Future contracts and futures options are two different ways to trade. They offer distinct strategies, risks, and rewards. While they share some similarities, they operate differently, resulting in varying costs and benefits. Are futures more expensive than options? To determine whether futures are more expensive than options, examining their inherent characteristics, cost structures, and trading strategies is necessary.

What Are Futures Contracts in Trading?

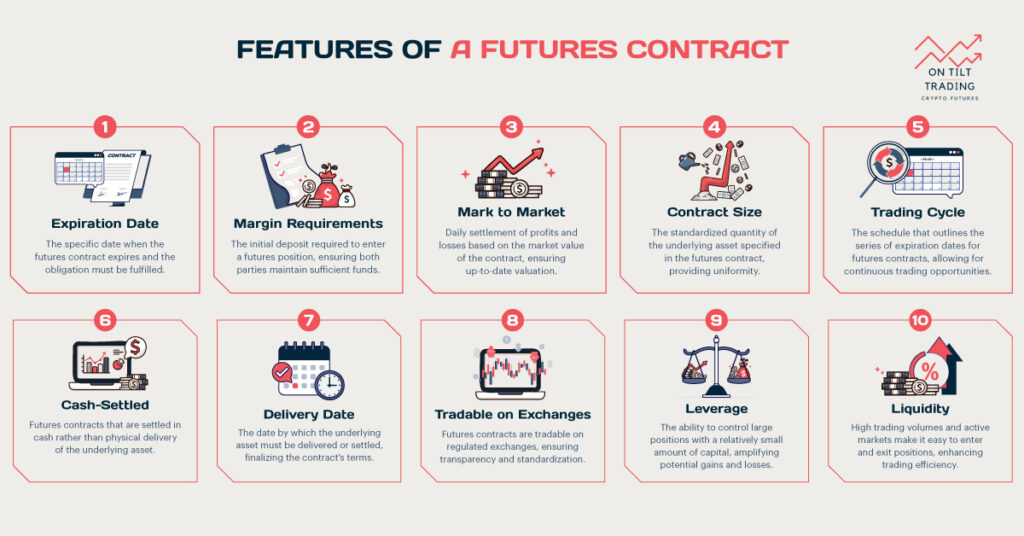

A futures contract is an agreement to buy or sell an asset at a predetermined price at a specified time. This asset can be anything from commodities like oil and wheat to financial instruments like currencies, stock indexes, and even cryptocurrencies.

Types of Futures Contracts

With a futures contract, you commit to buying or selling an asset on the expiration date of the contract. There are two main types of futures traders: hedgers and speculators.

Hedgers use futures contracts to protect themselves from price changes in the underlying asset. For example, a wheat farmer might sell a futures contract to lock in a specific price for their crop, ensuring they get a predictable income regardless of market fluctuations. Similarly, a bakery might buy a futures contract to secure a stable price for wheat, helping them manage costs.

Speculators, on the other hand, aim to profit from price movements. They don’t intend to actually buy or sell the physical asset but rather make money from the changing value of the contract itself. For example, a trader might buy a crude oil futures contract if they believe the price of oil will rise. If the price does go up, they can sell the contract at a higher price and make a profit.

Suppose it’s January, and you believe Bitcoin’s price will increase by June. You decide to buy a Bitcoin futures contract for $30,000 per Bitcoin, with a contract size of 5 Bitcoins, expiring in June. This means you agree to buy 5 Bitcoins at $30,000 each in June.

If June arrives and the price of Bitcoin has risen to $35,000 per Bitcoin, you can sell the contract for a profit. The difference between the buying price and the current price ($35,000 – $30,000 = $5,000 per Bitcoin) multiplied by the contract size (5 Bitcoins) results in a profit of $25,000.

Conversely, if the price of Bitcoin falls to $25,000 per Bitcoin, you would incur a loss of $25,000.

Futures contracts are powerful tools for managing risk and capitalizing on market movements. However, they also come with significant risks and require careful consideration and understanding before trading.

What are Options in Trading?

An option in trading is a financial contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain period. Options are versatile tools used by traders for various purposes, such as hedging risks, speculating on price movements, or generating income.

Types of Options

- Call Option: This gives the buyer the right to buy an asset at a specified price (strike price) before the option expires.

