Financial markets are intricate, with various instruments influencing each other. Among these, the relationship between futures and spot prices stands out as a critical area of interest for traders. You can make better trading decisions and strategies if you understand this correlation. Therefore, in this blog, we will explore the correlation between futures and spot prices. Toward the end, you’ll have a better idea of how these markets work and how to leverage them.

What are Futures Contracts?

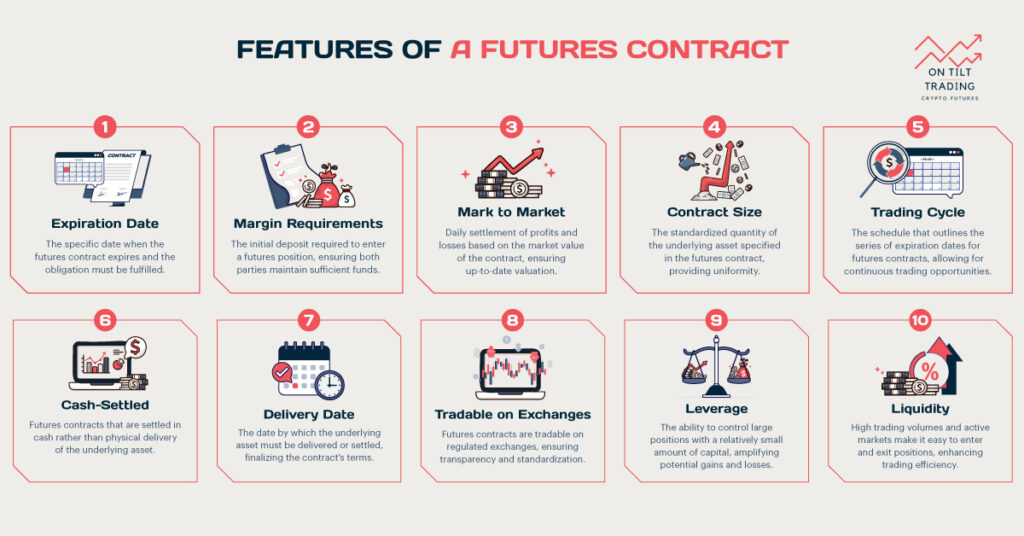

Futures contracts are agreements to buy or sell assets at a future date. The price is fixed at the time of the agreement. These contracts are standardized and traded on exchanges. They are commonly used in commodities and financial markets.

For example, oil, gold, and stock indices have active futures markets. Futures help hedge against price fluctuations and allow for speculation.

What are Spot Prices?

Spot prices are the current market prices for immediate delivery of assets. They reflect real-time supply and demand in the market and are crucial for determining an asset’s current market value.

Unlike futures prices, spot prices are settled on the spot, hence the name. For instance, the spot price of gold is what you would pay to buy gold immediately. Spot prices can fluctuate rapidly based on market conditions.

What is the Correlation Between Futures and Spot Prices

The cost-of-carry model explains the correlation between futures and spot prices. It includes costs like storage, insurance, and interest, which influence futures prices. The expectations hypothesis suggests that futures prices reflect expected future spot prices. Both theories help explain the relationship between futures and spot prices.

Contango and Backwardation

Contango occurs when futures prices are higher than spot prices. This usually happens when there are storage costs or high demand for future delivery. Backwardation occurs when futures prices are lower than spot prices.

It can happen when there is a high demand for immediate delivery or anticipated shortages. Supply, demand, and storage costs influence these conditions.

Basis and Convergence

The basis is the difference between the futures price and the spot price. A narrowing basis indicates convergence, meaning futures prices and spot prices are moving closer together. This typically happens as the futures contract approaches its expiration date.

A widening basis indicates divergence, meaning the prices are moving apart. Basis helps traders identify arbitrage opportunities and market trends.

