Cryptocurrency trading is a fast-paced world that demands accuracy and efficiency. Traders need specialized tools to make informed decisions, and calculator apps have become an essential part of that toolkit. Having the right calculator can make a significant difference in your trading success, whether you’re trading futures or spots. In this blog post, we’ll delve into the differences between crypto futures vs spot calculator app. We’ll discuss their functionality, benefits, and how they help traders maximize profits while minimizing risk. This guide will help you determine which calculator app is right for you. Let’s dive in.

What is Crypto Futures Trading?

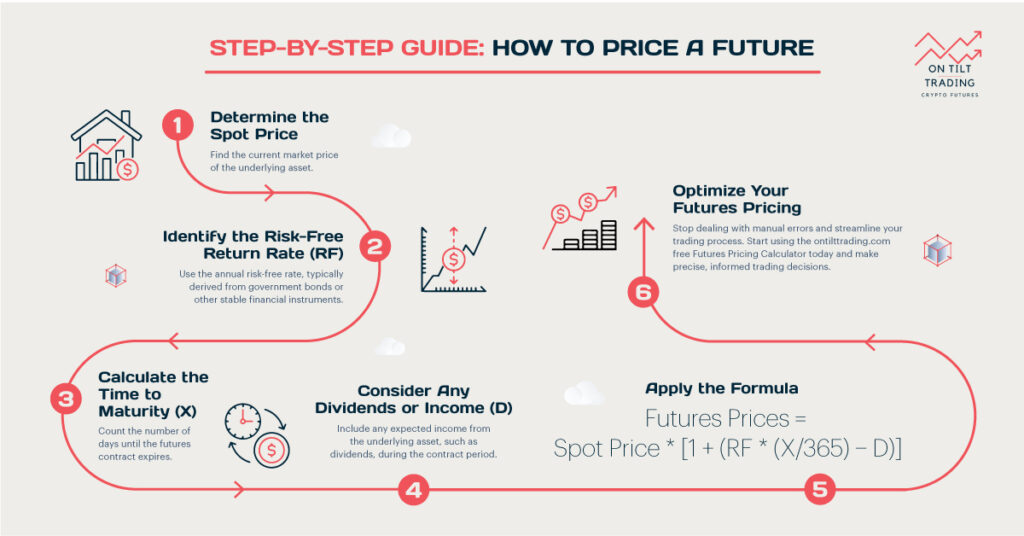

Crypto futures trading involves agreements to buy or sell a specific amount of cryptocurrency at a predetermined price at a future date. In contrast to spot trading, where assets are traded right away, futures contracts allow traders to speculate on cryptocurrency prices.

