Cryptocurrency trading offers incredible opportunities but also comes with significant risks. Managing these risks is crucial for long-term success in the volatile world of crypto. A solid crypto risk management strategies is essential whether you’re an experienced trader or a beginner.

Prime XBT is a reliable crypto trading platform that offers valuable resources and tools to help you manage your risks effectively. Its advanced features and user-friendly interface make Prime XBT a good choice for crypto trading. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

In this blog post, we will explore various crypto risk management strategies to help protect your investments. We’ll cover essential risk mitigation techniques, from understanding market volatility to using technical analysis tools. Let’s look at crypto risk management and ensure your trading is successful.

What are Common Crypto Trading Risks

Cryptocurrency investments come with various risks that traders must understand and manage. This section delves into key risks associated with crypto trading and offers insights on how to navigate them effectively.

Market Volatility

Cryptocurrency markets are known for their extreme volatility. Prices can fluctuate dramatically within short periods. This volatility can lead to substantial gains or significant losses. It’s crucial to stay informed about market trends. By doing so, you can make more strategic decisions.

Market volatility requires a proactive approach. Utilize tools and resources to track price movements. This helps in anticipating potential changes. Always be prepared for sudden price swings. Effective risk management strategies can mitigate the impact of volatility.

Regulatory Risks

Cryptocurrency regulations are constantly evolving worldwide. Governments implement different rules for the crypto market, which can impact your investments. Staying updated on these changes is crucial, as is understanding regulations in various countries. Compliance with local laws is necessary to avoid legal issues.

Regulations can affect the accessibility and value of cryptocurrencies. Monitoring regulatory news can provide early warnings. Adapting to new rules ensures you remain compliant. Proactive measures can safeguard your investments against regulatory risks.

Security Risks

Security risks are a significant concern in the crypto market. Hacking, phishing, and fraud are prevalent threats that can lead to fund loss. Using secure hardware wallets is essential for asset protection. Ledger hardware wallets store private keys for cryptocurrencies offline in cold storage. So, you can secure crypto and digital assets and have peace of mind with a Ledger wallet.

Choose reputable exchanges with robust security measures. Regularly update your security protocols. Employ two-factor authentication for added security. Be cautious of phishing scams and suspicious links. Monitor your accounts regularly for unusual activities. Staying vigilant can help mitigate security risks. Protecting your assets should always be a top priority.

Liquidity Risks

Liquidity refers to how easily an asset can be bought or sold. Low liquidity can cause significant price slippage. This can lead to unfavorable trading conditions. Investing in highly liquid assets can reduce this risk. It’s essential to assess the liquidity of cryptocurrencies. Liquidity levels can vary between different assets.

Use liquidity indicators to inform your decisions. Higher liquidity ensures smoother transactions. It also provides better price stability. Prioritizing liquidity can help manage trading risks effectively.

Technological Risks

Cryptocurrencies rely heavily on complex technology. Technological failures can significantly impact investments. Early-stage technologies carry higher risks. Understanding the underlying technology is crucial. Stay informed about the latest technological developments. Technical issues can disrupt trading activities. Regularly update software and hardware. Diversify investments to spread technological risks.

Trading on an open server can expose you to malware, hindering progress and affecting your device output. Using Forex VPS provides top-notch security, protecting against malware and interruptions, and securing your trading portfolio. Being aware of potential technical problems helps. Prepare for possible technical failures. Effective risk management includes monitoring technological stability.

Crypto Risk Management Strategies

Implementing effective risk management strategies is crucial for successful cryptocurrency trading. Here are several key strategies to help you manage risks effectively.

Regulatory Compliance

Cryptocurrencies are subject to different regulations in various jurisdictions. Make sure you understand the legal framework in your region. Compliance with local laws is essential for risk management. Non-compliance can lead to penalties or asset loss. Stay updated on government policies regarding cryptocurrency.

Some countries have clear guidelines, while others are still developing regulations. Understanding these rules helps protect your investments. Consult legal experts if you’re unsure about regulations in your area. Following the law ensures your crypto activities are safe and secure.

Diversification

Diversification reduces risk by spreading investments across multiple assets. Avoid putting all your funds into one cryptocurrency. Diversifying within the crypto space is essential. Consider investing in different types of cryptocurrencies. This approach can balance potential losses. Diversification helps manage market volatility. It also provides opportunities for gains. A diverse portfolio is more resilient.

Regularly review and adjust your portfolio. Diversification is a fundamental risk management strategy. It allows for more balanced growth. Diversifying reduces the impact of any single asset’s poor performance, mitigates overall risk, and enhances the potential for returns. Diversification is key to long-term success. Spread your investments across various assets.

