To succeed in the markets, you must understand trading psychology. Technical analysis and market knowledge are essential. But, the mental side of trading can have a significant impact on your results. Mastering your emotions and mindset can be the key to consistent profitability. In this article, we will delve into trading psychology meaning. We will examine its impact on trading. Then, we will share strategies to manage your emotions. By the end, you’ll have a deeper understanding of how to develop a winning trading mindset.

Platforms like Prime XBT offer invaluable support for those seeking reliable resources and tools. Prime XBT has many features to boost your trading. It includes advanced charting tools and educational materials as well as you can participate in spot trading. So join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is Trading Psychology?

Trading psychology involves the emotions and mental state affecting a trader’s decisions. It includes feelings, behaviors, and thought patterns influencing trading outcomes. The concept has undergone substantial evolution over the years. Psychological aspects were often overlooked at the beginning. As markets became complex, understanding the human element became crucial.

Pioneers like Dr. Van K. Tharp and Dr. Alexander Elder greatly advanced this field. Their research highlights the profound impact of psychology on trading success. Trading psychology includes emotional regulation, cognitive biases, and mental resilience. Emotional regulation involves managing feelings like fear and greed. Cognitive biases are deviations from rational judgment.

Mental resilience helps maintain focus under pressure. Understanding these elements helps traders manage their psychological state. This is essential for informed decisions and maintaining discipline. Mastering trading psychology can lead to a large improvement in trading performance. By recognizing and addressing these psychological factors, traders can achieve consistent profitability.

The Role of Emotions in Trading

Emotions play a significant role in trading. They can heavily influence decisions and market behavior. Understanding these emotions is crucial for successful trading. Traders who ignore their feelings may face disastrous outcomes. Effective emotional management can lead to better decision-making and increased profitability.

Common Emotions in Trading

The following are some of the most common emotions in trading that you should be aware of.

Fear

Fear is a powerful emotion that often causes traders to exit positions prematurely. This can lead to missed opportunities and reduced profits. Traders may fear losing money or making the wrong decision. Fear often arises from potential losses and market volatility. Recognizing fear is the first step to managing it effectively. One strategy is to set stop-loss orders, which can limit potential losses.

Greed

Greed can drive traders to take excessive risks. It often results in substantial losses when trades don’t go as planned. Greed may cause traders to ignore their strategies and pursue unrealistic gains. This often leads to chasing profits without proper analysis. Recognizing greed helps maintain discipline and focus. One way to manage greed is by sticking to a well-defined trading plan and setting realistic profit targets.

Anxiety

Anxiety often leads to stress and uncertainty. This emotional state can cause indecision and hesitation in making trades. Traders may worry about potential losses or market fluctuations. Managing anxiety involves staying informed about market conditions. Having a well-defined trading plan can help reduce uncertainty. Practicing mindfulness and stress-reduction techniques can also alleviate anxiety and improve focus.

Overconfidence

Overconfidence can lead traders to take unnecessary risks. This often results in significant trading mistakes and unexpected losses. Overconfident traders may overlook important market signals and risk management strategies. This emotional state can blind them to potential dangers. Recognizing overconfidence is essential for maintaining a balanced approach. Regular self-assessment and seeking feedback can help manage this emotion effectively.

Psychological Biases in Trading

Psychological biases can significantly affect trading decisions. They often lead to irrational behavior and poor outcomes. Understanding these biases is essential for successful trading.

Cognitive Biases

Confirmation Bias: Confirmation bias occurs when traders seek information that confirms their existing beliefs. This can result in ignoring crucial data that contradicts their views. For example, a trader may focus only on positive news about a stock they own, dismissing negative reports. This bias can lead to significant losses if conditions change.

Hindsight Bias: Hindsight bias refers to the tendency to believe past events were predictable after they occur. Traders may think they should have foreseen a market move. This can create a false sense of confidence in their predictive abilities. Acknowledging hindsight bias is important for realistic self-assessment.

Anchoring Bias: Anchoring bias occurs when traders rely too heavily on initial information or prices. For instance, if a stock was once valued at $100, traders may anchor their decisions to this price, ignoring its current value. This bias can lead to poor decision-making and missed opportunities.

Emotional Biases

Loss Aversion: Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. Traders may hold onto losing positions too long, hoping for a turnaround. This behavior can magnify losses and erode capital over time. Understanding loss aversion is crucial for effective risk management.

