You can earn 10 times or 50 times your investment in the crypto market. According to reports, the global cryptocurrency market will reach USD 17.03 billion by 2033. It is a volatile market, so you have to act quickly and make informed decisions. You can make things simpler by using AI tools. What about creating pre-programmed indicators to help you trade on crypto? It will work only if you 24/7 gather data and analyze it to help you make decisions that will lead to big wins. How to build a crypto bot? Well, we have made a complete guide to help you create your personal crypto bot.

What is a Crypto Bot?

A crypto bot automates the crypto trading process. It follows programmed rules to buy and sell digital coins. Traders deploy crypto bots to execute trades quickly, recognize patterns, and execute trades based on predefined criteria. These bots can monitor markets 24/7 and trade on behalf of you. The tools aim to make profits by taking advantage of price changes.

Crypto bots can also perform complex trading strategies. They can react faster than human traders. But make sure to trade on a reliable platform. There are so many crypto trading platforms available online. Currently, Prime XBT has become a go-to trading destination for expert traders. Because the platform offers access to more than 100+ global markets. To know more, join Prime XBT now for free. The platform is offering executive bonuses. All who use promo code PRIMEOTT will receive a +7% bonus on their deposit.

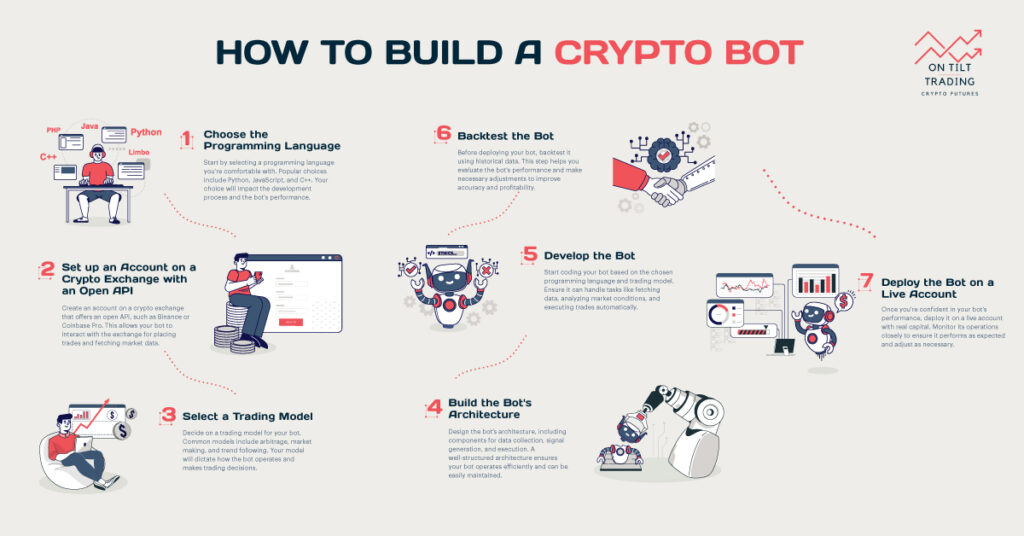

How to Build a Crypto Bot: Step-By-Step Guide

You need a lot of technical skills to build a crypto bot. Besides, hiring a professional programmer can help you create a custom bot.

Choose A Suitable Programming Language To Build The Bot

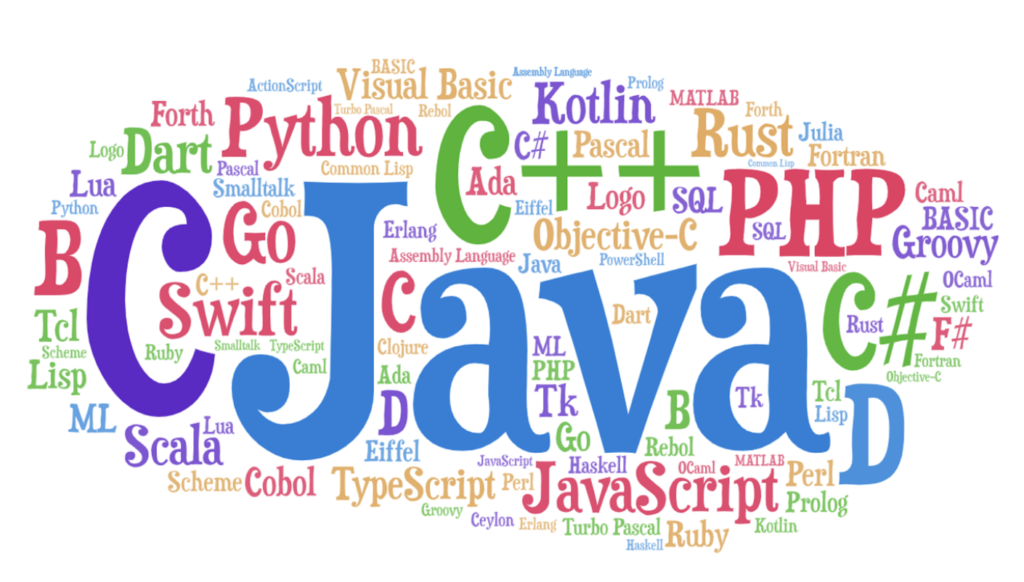

Selecting the right programming language is the first step. According to experts, popular choices include Python, JavaScript, and C++. You can also use languages like Rust and Go. Because these programming languages come with unique features.

Python is often preferred for its simplicity and powerful libraries. It has many tools for data analysis and machine learning. JavaScript works well for web-based bots. On the other hand, C++ is fast and efficient, making it good for high-frequency trading.

Consider your skill level when choosing a language. You have to pick one you’re comfortable with or willing to learn. The language should also suit your bot’s needs. Some exchanges prefer certain languages for their APIs.

