The cryptocurrency market offers traders unique opportunities to profit from digital assets. Traders are exploring different ways to maximize their returns on the crypto market. Two of the most popular trading instruments are crypto futures and options, each offering distinct advantages and challenges. So, what are the differences between crypto futures vs options?

Traders who want to succeed in the volatile cryptocurrency market need to know the difference between crypto futures and options. In this article, we will examine how these trading instruments work, compare their key features, and discuss how they can be used effectively.

What are Crypto Futures?

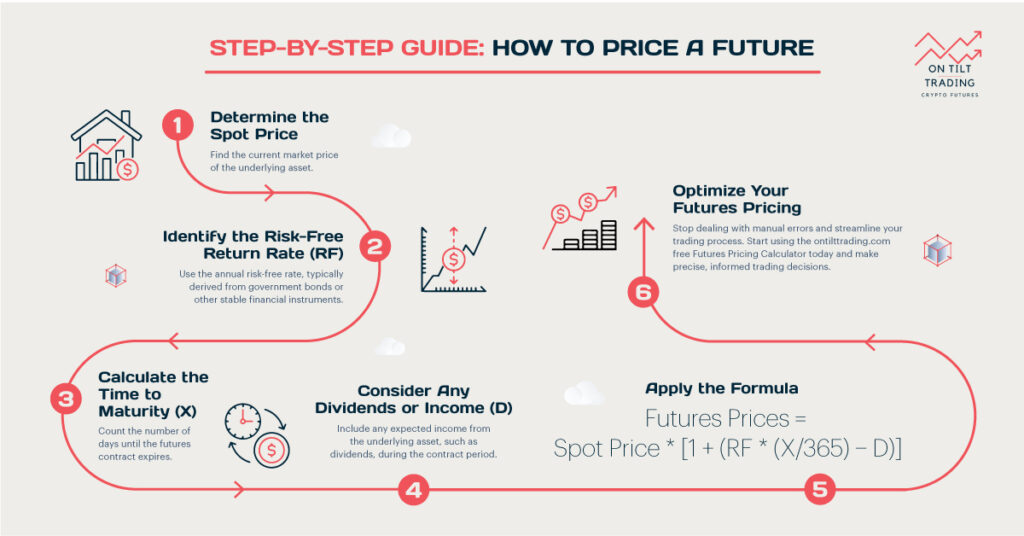

Crypto futures are financial contracts that bind the buyer to buy or the seller to sell an asset at a specified price and date. Unlike spot trading, where transactions happen right away, futures contracts set terms for future transactions. As a result, traders can speculate on future cryptocurrency price movements and potentially profit both up and down.

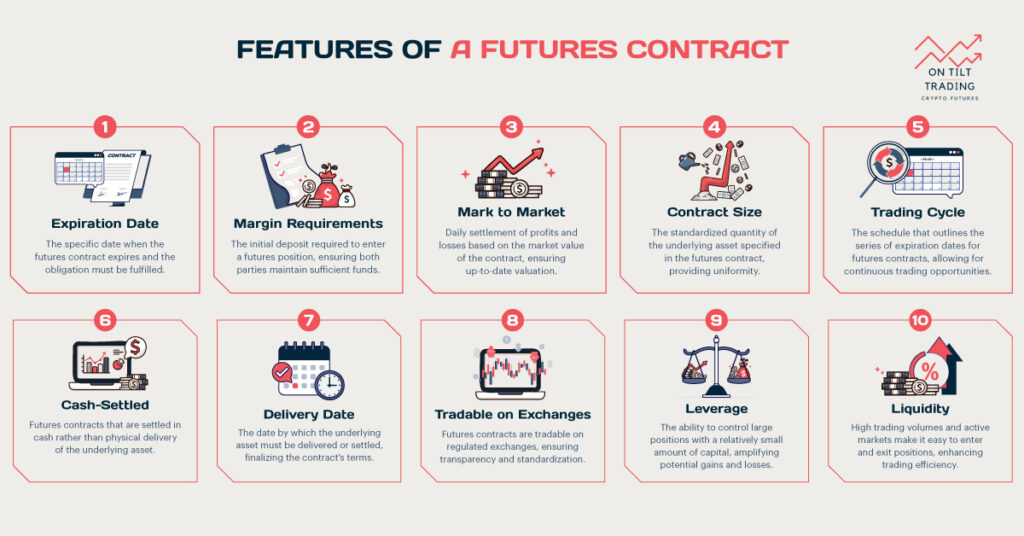

Crypto futures work in a relatively straightforward manner. Contracts specify the amount of cryptocurrency and the price at which a transaction will take place on a future date. The contracts are standardized and traded on exchanges, so they’re accessible and liquid.

A key feature of crypto futures is leverage, which allows traders to open positions much bigger than they invested. For instance, with leverage of 10x, a trader can control $10,000 worth of cryptocurrency with only $1,000.

Several popular platforms offer crypto futures trading, and they provide a range of tools and features to enhance your trading experience.

What are Crypto Options?

Crypto options are financial derivatives that give traders the right, but not the obligation, to buy or sell a specific amount of cryptocurrency at a predetermined price before a specified expiration date. With options, you can hedge your positions, speculate on price movements, and leverage your investments.

Crypto options come in two main types: call options and put options. A call option gives the holder the right to buy a cryptocurrency at a specific price (strike price) before the option expires, while a put option allows them to sell the cryptocurrency at the strike price.

The cost of purchasing an option is known as the premium. The premium represents the maximum loss the options buyer can suffer, while the potential profit can be substantial.

Crypto options trading can be complex due to the various strategies traders can employ. For example, traders may use covered call strategies to generate income by holding cryptocurrency and selling call options.

