Cryptocurrencies have revolutionized the financial world and opened up new opportunities for investment and trading. One of these innovations is crypto futures, which allow traders to speculate on future price movements of digital assets. Germany, a leading participant in the European crypto market, has embraced this trend with a robust regulatory framework.

In this comprehensive guide, we’ll walk you through the intricacies of crypto futures in Germany, from legal considerations to the major trading platforms to tax implications. If you’re a seasoned trader or a newcomer to crypto futures, this article will provide valuable insights to help you navigate the market. Let’s dive in.

What are Crypto Futures?

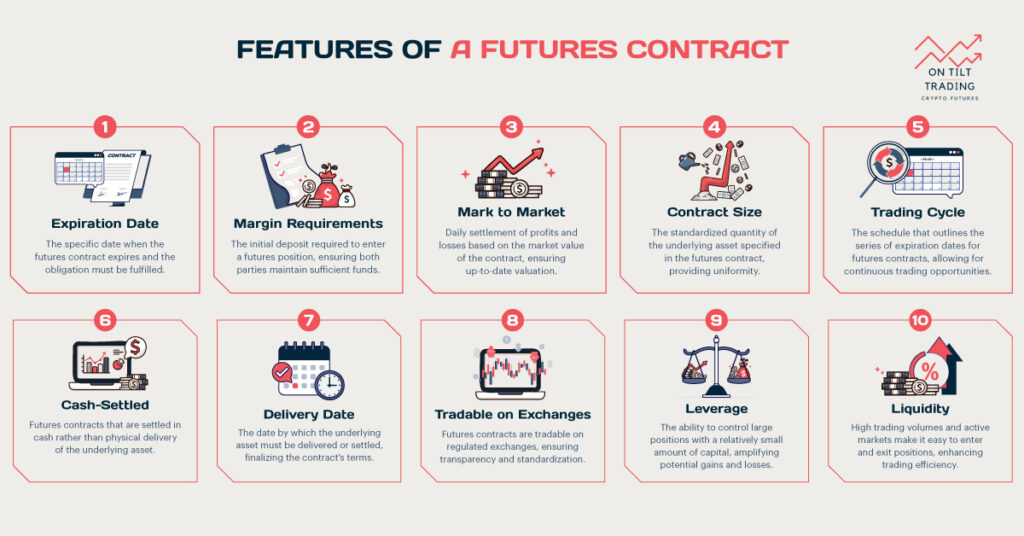

Crypto futures are financial contracts that require buyers and sellers to buy or sell a certain amount of cryptocurrency at a predetermined price. With these contracts, traders can make money in both rising and falling markets by betting on cryptocurrencies’ price movements.

Crypto futures provide liquidity and allow traders to leverage their positions, which will enable them to control large positions with relatively small capital. However, this leverage also introduces higher risks, as both gains and losses are magnified. Many crypto futures are settled in the underlying cryptocurrency, creating an additional level of complexity.

Crypto futures have grown in popularity in Germany due to the country’s progressive stance on digital assets and robust financial infrastructure. Anyone looking to trade crypto futures effectively needs to know how they work and the risks.

The Legal Landscape of Crypto Futures in Germany

Due to Germany’s progressive approach to cryptocurrency regulation, crypto traders and investors enjoy a safe, transparent, and secure environment. Germany’s Federal Financial Supervisory Authority (BaFin) regulates the crypto market, including crypto futures.

BaFin classifies cryptocurrencies as financial instruments and requires trading platforms and brokers to get licenses. It enables platforms to offer crypto futures and requires them to adhere to stringent standards, making trading safer for traders.

In addition, BaFin’s regulations allow platforms to implement anti-money laundering (AML) and know-your-customer (KYC) procedures, giving traders an extra layer of protection.

Individual traders need to understand and follow these regulations.

Engaging with licensed platforms not only ensures legal compliance but also enhances the security of their trading activities. As the market evolves, anyone who trades crypto futures in Germany needs to stay on top of regulatory changes.

Best Platforms for Trading Crypto Futures in Germany

Crypto futures are available on several popular platforms within Germany’s robust financial scene. These platforms offer different features, fees, and trading options, catering to both beginners and experienced traders alike. Some of them are:

1. Prime XBT

The Prime XBT trading platform is known for its robust trading options for futures trading in cryptocurrencies. Advanced trading tools, including charting and risk management, distinguish it from its competitors. Both beginners and experienced traders love Prime XBT because of its competitive fees and ability to leverage across different cryptocurrencies.

2. Bybit

Bybit is known for its user-friendly interface and competitive trading fees. It offers futures contracts with leverage options for significant cryptocurrencies such as Bitcoin and Ethereum. Traders looking for efficient execution and risk management will like Bybit’s advanced order types and liquid trading environment.

3. Bitvavo

Bitvavo offers a straightforward trading platform for cryptocurrency, including futures in Germany. Its low trading fees and wide range of supported cryptocurrencies make it accessible to traders at all levels. The Bitvavo platform provides a reliable trading environment within the European market by emphasizing security and regulatory compliance.

