. Many exchanges accept Bitcoin or Ethereum, while others accept bank transfers or credit cards for direct deposits.

Once your account is funded, you will need to transfer the funds into your future wallet. It is where you will trade futures contracts with your capital. Make sure you know the exchange’s transfer fees to avoid being surprised. You’re now ready to dive into the exciting world of crypto futures trading!

Conclusion

Trading crypto futures is an exciting way to capitalize on the momentum of the cryptocurrency market. Knowing the fundamentals, implementing effective strategies, and leveraging market volatility can increase your chances of success. You’ll need to keep learning and practicing as you go along your trading journey to refine your skills and maximize your profits.