Set up an Account on a Crypto Exchange with an Open API

You need an account on a crypto exchange to trade. Choose an exchange that offers an open API (Application Programming Interfaces). This feature lets your bot connect to the exchange. It allows the bot to place trades and access market data. Popular exchanges with good APIs include Binance, Kraken, and Coinbase Pro.

Research different exchanges before deciding. You have to look at their fees, security measures, and available cryptocurrencies. Make sure the exchange is reliable and has good customer support. Once you choose an exchange, create an account and verify your identity.

Here is an example using the Binance API with the python-Binance library:

# Replace with your API key and API secret

api_key = ‘your_api_key’

api_secret = ‘your_api_secret’

client = Client(api_key, api_secret)

# Fetch the current price of Bitcoin (BTC)

ticker = client.get_symbol_ticker(symbol=’BTCUSDT’)

btc_price = float(ticker[‘price’])

print(f”Current Bitcoin (BTC) price: ${btc_price:.2f}”)

You have to replace ‘your_api_key’ and ‘your_api_secret’ with your actual Binance API key and secret.

Select a Perfect Trading Model

Your bot needs a trading model to make decisions. This model determines when to buy or sell. Common models include:

- Trend following: The bot buys when prices are rising and sells when they’re falling.

- Mean reversion: It assumes prices will return to their average over time.

- Arbitrage: The bot profits from price differences across exchanges.

- Market making: It places buy and sell orders to profit from the spread.

- Scalping: Quick, frequent trades aiming to profit from small price fluctuations within short time frames.

- Sentiment Analysis: Analyzing social media, news, and other sentiment indicators to gauge market sentiment and make trading decisions.

Choose a model that fits your risk tolerance and investment goals. You can also combine multiple models for a more complex strategy.

Build the Bot’s Architecture

Plan your bot’s structure before you start coding. Decide how different parts of the bot will work together. Key components include:

- Data collection: Gathers price and market information.

- Signal generation: Analyze data to create buy or sell signals.

- Risk management: Controls the size of trades and manages losses.

- Execution: Places orders on the exchange.

- Monitoring: Tracks the bot’s performance and market conditions.

You have to design each component carefully. Make sure they can communicate effectively with each other.

Develop the Bot

Now, it’s time to write the code. Start with the data collection module. Use the exchange’s API to fetch real-time market data. Then, build the signal generation system based on your chosen trading model.

Next, create the risk management module. This should control position sizes and set stop-loss orders. The execution module will handle placing and canceling orders through the API.

Develop a monitoring system to track your bot’s performance. Include error handling to deal with potential issues. Test each component thoroughly as you build it.

Backtest the Bot To Ensure Its Credibility

You should also check how the bot works. You can utilize middleware such as Alpha Shifter to seamlessly connect your TradingView strategies with exchanges like Binance. Send custom signals directly to your exchange account.

Before using real money, test your bot on historical data. This process is called backtesting. In that case, use Bitsgap and Gainium to backtest your strategies.

Analyze the results carefully. Look at total returns, maximum drawdown, and risk-adjusted performance before investing a significant amount of money.

If the results aren’t satisfactory, adjust your bot’s strategy or parameters. Keep testing until you’re confident in your bot’s performance.

Remember that past performance doesn’t guarantee future results. Markets can change, and strategies that worked before might not work in the future.

Deploy the Bot on a Live Account

Once you’re satisfied with your bot’s performance, it’s time to go live. Start with a small amount of money. Monitor your bot closely in the beginning to ensure your credibility. Watch for any unexpected behavior or errors.

Gradually increase the trading amount if the bot performs well. Keep tracking its performance and the market conditions. Be prepared to turn off the bot if market conditions change dramatically. You can also give other traders access to the bot to get feedback.

Regularly review and update your bot. Markets evolve, and your bot should adapt. Consider implementing safeguards like daily loss limits or automatic shutdown triggers.

Security is the most important factor when building a crypto bot. So, protect your API keys and never share them. Use secure coding practices to prevent vulnerabilities. Consider hosting your bot on a reliable server for 24/7 operation.

Stay informed about crypto regulations in your area. Because some countries have restrictions on automated trading. Make sure your bot complies with all relevant laws.

Benefits of Using Crypto Custom Crypto Bots?

Custom Crypto bots can help you take your crypto trading experience to the next level. Here’s what you can expect:

- Investors can tailor trading strategies using your knowledge or from an expert view.

- Investors can execute trades automatically.

- Using crypto bots helps you manage multiple assets and trading pairs simultaneously, diversifying risk and capturing opportunities across different markets.

- Follows predefined rules rigorously, avoiding emotional biases. It helps you to maintain consistency in trading decisions.

- Reduces trading costs by minimizing human error and optimizing entry and exit points effectively.

- You can scale trading operations efficiently, handling large volumes of trades and complex strategies that may be impractical for manual trading.

These benefits make custom cryptocurrency trading bots valuable tools for both novice traders looking to automate basic strategies and experienced traders seeking to optimize and scale their trading operations.

Final Words

Keep learning and improving your bot to ensure the best results. The crypto market is constantly changing. Staying updated with new trading strategies and technologies is important to be in the game. You can join online communities to share knowledge with other bot developers.

But as we all can understand, building a crypto bot is a complex process. It requires time, effort, and ongoing maintenance. Besides, it may not provide the expected results. Instead, you can utilize platforms like Vestinda that are used by professional traders. It is a comprehensive crypto investment automation platform. It includes features for automating trading strategies (similar to what a crypto bot does). Users can automate trading strategies without needing to write code. Amazing right? To understand what more the platform can offer you, visit the official website of Vestinda now.