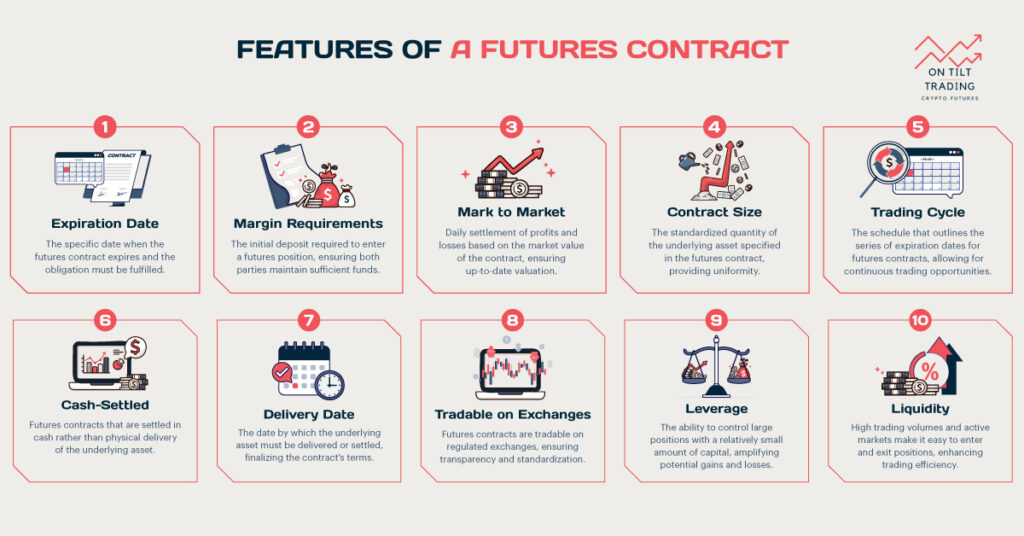

With this type of trading, traders can control larger amounts of cryptocurrency with a smaller initial investment. Leverage, margin requirements, and the potential for high profits and losses are all key features of crypto futures trading.

What is Crypto Spot Trading?

Crypto spot trading involves buying and selling cryptocurrencies for immediate delivery. Spot trading is simple, with the transaction settled “on the spot.”

It is excellent for traders who like simplicity and immediate ownership. In contrast to futures trading, spot trading doesn’t require leverage or margin, making it a less risky option for beginners.

Features of a Crypto Futures Calculator App

A crypto futures calculator app helps traders manage their futures trades more efficiently. Users can calculate potential profits and losses, manage leverage and margin requirements, and determine entry and exit points. With these apps, traders can make informed decisions, minimizing the risk of unexpected losses.

Leverage Adjustment

One of the most critical features of a crypto futures calculator app is the ability to adjust leverage settings. Leverage allows traders to control a larger position with a smaller initial investment, amplifying both potential profits and losses. The leverage makes it easier for traders to see how different levels impact their potential returns and risks.

This feature helps traders plan trades and avoid taking on more risk than they can handle. As a result, they can make more informed decisions based on knowing how leverage impacts their margin requirements and potential outcomes.

Margin Calculation

Margin calculation is another essential feature of a futures calculator app. It calculates the margin needed to open and maintain a futures position so traders have enough money to cover their trades. Calculating margins correctly can prevent margin calls and position liquidation.

This feature gives traders peace of mind, as they know that they are meeting the necessary financial requirements. A better understanding of margin requirements helps traders plan their strategies more effectively.

PnL (Profit and Loss) Estimates

A good futures calculator app will provide clear and precise PnL calculations based on various market scenarios for traders. Traders can use this feature to set realistic profit targets and stop-loss levels for their trades.

They can also assess the viability of their strategies with the app’s PnL estimates and make adjustments as necessary. This is essential for effective risk management and to maximize returns.

Break-even Point Calculation

A crypto futures calculator app can calculate the break-even point for any trader. Break-even is the price at which a trade becomes profitable, covering all associated costs and fees. Traders who understand their break-even point can manage their risk more effectively.

With this feature, traders can determine the price movement they need to cover their expenses and start making money. The tool helps traders plan trades and ensure they’re not taking on too much risk.

Benefits of Using a Futures Calculator App

- Precision in Trade Planning: Futures calculator apps provide precise calculations, helping traders plan their trades more effectively and avoid costly mistakes.

- Risk Management: By calculating potential profits and losses, traders can better manage their risk and make more informed decisions about when to enter or exit a trade.

- Time-Saving for Traders: Traders can use the app to quickly calculate leverage, margin, and PnL instead of calculating them manually.

Features of a Crypto Spot Calculator App

The crypto spot calculator app simplifies calculating trade costs, potential profits, and losses in spot trading. Unlike futures trading, spot trading involves exchanging cryptocurrencies immediately.

Traders use spot calculator apps to make informed decisions with precise calculations. Cryptocurrency spot market traders need these apps to understand the financial implications of their trades.

Fee Calculation

One key feature of a crypto spot calculator app is fee calculation. Crypto exchanges charge fees for every trade, which can significantly impact profitability. With the fee calculation feature, traders can see exactly what their fees will be before they trade.

