Overthinking is a common challenge for traders. It can hinder your ability to make effective decisions, ultimately affecting your trading performance. Finding ways to combat this tendency is essential for success in the fast-paced world of trading. Therefore, most traders wonder, “How do I stop overthinking in trading?”

In this blog post, we will explore strategies to help you stop overthinking when trading. These techniques will help you cultivate a more disciplined and focused approach to trading. Prime XBT is an excellent platform for navigating the complexity of trading without getting overwhelmed.

This platform offers various resources and tools to help streamline your trading process. It’s easy to focus on executing your strategies confidently when you’ve got the right tools. So, join PrimeXBT today! Use promo code PRIMEOTT to receive a +7% bonus on your deposit.

What is Overthinking in Trading?

Overthinking in trading refers to excessive analysis and second-guessing decisions. Traders may dwell on potential outcomes rather than taking action. This mental state can create a cycle of doubt that hinders effective trading.

When traders overthink, they often lose focus on their strategies. They may spend too much time analyzing charts, indicators, and news. Instead of making clear decisions, they become paralyzed by uncertainty. This can lead to missed opportunities and increased stress.

Ultimately, overthinking disrupts the trading process. It creates confusion, reduces confidence, and can negatively impact overall performance. Understanding overthinking is the first step in overcoming it.

Common Triggers of Overthinking in Trading

Several factors can trigger overthinking in traders. Such as:

1. Fear of Loss

Fear of loss is a powerful trigger for overthinking in trading. Many traders experience anxiety about losing their hard-earned capital. This fear can lead to a heightened state of alertness when making decisions. As a result, traders may hesitate to enter positions or exit trades too early.

They might overanalyze potential risks instead of focusing on opportunities. This constant worry creates a cycle of doubt that can paralyze decision-making. The fear of losing money often outweighs the potential for profit. This mentality can prevent traders from executing their strategies effectively, ultimately harming their performance.

2. Information Overload

Information overload is another significant trigger for overthinking in trading. The financial markets generate vast amounts of data daily, and traders have access to countless news articles, analysis reports, and social media updates. Sorting through this information can become overwhelming.

When faced with too many choices, traders can struggle to make informed decisions. They may analyze every piece of data, fearing they might miss something crucial. This over-analysis can lead to analysis paralysis, where traders become immobilized by indecision. Instead of executing their strategies, they waste valuable time second-guessing themselves.

3. Market Volatility

Market volatility is a key factor that triggers traders to overthink. Rapid price fluctuations can evoke strong emotional reactions. When markets are unstable, uncertainty increases, leading to heightened anxiety. Traders may begin to question their strategies, fearing they might incur significant losses.

This volatility can prompt over-analysis of market movements, causing traders to hesitate. They may obsessively check charts and indicators for reassurance. In doing so, they miss out on potential opportunities. The fear of making the wrong decision becomes all-consuming. Managing emotions during volatile market conditions is essential for maintaining confidence and clarity.

4. Comparison with Other Traders

Comparison with other traders can also fuel overthinking. In today’s digital age, traders often share their successes online. This visibility can create pressure to perform at a similar level. When traders see others making profits, they may feel inadequate or insecure.

This sense of comparison can lead to a constant re-evaluation of their trading strategies. They might second-guess their decisions and mimic others’ approaches, which detracts from their unique trading style and strategies. Instead of focusing on their progress, they become consumed with what others are doing, which can be detrimental to their trading journey.

The Impact of Overthinking on Trading Performance

Overthinking can significantly affect a trader’s performance. It can create emotional, cognitive, and behavioral challenges that hinder success. Improving performance requires understanding these impacts.

Emotional Effects

Overthinking often leads to increased stress and anxiety. As traders dwell on potential losses, their confidence can plummet. This constant worry can create a negative feedback loop, escalating stress levels over time and making trading more difficult.

Emotional turmoil can cloud judgment, leading to impulsive decisions. Consequently, traders may struggle to stick to their strategies. This emotional instability ultimately detracts from trading performance and consistency.

Cognitive Effects

The cognitive effects of overthinking include impaired decision-making. When traders become fixated on details, they lose sight of their goals. Their focus shifts from strategic analysis to endless worry, which can lead to missed opportunities in the market.

Additionally, overthinking can result in analysis paralysis, where traders cannot make decisions. Instead of taking action, they remain stuck in their thoughts. This indecision can be detrimental as market conditions change rapidly.

Behavioral Effects

The behavioral effects of overthinking manifest in various ways. Traders may hesitate to execute trades they initially planned. This second-guessing can prevent them from following through on their strategies. Moreover, overthinking can lead to frequent adjustments in trading plans.