4. BitMEX

BitMEX has become a pioneer in cryptocurrency derivatives trading, offering high leverage options and perpetual contracts. It has a liquid Bitcoin futures market and advanced trading features like customizable leverage and options. BitMEX caters mainly to experienced traders looking for advanced trading tools.

5. Kraken

Kraken’s regulatory compliance and security measures are among the best in the industry. It offers futures trading for several major cryptocurrencies with competitive fees and robust customer support. Kraken’s educational resources and trading analytics help traders make informed decisions on the crypto futures market.

6. Deribit

Deribit offers Bitcoin and Ethereum options and futures trading with deep liquidity pools and competitive fees. It offers advanced trading features such as portfolio margining and a variety of order types. Its options and futures trading expertise within the cryptocurrency space make it a favorite among traders.

Tax Implications of Crypto Futures Trading in Germany

It is crucial to understand the tax implications of trading crypto futures in Germany for compliance and financial planning. The German tax system has specific rules and regulations regarding cryptocurrency transactions, including trading in futures. Here’s an overview of the critical tax considerations:

Taxable Events

In Germany, the taxation of crypto futures trading is centered around the concept of taxable events. Profits derived from trading crypto futures contracts are subject to taxation as capital gains. Therefore, any gains you make from selling crypto futures contracts are taxable.

Conversely, any losses can be used to offset gains within the same tax year, reducing your overall tax bill. Thus, maintaining accurate and detailed records of all transactions is crucial for reporting gains and losses.

Tax Rates

The tax rate on crypto futures trading profits in Germany depends on how long you held the positions. If you hold a futures position for less than a year, the gains are taxed at your personal income tax rate, which can be up to 45%, plus a solidarity surcharge. Alternatively, if you hold a position for more than a year, your gains might be tax-free.

It only applies to direct cryptocurrency holdings, not futures contracts, since futures tend to be short-term. It’s essential to understand these distinctions if you want to do your taxes right.

Reporting Requirements

Keeping accurate records is essential to complying with Germany’s crypto futures reporting requirements. Keep detailed records of all your trading activities, including the dates, amounts, types, and prices.

When you’re preparing your tax return, this information is crucial. When you report your trading activities, make sure you use the proper forms and provide all the documentation you need. In addition to ensuring compliance, appropriate record-keeping helps you save money.

Professional Trading

If your crypto futures trading activity is substantial or if you trade a lot, it may be considered business income. Different tax rates and regulations may apply, such as registering as a business and paying trade tax.

To stay in compliance with your tax obligations, it’s crucial to understand the criteria for professional trading. You can find out if your trading activities fall into this category by consulting a tax pro.

Tax Advisors

Due to the complexity of cryptocurrency taxation, especially when it comes to futures trading, you should consult a tax advisor. Tax professionals can provide personalized advice, ensure compliance with all relevant tax laws, and guide you through crypto taxation. In addition to optimizing your tax strategy, tax advisors can ensure accurate reporting and reduce your overall tax burden.

Advantages and Disadvantages of Trading Crypto Futures in Germany

Traders should carefully consider the advantages and challenges of trading crypto futures. Here’s an overview of the key advantages and disadvantages:

Advantages of Trading Crypto Futures

High Leverage Opportunities

Traders can leverage crypto futures to control larger positions with minimal capital, significantly amplifying potential profits. This option is attractive to experienced traders capable of managing the associated risks.

Hedging Against Price Volatility

A futures contract provides a hedge against cryptocurrency price volatility, stabilizing portfolios and protecting investments from adverse movements.

Access to a Variety of Trading Strategies

In crypto futures trading, traders can go long or short on various cryptocurrencies, profiting from rising and falling markets.

Enhanced Market Liquidity

Crypto futures trading boosts market liquidity, resulting in tighter spreads and better trade execution, benefitting all participants.

Round-the-Clock Trading

Cryptocurrency traders can take advantage of continuous price movements on the market, which is open 24/7.

Disadvantages of Trading Crypto Futures

High Risk of Losses

Leverage can increase profits, but it can also increase losses. Traders must manage their risk effectively if the market moves against their positions.

Complex Market Dynamics

The trading of crypto futures involves complex market dynamics, which require a deep understanding of technical analysis and market trends. Traders who are unfamiliar with these complexities may find them challenging.

Regulatory Uncertainty

Regulations governing cryptocurrency trading have the potential to affect market practices. Traders must follow the rules to avoid legal repercussions.

Potential for Market Manipulation

Trading cryptocurrency can be risky due to manipulation, including price manipulation and pump-and-dump schemes.

Technological Risks

There are risks associated with trading platforms, such as cyberattacks and system failures. It can disrupt trading activities and result in financial losses, making platform security crucial.

Emotional Stress

The fast pace and high volatility of crypto futures trading can be emotionally draining. Success in trading depends on maintaining emotional discipline as well as adhering to a well-defined trading plan.

Read our comprehensive guide on Crypto Futures France to learn more about the crypto futures landscape in France.

Conclusion

Crypto futures trading in Germany offers significant opportunities but also considerable risks. Navigating this complex landscape is easier if you understand market dynamics, use advanced tools, and stay on top of regulations.