- Put Option: This gives the buyer the right to sell an asset at a specified price before the option expires.

You believe that Bitcoin’s (BTC) price will increase next month. Currently, Bitcoin is trading at $30,000. You decide to buy a call option with a strike price of $32,000, expiring in one month. This option costs you a premium of $500.

Bitcoin rises to $35,000 before the option expires. You exercise your option and buy Bitcoin at the strike price of $32,000. Your profit is $35,000 – $32,000 – $500 (premium) = $2,500.

Bitcoin stays below $32,000. You do not exercise your option and lose the $500 premium.

Example of a Put Option in Crypto Trading

Now, let’s say you own 1 Ether (ETH) and are worried its price might fall. Currently, ETH is trading at $2,000. You buy a put option with a strike price of $1,800, expiring in one month, for a premium of $50.

- Scenario 1: ETH falls to $1,500. You exercise your option and sell ETH at $1,800, avoiding a larger loss. Your net gain is $1,800 – $1,500 – $50 (premium) = $250.

- Scenario 2: ETH stays above $1,800. You do not exercise your option and lose the $50 premium.

Options in trading offer flexibility and can be powerful tools for managing risk or capitalizing on market opportunities. However, they require careful consideration of market conditions and strategies.

Are Futures More Expensive Than Options?

There isn’t a definitive answer to whether futures are more expensive than options as it depends on the specific circumstances, including the trader’s objectives, market conditions, and the time horizon. Futures might be cheaper in terms of upfront costs and leverage, while options can offer limited risk with higher premiums. Each way has its own cost structure and risk profile, so the trader should choose according to his or her strategy. Here’s what you need to know before investing:

Initial Costs

The first difference between futures and options in how much you pay upfront. When you trade futures, you need to deposit an initial margin, which is a percentage of the contract’s total value. This can range from 2% to 12%. For example, if you’re trading a futures contract worth $10,000 and the margin requirement is 10%, you need to deposit $1,000.

To trade options, you pay a premium, which is the cost of the option. This premium varies based on factors like the current price of the asset, the strike price, the time until expiration, and market volatility. Typically, the premium for an option is much less than the margin required for a futures contract. Worried about margin calls? Our On Tilt Trading Margin Requirement Calculator shows you exactly how much margin is needed for your positions, avoiding costly errors. It will help you to make the right decision.

Ongoing Costs

Besides the initial cost, there are ongoing costs to consider. You might have to add more money to your margin account if the market moves against you. This is called a margin call. If you can’t meet the margin call, you might be forced to close your position at a loss.

Once you pay the premium for an option, there are no additional costs. If the option expires worthless, you simply lose the premium paid.

Potential Profits and Losses

How much you can gain or lose also differs between futures and options. Futures contracts can result in unlimited gains or losses. If the market moves in your favor, you can make a lot of money. However, if the market moves against you, your losses can be equally large.

With options, your potential loss is limited to the premium you paid. If the market moves in your favor, you can make a significant profit. However, if the market moves against you, the most you can lose is the premium.

Time Value and Decay

Another important aspect is how time affects futures and options. Time doesn’t impact futures contracts in the same way it does options. The value of a futures contract is directly tied to the current market price of the asset.

Options lose value as they get closer to expiration. This is known as time decay. The longer you hold an option, the less valuable it becomes, especially if the market price doesn’t move in your favor.

Liquidity and Market Access

Liquidity, or how easily you can buy and sell these contracts, is another factor. Futures markets are usually very liquid, meaning you can easily enter and exit positions. This makes them attractive to large traders.

Options markets can be less liquid, especially for options with longer expiration dates or those tied to less popular assets. This can make it harder to buy or sell options at your desired price.

Complexity and Risk Management

Both futures and options can be complex, but options offer more strategies to manage risk. Trading futures requires a strong understanding of the market because of the potential for unlimited losses. Options trading allows for more complex strategies like spreads and hedging, which can help manage risk and potential losses.

Read More: Everything You Need to Know About Crypto Futures Germany

Final Words

Choosing between futures and options can indeed be challenging for traders. However, with proper scenario analysis and careful calculations, you can make informed decisions that lead to significant gains. Making the right choice can pave the way to substantial profits. You have to utilize the right trading tools before you make any decisions.