Asset Allocation

Asset allocation involves distributing your investments across different asset classes. Allocate a specific percentage to cryptocurrencies. Balance your crypto investments with traditional assets. This approach mitigates overall risk. Asset allocation ensures a diversified portfolio and helps manage exposure to volatile assets.

Regularly review and adjust your asset allocation, considering your risk tolerance and investment goals. Proper asset allocation can enhance returns. It also reduces the impact of market fluctuations. Tailor your asset allocation to your financial situation. Reallocate funds as market conditions change. This strategy helps achieve a balanced portfolio, which is essential for effective risk management.

Position Sizing

Position sizing determines the amount of capital to allocate per trade based on your risk tolerance. Use the 1% rule for position sizing, which limits potential losses to 1% of your capital. Calculate position size before trading. Proper position sizing manages risk exposure. It helps protect your portfolio from significant losses. Adjust position sizes based on market conditions.

Consistent position sizing improves trading discipline. This strategy is essential for effective risk management. Position sizing helps in minimizing losses. It keeps your investments secure. Correct position sizing prevents overexposure. It balances potential profits and losses. This strategy enhances trading performance. You can use our position size calculator to determine the ideal position size based on your account size.

Setting Stop-Loss Orders

Stop-loss orders automatically sell your assets at a predetermined price. They limit potential losses in volatile markets. Set stop-loss levels based on analysis. Properly placed stop-loss orders protect your investments. They help maintain trading discipline. Review and adjust stop-loss levels regularly. This strategy reduces emotional trading decisions.

Stop-loss orders provide a safety net and are crucial for managing risk effectively. Implementing stop-loss orders enhances portfolio protection. It prevents significant losses during market downturns. Stop-loss orders are essential tools for disciplined trading. Setting stop-loss orders is vital for safeguarding your investments. Our On Tilt Trading Store offers Stop-Loss calculators to help you calculate better and maximize profits.

Regular Portfolio Rebalancing

Portfolio rebalancing involves adjusting your asset allocation. It aligns your portfolio with investment goals. Rebalancing helps manage risk exposure. Regularly review your portfolio performance. Adjust investments based on market conditions. Rebalancing maintains diversification. It ensures consistent risk management.

This strategy adapts to changing market dynamics. Regular rebalancing improves portfolio stability. It enhances long-term returns. Consistent rebalancing is a key risk management strategy. It keeps your investments aligned with your goals, prevents overexposure to any single asset, and supports sustained growth. Portfolio rebalancing is crucial for maintaining a balanced portfolio.

Automated Trading Bots

Automated trading bots execute trades based on predefined strategies. These bots help manage risk by following specific parameters. They can monitor the market 24/7. Bots reduce human error and emotional trading. They operate based on set algorithms and conditions.

You can program risk limits into the bots, ensuring you never exceed a predetermined loss. Bots also help manage trading frequency and size. Use trading bots to maintain consistent risk management. With Vestinda trading app, you can eliminate emotional decision-making with automated crypto trading strategies.

Crypto Wallets

Crypto wallets are essential for securing your digital assets. These wallets store your private keys and allow you to manage your cryptocurrencies. Understanding the different types of wallets and their security features is essential. There are two primary types of wallets: hot wallets and cold wallets.

Hot wallets are connected to the internet and provide easy access, but they are more vulnerable to hacking. On the other hand, cold wallets are offline and offer a higher level of security. In terms of security, cold wallets are the best. Ledger is one of the best examples of a cold wallet.

Utilizing Technical Analysis Tools

Technical analysis tools are essential for making informed trading decisions. These tools help analyze market trends and predict potential price movements.Moving AveragesMoving averages smooth out price data and help identify trends over a specific period. They can also be used to determine market direction and signal buying or selling opportunities.

Different types of moving averages exist. Simple and exponential moving averages are popular. They are calculated over various time frames. Combining different moving averages can provide better insights. Moving averages help traders understand market momentum. They are fundamental tools for technical analysis.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the speed and change of price movements. It ranges from 0 to 100. RSI identifies overbought or oversold conditions. Readings above 70 indicate overbought markets.

Readings below 30 suggest oversold markets. RSI helps predict potential price reversals. It is a momentum oscillator. Traders use RSI to identify entry and exit points. Regularly monitoring RSI can improve trading decisions. RSI is a valuable tool for risk management.

