Mastering trading psychology is key to success in trading’s fast-paced world. Psychological factors can significantly impact your trading decisions and overall performance. Success hinges on grasping and steering these vital components. Approach them decisively for lasting success. In this article, we will explore various trading psychology tips to enhance your trading skills. We’ll cover key strategies. They cover managing emotions to building a winning mindset.

These tips will help you become a more confident and successful trader. Prime XBT is a reliable crypto trading platform. It has great tools and resources to support your trading. Utilizing platforms like Prime XBT can help you stay disciplined and focused. Having access to reliable tools is just one part of mastering trading psychology. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is Trading Psychology?

Trading psychology refers to the mental and emotional aspects of trading. It’s about how emotions impact your trading decisions. Good trading psychology is key to long-term success. It helps traders make rational decisions. Poor psychology can lead to impulsive trades.

Common psychological challenges include fear, greed, and hope. These emotions can disrupt even the best trading plans. Understanding them is crucial. Fear often causes traders to exit trades too early. Greed can push traders to take unnecessary risks. Hope can make traders hold onto losses.

To master trading psychology, recognize these emotions. Develop strategies to manage them. Awareness and control are essential for success.

Most Common Trading Psychology Challenges

Trading can be a rewarding venture, but it also comes with numerous psychological challenges. Understanding these challenges is crucial for improving your trading performance. Here are some common trading psychology challenges that traders often face:

Fear of Missing Out (FOMO)

Fear of missing out, or FOMO, can lead to impulsive trading decisions. When traders see others profiting from a particular trade, they may feel pressured to jump in. This can result in poor entry points and losses. To combat FOMO, establish a solid trading plan.

Stick to your strategies, and avoid making hasty decisions based on market hype. Focus on your long-term goals instead of short-term gains. Being aware of FOMO can help you maintain discipline.

Overconfidence

Overconfidence can be detrimental to traders. When traders experience a series of wins, they may develop an inflated sense of their abilities. This can lead to risky trades without proper analysis. Overconfident traders often ignore market signals.

To mitigate overconfidence, regularly review your trades and results. Stay humble and remember that markets can be unpredictable. Emphasize risk management in every trade. This helps maintain a realistic perspective on your skills and decisions.

Loss Aversion

Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains. This can cause traders to hold onto losing positions for too long. Instead of cutting losses, they hope for a turnaround. This behavior can lead to significant losses.

To overcome loss aversion, implement strict stop-loss orders. Accept that losses are part of trading. Learn to view losses as opportunities for growth. Analyzing losing trades can provide valuable insights for future strategies.

Emotional Decision-Making

Emotions play a significant role in trading decisions. Traders may act impulsively based on fear, greed, or excitement. Emotional decision-making can cloud judgment, leading to poor trades. To counteract this challenge, develop a structured trading plan.

Use tools to automate trades when possible. Keeping a trading journal can help identify emotional triggers. Recognize when emotions influence your decisions. Taking breaks during emotional periods can provide clarity.

Imposter Syndrome

Imposter syndrome is the feeling of self-doubt regarding your abilities. Many traders, especially beginners, may feel like they don’t belong in the trading world. This can hinder performance and lead to anxiety.

To combat imposter syndrome, focus on continuous learning and improvement. Celebrate your achievements, no matter how small. Connecting with other traders can also help. Sharing experiences can boost confidence and validate your journey.

Burnout

Trading can be mentally and emotionally exhausting. Constantly monitoring the markets can lead to burnout. Symptoms include fatigue, irritability, and decreased motivation. To prevent burnout, maintain a healthy work-life balance.

Set aside specific trading hours and take regular breaks. Engage in activities outside of trading. Practicing self-care can help you recharge and return to trading with a fresh perspective. Recognize the signs of burnout and take proactive measures to address it.

Analysis Paralysis

Analysis paralysis occurs when traders overanalyze data and miss opportunities. They may get stuck in a cycle of researching and fail to make timely decisions. This can be detrimental, especially in fast-moving markets.

To overcome analysis paralysis, set specific time limits for analysis. Trust your research and instincts. Develop a simplified trading strategy that focuses on key indicators. Taking action, even if imperfect, is better than inaction.

11 Best Trading Psychology Tips

Trading is as much about mindset as it is about strategy. Developing strong psychological habits can significantly enhance your trading performance and help you navigate market fluctuations.