Traders might abandon well-thought-out strategies due to fear or doubt. Such behaviors create inconsistency in trading results. This inconsistency can lead to frustration and further overthinking. Ultimately, these behavioral patterns hinder long-term success in trading.

How Do I Stop Overthinking in Trading

Implementing effective strategies is essential to stopping overthinking in trading. These techniques can help traders regain focus and clarity, enhancing their performance.

Establish a Trading Plan

Creating a well-defined trading plan is crucial for success. A solid plan outlines your goals, strategies, and risk management techniques. Having a clear framework allows traders to make confident decisions, reducing the need for constant analysis of market conditions. Traders should include specific entry and exit points in their plans.

Additionally, regularly reviewing and adjusting the plan helps maintain focus on objectives. Sticking to a structured approach minimizes traders’ emotional responses to market fluctuations. A well-crafted plan serves as a roadmap, guiding traders through their trading journey. This discipline reduces overthinking and increases overall performance.

Set Realistic Goals

Setting realistic goals can help reduce overthinking in trading. Focus on process-oriented goals rather than outcome-oriented goals. For example, aim to execute a specific number of trades each week. This shift in focus helps reduce pressure and encourages consistency. Traders should also ensure that their goals are achievable and measurable.

Celebrate small achievements along the way to maintain motivation and confidence. Traders who focus on the process are less likely to be anxious about potential losses. This mindset fosters a healthier trading environment, promoting long-term success. As traders become more comfortable with their progress, they can combat overthinking effectively.

Limit Information Intake

Limiting information intake is vital for reducing overthinking in trading. Traders should be selective about the sources they follow. Choose reliable news outlets and analysis tools to minimize confusion and distraction. Constantly checking multiple sources can lead to information overload.

Instead, focus on a few trusted resources to stay informed about market trends. Setting specific times for checking updates can also help create a routine. This discipline reduces distractions and promotes better decision-making. By streamlining information intake, traders can focus on what truly matters. A clear focus helps minimize the impact of overthinking on trading performance.

Practice Mindfulness and Emotional Regulation

Incorporating mindfulness practices can greatly help traders combat overthinking. Techniques such as meditation and deep breathing exercises can enhance mental focus. Practicing mindfulness promotes emotional regulation, which reduces stress levels. Traders can also consider journaling as an effective tool. Writing down thoughts and feelings helps track patterns over time.

This awareness enables traders to identify triggers that lead to overthinking. Recognizing these patterns allows them to implement coping strategies better. Engaging in mindfulness helps create a balanced mental state. A calm mind fosters better decision-making and can significantly improve trading outcomes.

Take Breaks and Step Away

Taking regular breaks is essential for maintaining mental clarity while trading. When feeling overwhelmed, stepping away from the trading screen can provide valuable perspective. Engaging in different activities allows the mind to reset and recharge. Consider going for a walk, exercising, or practicing a hobby during breaks.

These activities help clear the mind and reduce stress. After a break, traders often return with a fresh perspective. This renewed focus can enhance decision-making and increase confidence. Regular breaks create a balanced trading routine, helping to combat overthinking effectively. A clear mind is crucial for trading success.

Automated Trading Systems

Automated trading systems allow traders to set specific parameters for their trades. These systems execute trades automatically based on predefined criteria, removing the emotional element from trading decisions. Technology helps traders avoid second-guessing themselves, and automated systems can help ensure consistency in executing strategies.