Overtrading Due to Emotional Impulses: Emotional impulses can lead traders to overtrade. This often happens when they react impulsively to market fluctuations. Overtrading can result in excessive fees and increased exposure to market risk. Recognizing emotional triggers is vital for maintaining discipline.

Impact of Biases

Psychological biases can significantly distort decision-making processes. They often lead to impulsive actions and irrational trading behavior. Traders influenced by these biases may ignore their strategies and act on emotions. This can result in substantial financial losses and decreased confidence.

Developing a Winning Trading Mindset

A winning trading mindset is crucial for success in the markets. It encompasses various psychological traits and skills that differentiate successful traders from others. Developing this mindset can enhance performance and lead to consistent profitability.

Characteristics of Successful Traders

Discipline and Patience: Discipline is essential for adhering to a trading plan. Successful traders stick to their strategies, even in volatile markets. Patience allows traders to wait for optimal entry and exit points. This combination helps avoid impulsive decisions driven by emotions.

Adaptability and Resilience: The markets are constantly changing, and successful traders adapt to new conditions. They are resilient in the face of losses and setbacks. Instead of giving up, they learn from their mistakes and adjust their strategies. This adaptability is crucial for long-term success.

Confidence Without Arrogance: Successful traders possess a healthy level of confidence in their abilities. They trust their analysis and decisions but remain open to feedback and new information. This balance prevents overconfidence, which can lead to poor decision-making.

Building Mental Resilience

Techniques to Improve Mental Strength: Building mental resilience is vital for navigating market challenges. Techniques such as mindfulness and meditation can help traders manage stress. Regular exercise and maintaining a healthy lifestyle also contribute to mental strength. These practices improve focus and emotional control during trading.

Importance of a Growth Mindset: A growth mindset is the belief that skills and intelligence can be developed over time. Traders with a growth mindset view challenges as opportunities for growth. They embrace learning from mistakes and continually seek to improve their skills. This mindset fosters resilience and adaptability, key traits for successful trading.

Practical Strategies for Managing Emotions in Trading

Managing emotions is crucial for successful trading. Developing effective strategies can help traders maintain composure and make rational decisions. Here are practical strategies to help manage emotions effectively.

Develop a Routine

Establishing a daily trading routine can help create structure and predictability. A consistent routine promotes discipline and reduces anxiety. Include time for market analysis, trade execution, and reflection. Following a routine can also help traders remain focused on their objectives.

Practice Visualization Techniques

Visualization techniques can enhance emotional control. Traders can visualize successful trades and positive outcomes. This practice helps build confidence and reduces fear of failure. Regularly visualizing success can lead to a more positive mindset.

Use Breathing Exercises

Breathing exercises are a simple yet effective way to manage emotions. Deep breathing helps reduce anxiety and promotes relaxation. Taking a few deep breaths before making a trading decision can help clear the mind and improve focus.

Set Specific Entry and Exit Points

Having predefined entry and exit points minimizes emotional decision-making. Traders should establish these points based on their trading strategy. This approach reduces the urge to make impulsive decisions driven by fear or greed.

Limit Exposure to Market News

Constantly monitoring market news can increase anxiety and trigger emotional reactions. Limiting exposure to news updates can help maintain a balanced perspective. Traders should focus on their strategies rather than being swayed by market noise.

Implement Stop-Loss Orders

Using stop-loss orders can help manage risk and reduce emotional stress. By setting predetermined exit points, traders can limit potential losses. This strategy allows traders to stick to their plans, even in volatile markets.

Our On Tilt Trading Store offers a Stop Loss Calculator which can help you to stick with this strategy more effectively. So, check out our store today and use promo code OTT10 to receive 10% off your order!

Engage in Physical Activity

Regular physical activity is beneficial for managing stress and emotions. Exercise releases endorphins, which improve mood and reduce anxiety. Incorporating physical activity into daily routines can enhance overall well-being and mental clarity.

Resources and Tools for Improving Trading Psychology

Improving trading psychology involves leveraging various resources and tools. These can enhance emotional control, decision-making skills, and overall trading performance. Here are some valuable resources and tools that traders can utilize to strengthen their trading psychology.