Arbitrage Opportunities

Arbitrage involves buying and selling to profit from price differences between markets. In futures and spot markets, traders exploit changes in basis to make a profit. Arbitrage helps align futures and spot prices, maintaining market efficiency.

When arbitrageurs buy the lower-priced asset and sell the higher-priced one, they help bring prices closer together. This activity contributes to the correlation between futures and spot prices.

Statistical Correlation Between Futures and Spot Prices

Statistical measures are essential for quantifying the relationship between futures and spot prices. The correlation coefficient is a crucial metric that ranges from -1 to +1. A coefficient close to +1 indicates a strong positive correlation, meaning prices move together.

Conversely, a coefficient close to -1 indicates a strong negative correlation, where prices move in opposite directions. A coefficient around 0 suggests little to no correlation.

Historical Data Analysis

Analyzing historical data provides valuable insights into the correlation between futures and spot prices. By examining past price movements, traders can identify trends and patterns.

For example, studying the correlation during specific market conditions can reveal how prices react to various factors. Case studies in markets like oil and gold demonstrate how correlation can fluctuate based on supply, demand, and external events.

Regression Analysis

Regression analysis is another powerful tool for examining the relationship between futures and spot prices. This statistical method allows for a more detailed understanding of how one variable influences another.

By analyzing historical price data, traders can develop models that predict future price movements. These models help identify potential trading opportunities based on historical correlations.

Practical Applications of Statistical Correlation

Understanding the statistical correlation between futures and spot prices has practical applications for traders and investors. This knowledge can inform trading strategies, helping to decide when to enter or exit positions.

Additionally, it aids in risk management by highlighting periods of high volatility or stability. Overall, leveraging statistical analysis enhances decision-making and improves trading outcomes.

Factors Influencing Futures and Spot Prices

Several key factors influence the relationship between futures and spot prices. Understanding these influences is essential for traders seeking to navigate the markets effectively. Market sentiment, interest rates, and supply and demand dynamics all play a role in price movement.

Supply and Demand Dynamics

Supply and demand directly impact both futures and spot prices. When demand increases, spot prices rise due to immediate market needs. Conversely, an increase in supply leads to lower spot prices.

Futures prices are also influenced by expected future supply and demand. For example, a predicted shortage may drive up future prices. Conversely, the anticipated surplus may lower futures prices.

Interest Rates and Storage Costs

Interest rates and storage costs play crucial roles in determining futures prices. Higher interest rates increase the cost of carrying futures contracts because borrowing costs are higher.

Similarly, storage costs affect commodities like oil and grain. Higher storage costs lead to higher futures prices. These factors are part of the cost-of-carry model, which explains the pricing relationship.

Market Sentiment and Speculation

Market sentiment and speculation significantly influence futures and spot prices. Traders’ expectations about future market conditions can drive price movements, and positive sentiment can lead to higher prices.

Negative sentiment can lead to lower prices. Speculators buy and sell futures contracts based on their market predictions. Their activities add liquidity and volatility to the market, impacting prices.

External Factors and Events

External factors such as geopolitical events, natural disasters, and economic policies can impact futures and spot prices. Political instability in oil-producing regions, for example, can drive up oil prices.

Natural disasters can disrupt supply chains, affecting commodity prices. Economic policies, such as tariffs or subsidies, can also influence market prices. These external factors can cause sudden and significant price movements.

Seasonal and Cyclical Trends

Seasonal and cyclical trends also affect futures and spot prices. Certain commodities have seasonal demand patterns. For example, agricultural products may have higher prices during planting or harvest seasons.

Energy prices often rise in winter due to higher heating demand. Cyclical trends, such as business cycles, can impact prices across various markets. Understanding these patterns helps traders anticipate price movements.

These factors can help traders and investors understand futures and spot prices. The knowledge helps develop effective trading strategies and manage risk.

Practical Applications of Correlation in Futures and Spot Prices

The correlation between futures and spot prices has significant implications for traders and investors alike. Having a better understanding of this relationship can enhance decision-making and improve trading strategies. Using insights from this correlation, market participants can manage risk, optimize investment approaches, and navigate market changes.