In this way, traders can keep track of all their costs, ensuring they know how much they’re making or losing. Planning and executing trades efficiently requires understanding these fees.

PnL (Profit and Loss) Estimates

Similarly to futures calculators, spot calculator apps provide accurate profit and loss estimates. The feature allows traders to put in their buy and sell prices and trade volume to see potential gains or losses. Having a precise PnL estimate helps traders set realistic profit targets.

They can also evaluate potential outcomes of different trading scenarios, which is essential for risk management. These features help traders make better decisions and optimize their trading strategies.

Currency Conversion

Spot trading involves trading between different cryptos and fiat currencies. Traders can convert currencies seamlessly with a good spot calculator app that includes a currency conversion feature.

Traders can use this feature to understand the value of their trades in different currencies, which is especially helpful on international exchanges. The app makes sure traders have the most accurate and up-to-date information by providing real-time conversion rates.

Benefits of Using a Spot Calculator App

- Simplifies Trading Decisions: Provides accurate calculations of trade costs, potential profits, and losses, saving time and reducing the risk of errors.

- Helps in Understanding Market Movements: Offers real-time data on trade values, fees, and potential outcomes, allowing traders to react promptly to market changes.

- Assists in Accurate Financial Planning: Makes it easier for traders to set realistic financial goals and limits by calculating fees, potential profits, and losses.

- Saves Time for Traders: Instead of manually calculating trade details, traders can quickly obtain the necessary information, allowing them to focus on their trading strategies.

Crypto Futures vs Spot Calculator App: Key Differences

A calculator app can have a big impact on your trading strategy and success in cryptocurrencies. Both crypto futures calculators and spot calculators aid traders in making informed decisions, but their functionality, ease of use, and calculations differ. Selecting the right tool based on your trading style and objectives requires understanding these distinctions.

Functionality and Use Cases

Crypto futures calculator apps are different from spot calculator apps in terms of functionality and use cases. A futures calculator app allows traders to calculate leverage, margin requirements, potential profits, and losses based on future price movements. The apps are perfect for more advanced traders who want to leverage leverage and speculate on the market.

On the other hand, spot calculator apps cater to traders involved in immediate transactions. It helps calculate trade costs, fees, and potential profits and losses based on the current market price. Traders who don’t want to deal with leverage or novice traders often use spot calculators. Knowing these differences helps traders pick the right tool for their trading style.

Ease of Use and Accessibility

Ease of use is another critical factor when comparing these two types of calculator apps. Crypto spot calculator apps usually have a simple interface, making them accessible to beginners and casual traders. Its intuitive design allows users to enter trade details quickly and receive results immediately, with no technical jargon.

In contrast, futures calculator apps may require a deeper understanding of trading principles due to the complexities of these contracts and leverage. While many future calculators are user-friendly, some have advanced features that can be overwhelming for beginners. However, experienced traders may find the additional features helpful for managing more complex strategies.

Accuracy and Reliability

Crypto futures calculator apps and spot calculator apps prioritize accuracy and reliability, but their calculations can vary. Depending on future market conditions, futures calculators have to calculate leverage, margin, and possible profits or losses. Traders rely on these calculations to make informed decisions and manage their risk effectively.

While spot calculator apps also focus on accuracy, they’re mainly about immediate transactions. They provide real-time data on fees and trade values, which is essential for understanding the net profit or loss of a trade. Both apps are crucial for successful trading, but futures traders need accurate calculations since mistakes can have significant financial repercussions. Consequently, a futures calculator can be helpful if you plan to use leverage in your trades, calculate margins, or assess potential profits.

Read More: Crypto Futures vs Spot Calculator: A Complete Guide

Conclusion

Understanding how crypto futures calculators and spot calculators work is crucial for traders who want to improve their trading strategies. Depending on your trading style, each app will offer a unique set of features and benefits. With these tools, you can maximize your trading potential by making informed decisions.