1. Trading Books

Reading books on trading psychology provides valuable insights. Some recommended titles include:

- “Trading in the Zone” by Mark Douglas: This book explores the mental aspects of trading and offers strategies to develop a winning mindset.

- “The Psychology of Trading” by Brett N. Steenbarger: This book delves into the psychological challenges traders face and offers practical solutions.

- “The Daily Trading Coach” by Brett N. Steenbarger: This book provides actionable techniques and exercises to improve mental skills and emotional resilience.

2. Online Courses

Online courses focused on trading psychology can enhance understanding and skills. Many platforms offer specialized courses, such as:

- Coursera: Offers courses on behavioral finance and decision-making in trading.

- Udemy: Features various courses on trading psychology, risk management, and emotional discipline.

- Investopedia Academy: Provides comprehensive courses on trading strategies and psychology.

3. Trading Journals and Apps

Keeping a trading journal is essential for tracking emotions and performance. Journals help identify patterns and emotional triggers. Some popular trading journal apps include:

- Edgewonk: A comprehensive trading journal that allows traders to analyze their performance and emotions.

- Tradervue: An online platform for logging trades and reviewing performance metrics.

- Journalytix: A trading journal app that offers insights into trading behavior and psychology.

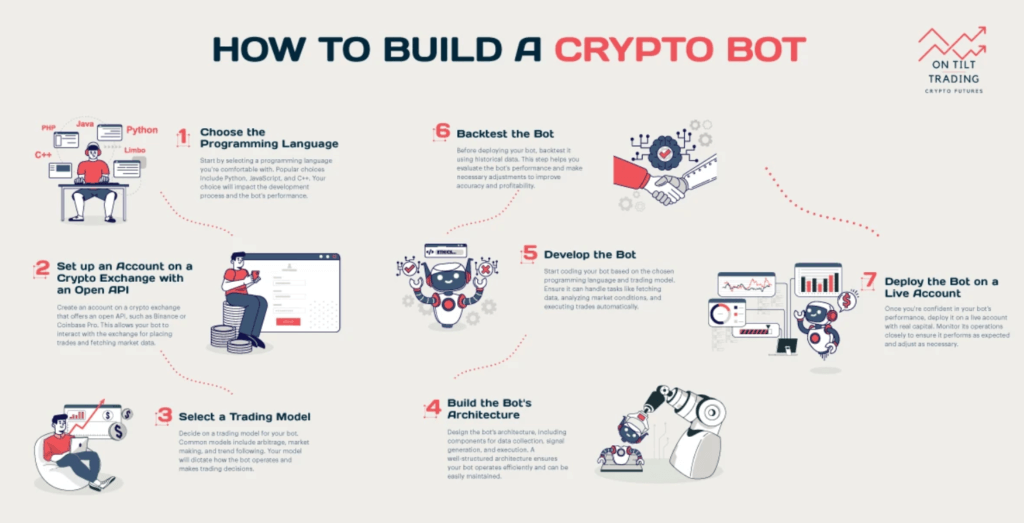

4. Automated Trading Solutions

Are you tired of losing money due to panic selling, FOMO, overtrading, and bag holding? We recommend the Vestinda Trading App to eliminate emotional decision-making with automated crypto trading strategies.

The app helps traders avoid emotional pitfalls by implementing strategies based on market analysis. This way, traders can focus on the bigger picture without getting bogged down by emotions.

5. Community and Support Groups

Engaging with a trading community can provide support and shared experiences. Joining forums and social media groups allows traders to exchange ideas and strategies. Some platforms include:

- Reddit (r/Daytrading): A forum for sharing trading experiences, strategies, and psychological insights.

- TradingView: A community where traders can share charts, ideas, and market analysis.

- Discord trading groups: Many traders use Discord to connect with peers, discuss strategies, and share insights.

Final Thought

Fear, greed, and anxiety can derail even the savviest trader. Mastering these emotions is key to market success. Discipline and patience form the foundation of a winning mindset. Mental resilience helps weather inevitable setbacks.

Tools like the Vestinda app offer automated strategies to reduce emotional decisions. This fosters a more disciplined approach. Practical techniques can also boost emotional management skills.

Ultimately, psychology drives trading outcomes. Those who cultivate self-awareness and leverage supportive resources gain an edge. With practice, traders can achieve greater consistency and profitability. A strong mindset and the right tools are key to lasting success in the financial markets.