Professional traders and investors are using trading bots to make millions. AI trading bots can help you trade without any prior knowledge. If you don’t have a proper idea about AI trading, you may feel confused and not know where to begin. Here are a few ways to get started on your journey as a beginner. Let’s explore how to get trading bots.

What is Trading Bots?

Trading bots execute trades on behalf of users according to predetermined algorithms. These automated and advanced tools monitor financial markets, analyze price movements, and execute buy or sell orders without human intervention.

Investors can trade on stock, forex, and cryptocurrency exchanges to optimize trading efficiency. However, the most important part of using trading bots is choosing the right platform to trade on. After all, these bots are preprogrammed. Especially for beginners, it’s best to start trading on platforms like PrimeXBT. The platform currently offers a +7% bonus on your deposit. To get the bonus, use the promo code PRIMEOTT. Join PrimeXBT now for free.

Different Types of Trading Bots

Arbitrage Bots

Arbitrage bots are widely used due to their ability to exploit price discrepancies between different exchanges. They continuously monitor multiple exchanges to find opportunities where an asset can be bought at a lower price on one platform and sold at a higher price on another, thus profiting from the price difference. These bots were popular before 2017’s crypto hype.

Coin lending bots

Coin lending bots are designed to lend cryptocurrencies on various platforms to earn interest.

These bots manage the lending process by continuously monitoring interest rates, market conditions, and available lending opportunities. They automatically place lending offers when rates are favorable and reinvest earned interest to maximize returns.

Market Maker Bots

Market maker bots are essential for providing liquidity to the market. It scans the market 24/7 to monitor. They place simultaneous buy and sell orders, profiting from the bid-ask spread. These bots ensure that both sides of the market are always in demand.

How to Get Trading Bots?

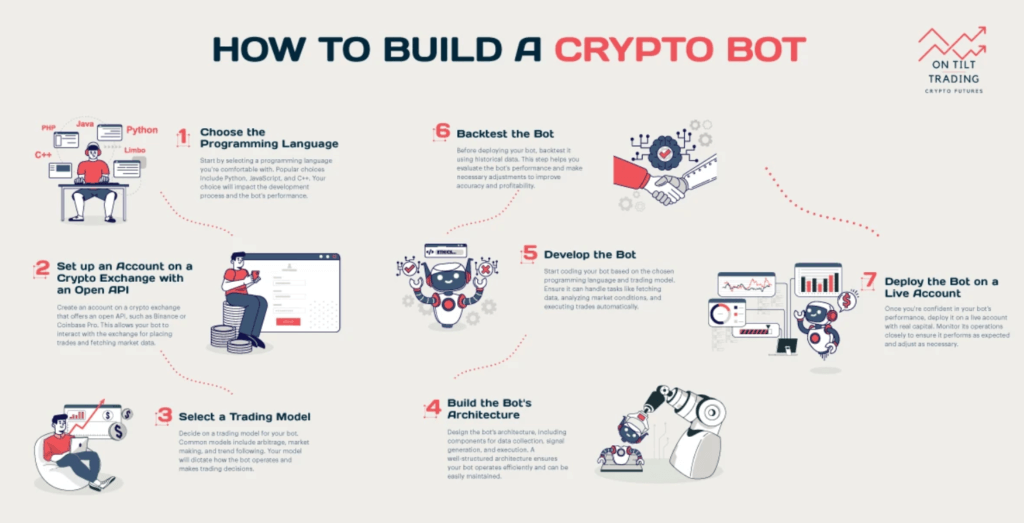

1. Make a Custom Trading Bot

If you have a background in programming and an understanding of trading, building your own trading bot can be a good option. But to do that, you need proper knowledge of programming and trading strategies. Decide which strategy aligns best with your trading goals and risk tolerance.

Familiarize yourself with programming languages commonly used in trading bot development. Python is a popular choice, according to the expert traders. Other languages like JavaScript, C++, and Java are also widely used. Set up your development environment with the necessary tools:

- IDE (Integrated Development Environment): Popular options include PyCharm, VS Code, and Eclipse.

- APIs (Application Programming Interfaces): Obtain API keys from the exchanges you plan to trade on, such as Binance, Coinbase, or Kraken.

- Libraries: Use libraries like Pandas for data analysis, NumPy for numerical calculations, and TA-Lib for technical analysis.

Start by writing basic functions for your bot:

- Create functions to fetch real-time market data from exchanges.

- Implement your trading strategy to generate buy and sell signals based on the collected data.

- Write functions to execute trades automatically when signals are generated.

- Incorporate features like stop-loss and take-profit mechanisms to manage risk.

Before deploying your bot, test it thoroughly using historical data (backtesting) and in a simulated trading environment (paper trading). Optimize your strategy based on test results to ensure the bot performs well under different market conditions.