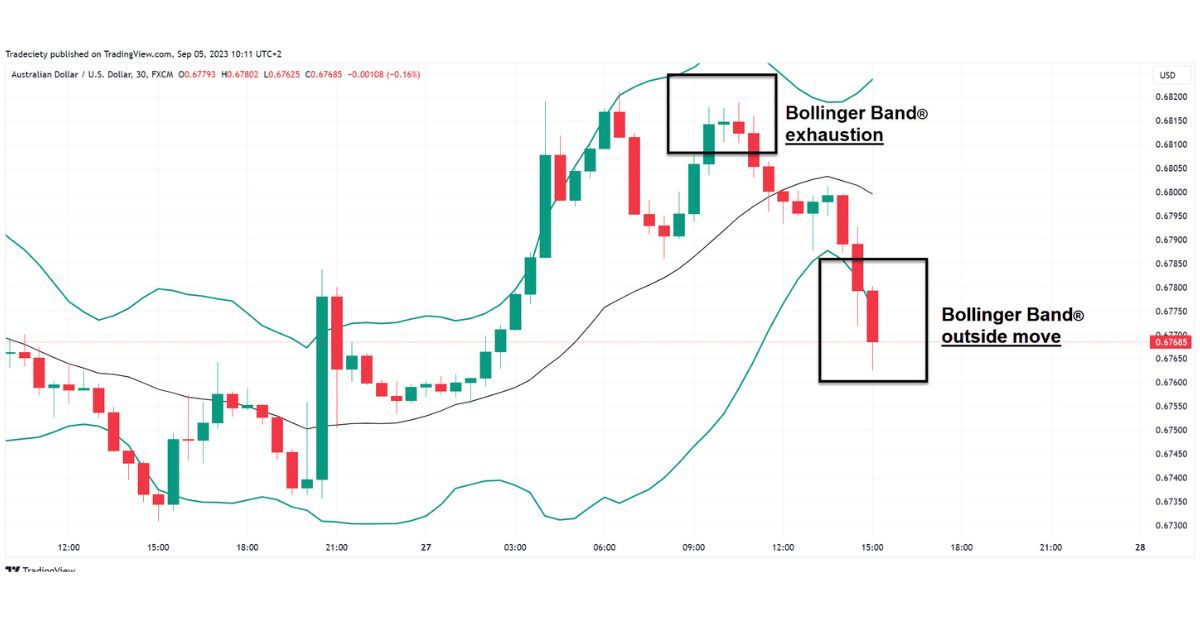

Bollinger Bands

Bollinger Bands consist of a moving average and two standard deviation lines. They help measure market volatility. The bands expand and contract with volatility changes. Prices typically stay within the bands. Bollinger Bands indicate overbought or oversold conditions.

When prices touch the upper band, the market is overbought. When prices touch the lower band, the market is oversold. Bollinger Bands can signal potential price reversals. They are essential for identifying trading opportunities and are widely used in technical analysis.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of the MACD line and signal line. Crossovers between these lines signal buying or selling opportunities.

Positive MACD values indicate upward momentum. Negative MACD values suggest downward momentum. MACD helps identify trend reversals. It is a versatile tool for technical analysis. Regularly monitor MACD for informed trading decisions. MACD is essential for effective risk management.

Fibonacci Retracement

Fibonacci retracement uses horizontal lines to indicate support and resistance levels. These levels are based on Fibonacci ratios. Traders use Fibonacci retracement to identify potential reversal points. The key ratios are 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels help predict price movements.

Fibonacci retracement is useful for setting target prices, aiding in determining entry and exit points, and is essential for technical analysis. Incorporate Fibonacci retracement into your trading strategy.

What is the Formula for Risk Management in Crypto?

The Risk/Reward Ratio is a crucial concept in cryptocurrency trading that helps traders assess a trade’s potential profitability. The risk is calculated as the difference between the entry price and the stop-loss level, representing the amount a trader stands to lose if the price moves against them.Conversely, the reward is the difference between the entry price and the take-profit level, representing the potential gain if the trade moves in the desired direction. To calculate the risk/reward ratio, the potential risk is divided by the potential reward.

Read More: Bitcoin Risk Management

Conclusion

Effective risk management is crucial for success in cryptocurrency trading. Implementing sound strategies and understanding the risks will help you reduce potential losses. Risk management involves diversifying your portfolio, using stop-loss orders, and allocating assets properly.

Understanding the market trends and maintaining emotional control during volatile periods is essential. Remember that risk management is an ongoing process that requires regular evaluation and adjustment. Using appropriate resources and continuously assessing your portfolio can help you navigate the crypto market.

Ultimately, mastering risk management in cryptocurrency trading will increase your chances of long-term success. Keep informed, stay disciplined, and prioritize risk management to safeguard your financial future.