1. Develop a Trading Plan

A solid trading plan is essential. It guides your decisions and actions. Define your entry and exit strategies clearly. Set risk management rules. Review and adjust the plan regularly. A trading plan helps maintain discipline. Stick to your plan even during market fluctuations. This reduces emotional trading.

Consistency is key. Follow your plan without exceptions. Your plan should reflect your trading style. It should also match your risk tolerance. Adapt your plan as you gain experience. Use your plan to avoid impulsive trades. A well-structured plan boosts your confidence.

2. Set Realistic Goals

Realistic goals keep you focused. They help manage expectations. Avoid aiming for unrealistic profits. Break down goals into achievable steps. Celebrate small successes. This keeps you motivated. Unrealistic goals can lead to frustration. They often cause emotional trading. Adjust your goals as needed.

Stay flexible but realistic. Goals should be specific and measurable. Review them regularly. Make sure they align with your trading plan. Setting achievable goals boosts your confidence. It keeps you on track. Always aim for progress, not perfection. Realistic goals provide a clear path to success.

3. Maintain Discipline

Discipline is crucial for trading success. It helps you stick to your plan. Avoid impulsive decisions. Emotional trading can lead to losses. Follow your plan strictly. Stay patient and disciplined. This builds consistency. Avoid trading based on tips or rumors. Trust your analysis.

Regularly review your trades. Learn from mistakes. Adjust your strategy if necessary. Discipline helps you stay focused. It minimizes emotional interference. Consistent discipline leads to better results. It also reduces stress. Discipline is the backbone of successful trading. Practice it daily.

4. Control Your Emotions

Emotions can cloud judgment. Recognize when you’re feeling emotional. Take a break if needed. Avoid trading when stressed or upset. Stay calm and focused. Breathing exercises can help. Meditation is also beneficial. Emotions like fear and greed can be damaging. Manage them effectively. Keep a trading journal.

Record your emotions and decisions. This helps identify patterns. Learn to control your reactions. Emotional control leads to better trading decisions. Practice mindfulness regularly. It improves emotional regulation. Control your emotions to improve your trading outcomes.

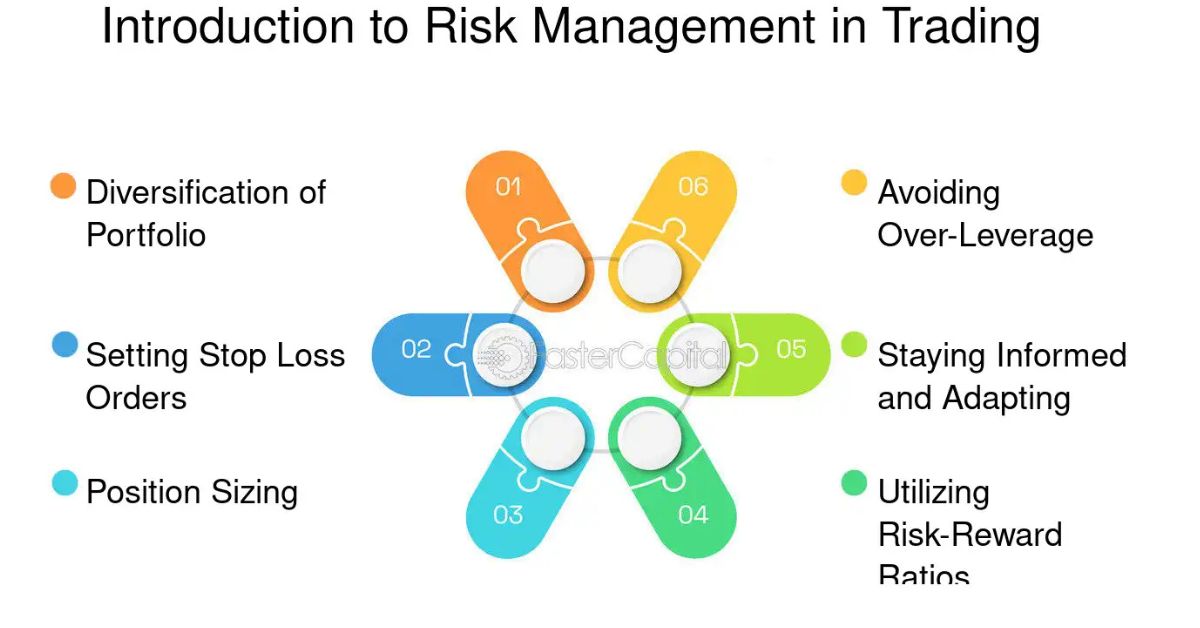

5. Practice Risk Management

Risk management is vital. Always set stop-loss orders. This limits potential losses. Define your risk per trade. Stick to it strictly. Avoid risking too much on a single trade. Diversify your portfolio. This reduces risk. Use position sizing techniques. Adjust based on market conditions.