Alternatively, they may use protective puts to protect their cryptocurrency holdings from potential losses. When traders understand how options work and employ the right strategies, they can better manage risk and optimize returns.

Crypto Futures vs Options: Key Differences

| Aspect | Crypto Futures | Crypto Options |

| Contract Structure | Standardized contracts with specific terms | Flexible contracts with customizable strike prices and expiration dates |

| Leverage and Margin | High leverage, controlling large positions with small investments | Leverage through premiums, controlling large positions at a fraction of the cost |

| Risk and Reward Profiles | High risk due to leverage; potential for significant gains or losses | Defined risk limited to premium paid; potential for high rewards |

| Expiration Dates and Settlement | Obligated to fulfill contract terms at expiration (cash or physical settlement) | Right, but not obligation, to buy/sell before expiration (no obligation to settle) |

| Flexibility and Strategy | Primarily directional bets (long/short positions) | Wide range of strategies (e.g., calls, puts, spreads, straddles) |

| Market Complexity | Simpler to understand and execute | More complex, requiring deeper understanding of strategies and pricing |

| Risk Management | Higher potential for margin calls and liquidations | Lower upfront capital risk, allowing for better-defined risk management |

Knowing the key differences between crypto futures and options is essential when choosing between them. Each offers unique features and benefits for different trading styles and risk appetites.

Contract Structure

Standardized crypto futures include specific terms, such as asset, quantity, and expiration date. The contracts are traded on exchanges, ensuring liquidity and ease of entry and exit.

Comparatively, crypto options offer more flexibility, allowing traders to customize contracts more, like picking the strike price and expiration date. As a result, options are great for more customized trading strategies.

Leverage and Margin

Leverage is one of the most significant differences between futures and options. Trading futures contracts typically offer high leverage, which allows traders to control large positions with relatively small investments. It can both increase profits and losses.

Similarly, options provide leverage, but differently; a small premium can control a large position for less than the cost of a large position. However, the leverage in options is not as straightforward and requires a deeper understanding of how options pricing works.

Risk and Reward Profiles

Due to leverage, futures trading involves a high level of risk. A small market movement can result in significant gains or losses. Furthermore, futures traders are required to fulfill contract terms at expiration, resulting in substantial financial commitments.

Alternatively, options trading allows a defined risk based on the premium paid. It provides traders with a safety net, as they can only lose the amount invested, while the potential reward can be pretty high.

Expiration Dates and Settlement

The settlement process for futures and options differs, but the expiration dates are identical. Futures contracts are typically settled in cash or physical delivery of the asset at expiration.

Option holders, however, can buy or sell the asset before expiration, but they are not obligated to do so. With this distinction, options traders have more flexibility, especially as the expiration date approaches.

Flexibility and Strategy

Crypto options offer a broader range of strategies compared to futures. Traders can combine calls and puts to create complex strategies that can profit from different market conditions. For example, straddles and strangles can take advantage of high volatility, while spreads can limit risk and reward. Trading futures is more straightforward, with strategies based on directional bets, either going long (buying) or short (selling) based on expected market movements.

These key differences help traders choose the right instrument for their trading goals and risk tolerance. Knowing when to use futures and options can enhance a trader’s ability to navigate the dynamic cryptocurrency market.

Choosing the Right Instrument for Your Trading Style

Choosing between crypto futures vs options depends on several factors, including your trading goals, risk tolerance, market outlook, and experience. You should consider these factors when choosing the right instrument for your trading style:

Risk Tolerance

You should consider your risk tolerance when choosing between crypto futures vs options. Futures trading may be a good choice for you if you’re comfortable with the potential for significant gains and losses.

Futures contracts have the advantage of high leverage, so traders can take on big positions with a smaller investment. Leverage can amplify both profits and losses, which can be advantageous to high-stakes traders.

Alternatively, if you want more defined risk and substantial rewards, options trading might be the way to go. Options have a maximum loss limit that can protect your capital from unexpected market swings.

Market Outlook

Choosing the right trading instrument also depends on your outlook on the market. You can benefit from futures if you have a strong directional view of the market. For example, if you anticipate a clear upward or downward trend in cryptocurrency prices, futures allow you to take a straightforward long or short position. This direct approach can be practical for traders looking to capitalize on short-term price movements.

In contrast, options offer greater versatility and can be used in a variety of market conditions, such as sideways or volatile markets. Options are suitable for a broader range of market views since straddles, strangles, and spreads allow traders to profit from different scenarios, not just price direction.

Investment Goals

Your investment goals will significantly influence your choice between futures vs options. If you’re looking for short-term gains through leveraged positions, futures may be for you. Futures are great for day trading and short-term speculation because they can be entered and exited quickly.

However, if you want a balanced approach with both short-term and long-term strategies, options might be better. In addition to hedging existing positions, options can also generate income through premiums and execute complex strategies that reflect specific investment goals. Making informed trading decisions requires understanding how each instrument aligns with your goals.

Experience Level

Trading experience is another essential factor to consider. Futures trading is relatively straightforward, so traders with a basic understanding of leverage and margin can do it. However, futures trading has high risk and requires a solid understanding of market movements and risk management.

Comparatively, options trading requires a deeper understanding of various strategies, pricing models, and factors like volatility and time decay. Due to their complexity, options are generally better suited to experienced traders who can navigate the intricacies of pricing and strategy implementation.

Conclusion

That’s all from today’s roundup on crypto futures vs. options. Each instrument has unique advantages that cater to different trading styles and risk appetites. If you carefully consider your goals, experience, and market outlook, you can select the right trading strategy.