2. Buy Pre-Built Bots (Subscription Based)

If developing a trading bot from scratch seems too complex or time-consuming, you can buy pre-built bots. These bots are professionally developed and ready to use. Here’s how to proceed:

| Bot Name | Features | Price |

| Algobot | Autonomous trading, multi-asset support (crypto, forex, stocks, commodities, indices), risk settings, Telegram signals, demo mode, TradingView integration | $44.99, $59.99, $109.99/mo |

| UltraAlgo | Supports multiple platforms (TradingView, TradeStation), 15 technical indicators, real-time data, portfolio allocation, risk management, alerts, backtesting | $67/mo |

| StockHero | Intelligent strategies (scalping, grid, take-profit), real-time market analysis, backtesting, paper exchange, AI chatbot, multiple asset support (forex, stocks, CFDs, crypto) | $4.99, $49.99, $99.99/mo |

| QuantConnect | Open-source, robust backtesting with historical data, custom strategy development, supports stocks, forex, futures, options, crypto, integration with major brokers | $8 to $80/mo |

| Forex Robotron | Fully automated, MT4 integration, customizable settings, backtesting with real tick data, trades multiple currency pairs | Starts at $1,188 |

| Tickeron | 100+ AI trading bots, advanced filters for strategies, supports stocks, ETFs, forex, crypto, AI-powered portfolio management | Subscription per bot |

| Cryptohopper | User-friendly interface, 24/7 market analysis, customizable strategies, strategy builder, copy trading, supports 16 crypto exchanges | $24.16/mo (paid plans) |

There are numerous trading bots available in the market. Research and compare different bots based on their features, performance, user reviews, and pricing.

Select a bot that aligns with your trading goals and experience level. Some bots are designed for beginners with user-friendly interfaces and pre-configured strategies, while others offer advanced features for experienced traders. Here is a list of pre-built AI trading tools:

After installation, configure the bot to suit your trading preferences:

- Connect the bot to your exchange accounts using API keys.

- Configure trading parameters such as the trading pair, order size, and risk management settings.

- Select from pre-configured strategies or customize your own.

Even though pre-built bots are automated, it’s essential to monitor their performance regularly. Make adjustments to the settings and strategies as needed to optimize performance and minimize risks.

3. Download for Free

If you’re looking for a cost-effective way to get started with trading bots, you can try free trading bots. These bots are available at no cost and can be a great way to experiment with automated trading. Here is a list of free AI trading bots:

Superalgos

Superalgos simplifies trading automation with its visual design interface. You can create and test complex strategies easily. The platform supports multiple exchanges and provides tools for backtesting and paper trading. Transform raw market data into actionable insights and automate your trading efficiently.

Growlonix

Growlonix uses AI to enhance your trading with bots like Hedge Grid Bot and Dual Grid Bot. The platform offers a sophisticated trading terminal and supports major exchanges such as Binance and Kucoin. Test your strategies with paper trading and enjoy advanced features designed to minimize risks and maximize profits.

PyCrypto

PyCrypto offers flexibility and security with its Python-based bot. Configure it easily via command-line or config files. It supports various encryption algorithms and runs in both live and test modes, making it a reliable choice for automating your trading strategies securely.

Freqtrade

Freqtrade is a powerful Python trading bot with features like backtesting, plotting, and money management tools. It supports major exchanges like Bittrex and Binance and can be controlled via Telegram. Optimize your strategies and automate trades through its user-friendly interface.

OctoBot

OctoBot is an open-source trading bot that supports many strategies and major exchanges. You can access it through a web interface, Telegram, or mobile app. You can design, test, and optimize your strategies with backtesting and paper trading. It is ideal for both beginners and advanced traders.

Besides, there are several platforms and communities where developers share free trading bots. GitHub is a popular platform where you can find open-source trading bots. Other platforms include forums like Bitcointalk and Reddit.

Benefits of Subscription-Based Tools

As a beginner, we recommend you go for subscription-based trading tools. They offer several advantages. These tools are valuable investments for both novice and seasoned traders. Here’s why:

Continuous Updates and Support

Subscription services typically provide regular updates. It ensures the software stays current with market changes and technological advancements. Subscribers also benefit from customer support, which can be crucial for troubleshooting and learning.

Advanced Features

Paid tools come with advanced features such as

- sophisticated technical indicators

- customizable strategies

- backtesting capabilities

- and real-time data analysis

These features can significantly enhance your trading performance and decision-making process.

Security and Reliability

Subscription-based platforms usually invest more in security measures to protect users’ data and funds. They also tend to be more reliable, offering robust infrastructure and minimizing downtime.

Learning Resources

Many subscription services offer educational resources, webinars, and tutorials to help users get the most out of the platform. This is particularly beneficial for beginners looking to improve their trading skills.

AI trading bots offer a range of features tailored to different trading needs. Choose the one that aligns best with your trading goals and expertise. However, the problem is that beginners may find the subscription-based tools costly. We recommend using Vestinda AI trading bot. The tool features a comprehensive strategy library curated by top traders. The platform supports integration with major exchanges like KuCoin, OKX, and Atani and serves users in over 50 countries. Start trading smarter with Vestinda now.