Regularly review your risk management strategy. Make necessary adjustments. Effective risk management protects your capital. It ensures long-term success. Never trade without a risk management plan. It’s essential for survival. Risk management is a trader’s safety net. Always prioritize it.

For effective risk management tools, check out the On Tilt Trading Store. They offer a variety of tools, like the stop-loss calculator, which is crucial for setting stop-loss orders. These tools help in precise risk calculation and management, enhancing your trading strategy.

6. Stay Informed

Keep up with market news. Stay informed about global events. Understand how they impact markets. Regularly read financial news. Follow expert analysis. Use reliable sources. Staying informed helps you make better decisions. It reduces uncertainty. Avoid overloading yourself with information.

Focus on relevant news. Too much information can be confusing. Filter what’s important. Stay updated but balanced. Use the news to adjust your strategies. Being informed gives you an edge. It helps you anticipate market movements. Stay informed to stay ahead.

7. Continuous Learning

Trading requires continuous learning. Markets are always changing. Stay updated with new strategies. Attend webinars and workshops. Read books on trading. Learn from experienced traders. Join trading communities. Share knowledge and experiences. Continuous learning improves your skills.

It keeps you adaptable. Regularly review and analyze your trades. Learn from successes and failures. This helps improve your strategy. Stay curious and open-minded. Adapt to new information and techniques. Continuous learning is a lifelong process. It’s key to long-term success. Never stop learning.

8. Keep a Trading Journal

A trading journal is a valuable tool. Record all your trades. Note entry and exit points. Include your reasoning and emotions. Review your journal regularly. Identify patterns and mistakes. Learn from them. A journal helps track progress. It provides insights into your trading behavior.

Use it to refine your strategy. A trading journal fosters discipline. It’s a useful tool for self-improvement. Detailed records help in identifying trends. They also show areas for improvement. A trading journal is a trader’s best friend. Keep it updated.

9. Take Breaks

Taking breaks is important. Trading can be stressful. Regular breaks help maintain focus. Step away from your screen. Take a walk or do some exercise. This refreshes your mind. Avoid trading when tired. Fatigue can impair judgment. Breaks prevent burnout. They help you stay sharp.

Balance trading with other activities. This keeps you mentally healthy. Taking breaks improves performance. It reduces stress. Regular breaks are essential for sustained success. They help maintain a healthy work-life balance. Remember to take breaks regularly.

10. Seek Support

Having support is beneficial. Join a trading community. Share experiences and tips. Learn from others. Consider finding a mentor. A mentor provides guidance. They offer valuable insights. Support helps you stay motivated. It reduces feelings of isolation. Trading can be lonely.

Connecting with others is encouraging. Seek emotional support if needed. Mental health is important. Don’t hesitate to ask for help. Support networks provide accountability. They also offer new perspectives. Having a support system is crucial. It enhances your trading journey.

11. Using AI Trading Bots

AI trading bots can enhance your trading strategy. They analyze market data quickly and execute trades based on pre-defined criteria. This reduces emotional decision-making. Consider using the Vestinda trading app, which offers automated crypto trading strategies. This app allows you to eliminate emotional trading, providing a more structured approach.

With Vestinda, you can set specific parameters and let the bot handle the execution, freeing you to focus on strategy. Select reliable bots with good reviews and ensure they align with your trading goals. Regularly monitor their performance, as AI bots can provide valuable insights. They offer a different perspective on market trends, improving your trading efficiency.

Read More: Futures Trading Psychology: A Comprehensive Guide

Final Thoughts

Trading psychology is vital for long-term success in the financial markets. Understanding your emotional triggers can improve your decision-making. Addressing issues like FOMO, overconfidence, and loss aversion can improve your trading strategy. Consistent self-reflection and education will help you grow as a trader.

Tools from our On Tilt Trading Store can help your trading journey. These resources can provide essential guidance in managing risks and emotions. Additionally, remember that trading is a continuous learning process. Adapt your strategies based on market changes and personal growth. Stay patient and disciplined, focusing on your trading plan.

Ultimately, achieving success in trading requires a balanced approach. Acknowledge your emotions while following a clear strategy to navigate the markets. Embrace the journey, and keep striving for improvement.