A spot market is where you can buy and sell commodities, currencies, stocks, and bonds right away. In a futures market, you agree to buy or sell these things at a set price on a future date. Both spot and futures markets are vital for traditional financial assets and are just as important for cryptocurrencies. If you plan on investing in crypto, you should thoroughly understand these financial markets. So without wasting time, let’s try to understand the differences between Crypto Futures vs Spot.

What is Futures Trading in Crypto?

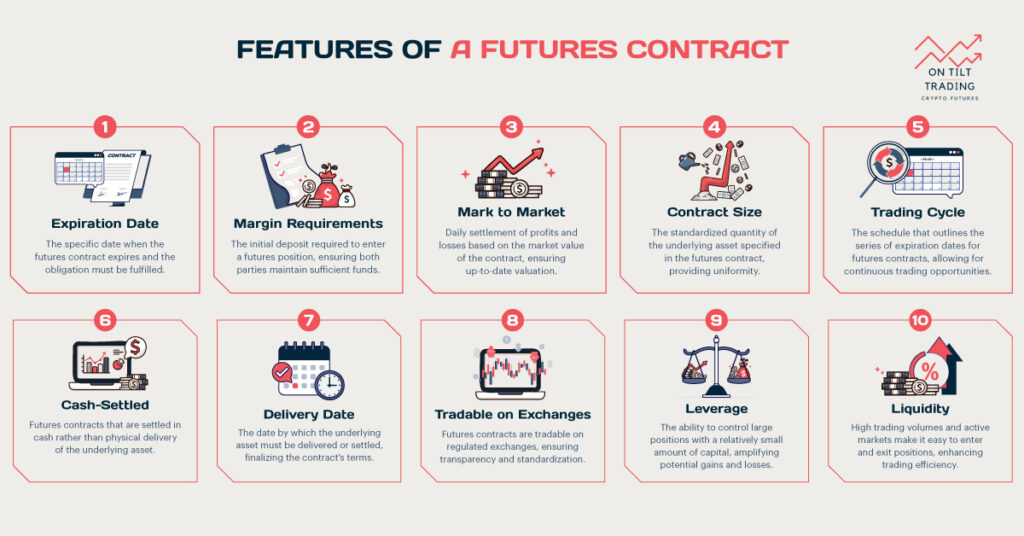

Futures trading in crypto is a financial strategy where traders agree to buy or sell a specific amount of cryptocurrency at a predetermined price on a future date. This type of trading allows investors to speculate on the future price movements of cryptocurrencies without actually owning the assets. Futures contracts are standardized agreements traded on futures exchanges, which provide a structured and regulated environment for trading.

But to make a profit through crypto futures trading you should choose a reliable trading platform. The platform allows traders to invest in future contracts without risking capital.

Advantages of Crypto Futures Trading

Leverage

One of the biggest advantages of futures trading in crypto is leverage. Leverage allows traders to open positions much larger than their initial investment. This means that with a relatively small amount of capital, traders can control a larger value of cryptocurrency. If the market moves in the direction they predicted, the potential profits can be substantial.

Hedging

Futures contracts offer a great way to hedge against potential losses in the spot market. If you own a significant amount of a particular cryptocurrency, you can use futures to protect yourself against adverse price movements. For instance, if you believe the price of Bitcoin will drop, you can enter into a futures contract to sell Bitcoin at a future date. This way, even if the price falls, you can lock in a selling price now, thus mitigating losses.

Market Liquidity

Futures markets often have higher liquidity compared to spot markets. High liquidity means there are plenty of buyers and sellers, making it easier to enter and exit trades without significant price slippage. This is particularly beneficial for large traders who need to execute big orders.

Price Discovery

Futures markets contribute to the price discovery process of cryptocurrencies. The prices of futures contracts are often used as a reference point for the spot market. This helps in creating a more transparent and efficient market environment.

Disadvantages of Crypto Futures Trading

High Risk

While leverage can amplify profits, it can also magnify losses. Because you are trading with borrowed funds, even a small adverse price movement can lead to significant losses. In extreme cases, traders can lose more than their initial investment. This high level of risk makes futures trading unsuitable for inexperienced traders.

Complexity

Futures trading is more complex than trading in the spot market. It involves understanding various concepts such as margin, leverage, and contract specifications. This complexity can be daunting for beginners and may lead to costly mistakes if not properly understood.

Market Volatility

Cryptocurrencies are known for their extreme volatility. While this volatility can create profit opportunities, it also increases the risk of substantial losses. The prices of futures contracts can swing wildly, making it challenging to predict market movements accurately.