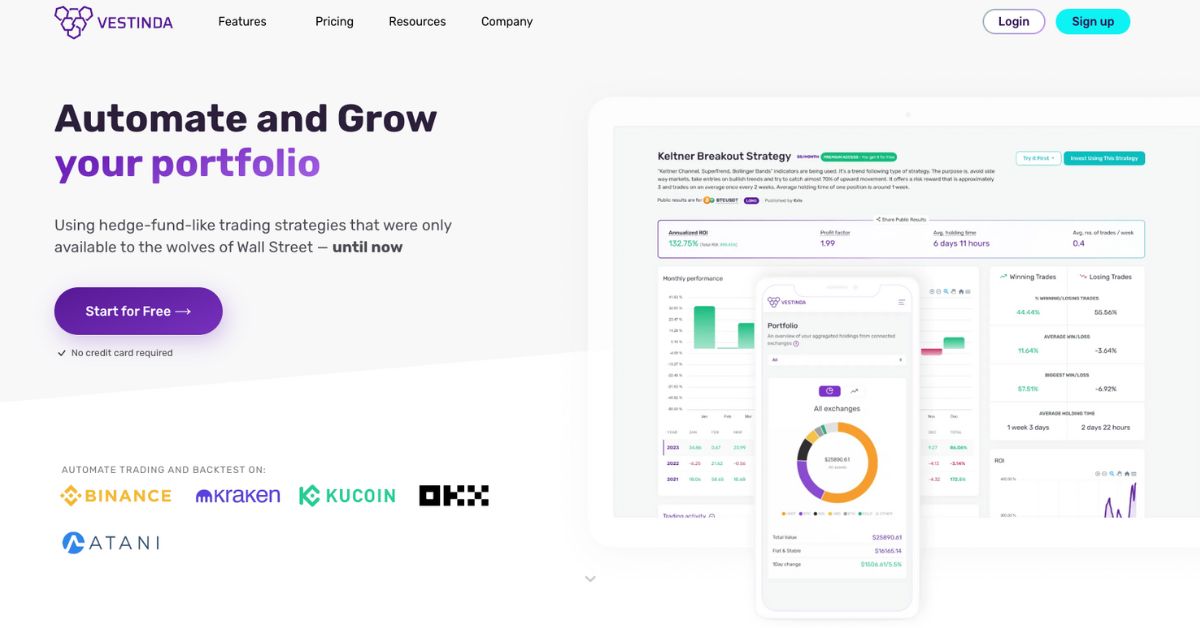

If you’re tired of losing money due to panic selling, FOMO, overtrading, and bag holding, consider the Vestinda trading app. This app eliminates emotional decision-making with automated crypto trading strategies.

Traders can customize their parameters to align with their trading goals, reducing the stress of constantly monitoring the market. Ultimately, automated trading systems can significantly reduce overthinking.

Trading Journals and Analytics Tools

Using trading journals and analytics tools can help traders track their performance. A well-maintained journal captures details of each trade, including strategies and outcomes. Analyzing past trades provides valuable insights into patterns and mistakes. This reflection helps traders identify areas for improvement.

Many analytics tools offer data visualization features that simplify analysis. Traders can quickly see trends and performance metrics. With this technology, traders can make informed decisions without overthinking. A structured approach to analysis fosters confidence in their trading strategies.

Educational Workshops and Seminars

Attending educational workshops and seminars can enhance trading skills. Many organizations offer events focused on various trading aspects, which often include interactive sessions and networking opportunities.

Learning from industry experts provides valuable insights into trading psychology. Workshops help traders stay updated on market trends and strategies. Networking with other attendees can lead to lasting connections. Participating in these events boosts confidence and reduces uncertainty.

FAQs

Is trading stressful?

Yes, trading can be stressful for many individuals. The fast-paced nature of the market creates pressure to make quick decisions. Emotional factors, such as fear and greed, can also contribute to stress. Uncertainty about market movements can lead to anxiety and overthinking. Additionally, the potential for financial loss adds to the pressure.

Many traders experience heightened stress levels during volatile market conditions. It’s essential to develop coping strategies to manage this stress effectively. Techniques such as mindfulness, trading plans, and seeking support can help mitigate the stress associated with trading.

Why is trading so hard?

Trading can be challenging for several reasons. First, the financial markets are unpredictable and influenced by numerous factors. Economic events, geopolitical tensions, and market sentiment can all impact price movements. Second, emotional discipline is crucial; fear and greed can lead to poor decision-making.

Many traders struggle to stick to their strategies during volatile conditions. Third, developing a solid trading strategy takes time and experience. It requires extensive research, practice, and continuous learning. Lastly, competition is fierce; many skilled traders are vying for profits. All these elements contribute to the difficulty of successful trading.

Do 90% of traders fail?

Yes, studies suggest that a significant percentage of traders, often cited as around 70-90%, do fail. Many new traders enter the market without adequate knowledge or experience. They usually underestimate the challenges involved in trading. Emotional factors, such as fear and greed, can lead to poor decision-making.

Additionally, a lack of proper risk management strategies contributes to losses. Many traders may also overtrade or chase losses, exacerbating their problems. However, with education, discipline, and a solid trading plan, individuals can improve their chances of success in trading. Continuous learning is essential for long-term profitability.

Read More: How Do I Stop Panic Trading?

Final Thought

Ultimately, overcoming overthinking in trading is essential for success. Utilizing effective strategies and technology can enhance traders’ decision-making. Seeking support from mentors and engaging in educational resources can further boost confidence.

Developing a disciplined mindset will ultimately lead to better performance and improved emotional well-being. Don’t forget that trading takes patience and continuous improvement, so stay committed to your growth and learning.