Hedging Strategies

Understanding the correlation between futures and spot prices is crucial for developing effective hedging strategies. Businesses often use futures contracts to protect against price fluctuations in the commodities they deal with.

For example, a farmer might lock in prices for their crops using futures contracts, ensuring stable revenue regardless of market changes. By recognizing how futures prices relate to spot prices, companies can make more informed hedging decisions, minimizing potential losses.

Investment Strategies

Understanding this correlation can also benefit investors when crafting their investment strategies. Futures can serve as a tool for diversifying portfolios and managing risk effectively. For instance, an investor anticipating rising spot prices may choose to buy futures contracts to capitalize on potential gains.

Conversely, if they expect spot prices to drop, they might sell futures to hedge against losses. This strategic use of futures can enhance overall investment performance and improve returns.

Speculation and Trading Decisions

Traders who grasp the relationship between futures and spot prices can make more informed trading decisions. Speculators often buy or sell futures based on their expectations of future spot prices.

By analyzing the correlation, traders can identify potential entry and exit points for their positions, maximizing profits. Additionally, recognizing market trends allows traders to adjust their strategies in response to changing conditions, increasing their chances of success.

Impact on Market Efficiency

The correlation between futures and spot prices contributes to market efficiency. When traders exploit price differences through arbitrage, they help align futures prices with spot prices. This activity ensures that prices reflect the actual value of the underlying assets.

The better you understand this correlation, the more efficient and transparent markets become. These insights can help traders, investors, and businesses navigate the market better.

Challenges and Limitations

Understanding the correlation between futures and spot prices presents many challenges and limitations. External factors, such as geopolitical events and market volatility, can disrupt established relationships. Additionally, statistical models might oversimplify complex market behavior, making predictions less accurate.

External Factors Influencing Correlation

Futures and spot prices exhibit a strong correlation, but understanding it involves several challenges. External factors, such as geopolitical events, can significantly impact market prices.

For example, political instability in a major oil-producing country can cause sudden price spikes.

Trade agreements or tariffs can also disrupt established correlations between futures and spot prices. These influences complicate predictions based solely on historical data.

Market Volatility

Market volatility presents another limitation when analyzing futures and spot prices. Rapid price fluctuations can obscure the proper relationship between these two markets. When prices change quickly, it becomes difficult to assess the strength of their correlation.

This volatility can lead to misleading signals for traders, making it harder to implement effective strategies. As a result, traders must be cautious and adaptable in volatile market conditions.

Changing Correlations Over Time

The correlation between futures and spot prices can change over time due to various factors. Shifting market dynamics, including changes in supply and demand, significantly affect this relationship.

Seasonal variations also influence how these prices interact; for instance, agricultural commodities may experience different correlations during harvest season. Consequently, historical data may not always accurately predict future correlations, requiring traders to constantly reassess them.

Reliance on Statistical Models

Relying heavily on statistical models can introduce significant drawbacks. While these models provide valuable insights, they may oversimplify complex market behaviors. For instance, they might not account for sudden market shocks or unexpected events.

If not used with caution, this oversimplification can lead to inaccurate forecasts. Traders should combine statistical analysis with a broader market understanding for better decision-making.

Read More: When To Buy Or Sell Futures

The Takeaway

To sum up, traders and investors need to understand the correlation between futures and spot prices. This relationship significantly influences trading strategies and investment decisions. Various factors, such as market volatility and external events, can impact this correlation.

Statistical analysis provides valuable insights but has limitations that traders must consider. By recognizing challenges and adapting strategies, traders can navigate complex market dynamics more effectively.

Ultimately, staying informed and continuously analyzing market conditions will empower traders to succeed. Keeping up with futures and spot price relationships is crucial in today’s volatile markets. Adopting these insights will improve trading and financial results.