Funding Fees

Holding a futures position over an extended period can incur funding fees. These fees are paid to keep the position open and can add up over time, eating into potential profits. Traders need to factor in these costs when planning their strategies.

Additionally, the cryptocurrency market is relatively unregulated. Large traders, or whales, can influence futures prices through their substantial buying or selling power. This can create artificial price movements, making it difficult for retail traders to navigate the market.

What is Spot Trading in Crypto?

Spot trading in the crypto market refers to buying and selling cryptocurrencies for immediate delivery. When you buy a cryptocurrency on a spot market, you own the asset right away. This type of trading is straightforward and involves trading pairs like BTC/USD or ETH/BTC. You purchase your chosen crypto using either fiat currency or another cryptocurrency, and the transaction is settled instantly.

Advantages of Spot Trading in Crypto

Easy to Understand

Spot trading is easy to understand and execute. You buy the asset and it’s yours immediately. There’s no need to worry about contracts, expiry dates, or margin requirements.

When you spot trade, you own the cryptocurrency. This means you can transfer it to your personal wallet, use it for transactions, or hold it as an investment.

Help to Maintain Transparency

Spot markets are typically more transparent. Prices are clear and reflect the current market value. You can see your trades and balances in real-time.

Spot trading involves less risk compared to leveraged trading. Since you are trading with the actual funds you own, there’s no risk of a margin call or liquidation.

Flexibility

You can hold your assets for as long as you want. There’s no obligation to sell or buy back at a specific time. Most crypto exchanges offer spot trading, making it accessible to anyone with an internet connection and a trading account. Spot trading allows you to participate directly in the market, influencing the price through supply and demand.

Disadvantages of Spot Trading in Crypto

Limited Profit Potential

Without leverage, your profit potential is limited to the amount of money you invest. This means you can’t amplify your returns as you can with margin trading. On Tilt Trading’s P&L Calculator helps you determine your trade profitability, track performance and make informed decisions.

Capital Requirement

Spot trading requires full capital upfront. If you want to buy $10,000 worth of Bitcoin, you need $10,000 in cash or crypto. This can be a barrier for those with limited funds.

Besides, Cryptocurrencies are known for their volatility. While this can lead to significant gains, it can also result in substantial losses. The value of your holdings can fluctuate widely.

Liquidity Issues

In less popular cryptocurrencies, liquidity can be a problem. This means it can be hard to buy or sell large amounts without affecting the price significantly.

Holding your assets on an exchange carries the risk of hacking. Although many exchanges have strong security measures, they are still prime targets for cyber-attacks.

No Income Generation

Unlike staking or lending, spot trading doesn’t generate passive income. Your profit depends solely on the price appreciation of the asset. Spot trading can lead to emotional decision-making, especially in a volatile market. Fear and greed can drive irrational trades, leading to losses.

How to Choose Between Crypto Futures vs Spot Trading?

Choosing between spot and futures trading depends on your goals, risk tolerance, and trading experience. Here’s a simple guide to help you decide.

Investment Goals

If you want to own the cryptocurrency right away, spot trading is the way to go. You buy and get the asset instantly.

But, if you’re interested in betting on the future price of a cryptocurrency without owning it immediately, futures trading might suit you better.

Risk Tolerance

Spot trading generally involves lower risk. You can only lose what you invest, and there are no margin calls or liquidations. Futures trading can offer higher rewards but also comes with higher risk. Using leverage can amplify both gains and losses.

Trading Experience

If you’re new to trading, start with spot trading. It’s simpler and less risky. In case you have more experience and understand how leverage and contracts work, futures trading might be for you.

Market Conditions

In a rising market, spot trading can be profitable as the value of your holdings increases. If you’re skilled at predicting market movements, futures trading can help you profit from both rising and falling prices.

Capital Available

Spot trading requires you to pay the full price of the asset upfront. You need enough capital to buy the cryptocurrency. Futures trading allows you to control larger positions with less capital, using leverage. However, this increases the risk.

Time Commitment

Spot trading is suitable for those looking to invest in cryptocurrency for the long term. You can buy and hold the asset. Futures trading often requires more active management and monitoring due to the nature of leverage and market fluctuations.

Read More: Crypto Futures India: A Comprehensive Guide

Final Words

Choosing between spot and futures trading comes down to your personal preferences and circumstances. Spot trading is straightforward, ideal for beginners, and involves owning the actual cryptocurrency. Futures trading offers the potential for higher profits but also comes with higher risks and complexity. With proper tools, you can choose the right strategy. Maximize efficiency and eliminate guesswork.